E-Way Bill: Meaning, Rules, and Generation

If you run a business, transporting goods without proper documentation can quickly become a costly mistake. Moving goods for business isn’t just about logistics. It also involves staying compliant with GST rules.

That is why the e-Way bill becomes very important. Whether you are moving goods between states or within a state, you should be familiar with the e-Way bill; otherwise, you risk fines and disruptions to your business.

Let's understand the meaning of the e-Way bill, its key components, and how you can generate it.

What Is an E-Way Bill?

E-Way bill means the short form of Electronic Way Bill. An e-Way billis an electronically generated document that contains details of goods in a consignmentmoving from one place to another. This is mandatory under the Goods and Services Tax (GST)for inter-state or intra-state shipments with a value exceeding ₹50,000.

The e-Way bill (EWB) is a GST compliance mechanism that contains key information on the supplier, recipient, transporter, and goods moved.

The EWB mechanism in India facilitates -

- Easy tracking of goods

- Reduces time and costs for doing business

- Prevents tax evasion

- Enables the smooth movement of goods nationwide.

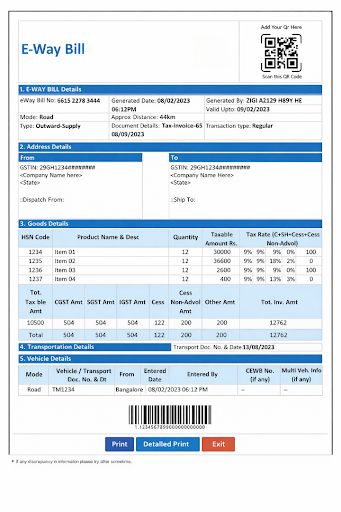

Components of an E-Way Bill

An EWB consists of two parts.

Part A captures transaction details, while Part B includes transportation-related information. Both parts are essential for a valid EWB.

Part A

Part A of the EWB has the complete details of the consignment.

- Recipient’s GST identification number (GSTIN)

- Delivery Place

- Bill or Challan Number

- The total consignment value

- Harmonised System of Nomenclature (HSN Code). For taxpayers with aggregate annual turnover (AATO) up to INR 5 crores, enter a minimum of 4 digits of the code, and for AATO over INR 5 crores, enter a minimum of six digits of the HSN code.

- Reason for Transport

- Transport Document Number

Part B

This field contains the transporter's vehicle number.

How to Generate an E-Way Bill in India?

The e-Way bill generation in India can be completed through several methods.

EWB Online

- Visit the official e-Way bill portal and log in to the EWB system.

- Choose “Generate New” e-Way bill. The system displays the EWB entry form for generating a new EWB.

- Fill in the form details, then click the submit button.

- Enter the details of Part A, including invoice details and GSTINs.

- Fill in Part B with transporter or vehicle details

Upon submission of an EWB request, the system validates the entered values and generates the EWB with a unique 12-digit number.

In addition to the portal, businesses can generate EWB via SMS, mobile apps, or API integrations for bulk transactions.

Generating E-Way Bill through SMS

Mobile EWB is a mobile SMS-based system for generating e-Way bills. The service applies to registered users who have opted in via a dedicated SMS number.

This is intended for small taxpayers who may not have IT systems or a high volume of EWB-generation transactions in a day. It is beneficial in situations without internet access.

Eligibility & Process

- The requester must register their mobile number on the e-Way bill portal to use SMS services.

- The requestor GSTIN should be linked to the registered mobile number.

Here's what you can do more via SMS-based operations.

- Cancel/Reject the e-Way bill

- Update the Vehicle Details/Transporter

- Get e-Way bills generated by the other party

This is a simple method for generating e-Way bills. However, the taxpayer must ensure the EWB request is submitted in the proper format and contains no data-entry errors.

Generating E-Way bill through Mobile Apps

- Log in to the official e-Way bill portalon a computer. Under the 'Registration' menu, select the option 'For Mobile App' and enter the IMEI number of the phone you will use.

- The system will send a download link via SMS to your registered mobile number. Click the link to download and install the app.

- Open the app and use your e-Way bill portal username and password to log in.

Note - Two-Factor Authentication might be mandatory, in which case you will also need the NIC-GST-Shield app for OTP generation.

- Within the app, navigate to the 'e-Way bill' option and select 'Generate New'.

- Fill in all required details, including:

- Transaction Type (Outward/Inward)

- Document Type, Number, and Date

- Consignor and Consignee details

- Item details (HSN code, value, tax rates, etc.)

- Transporter details (ID, mode, vehicle number, distance)

- Submit:The system will validate the information and generate a unique 12-digit e-Way bill number. You can then save or share the digital bill.

There are limits on how much data can be entered, and it is not suitable for mass data entry.

State-Wise Rules & Threshold Limit

Although the national limit on e-Way bill generation is ₹50,000, state-wise EWB rules may differ.

- EWB for Movement Between States: Mandatory for all states where the transaction value exceeds ₹50,000

- EWB for Movement within states: Limits vary by state

- Some states have made EWB mandatory for amounts below ₹50,000 for specific products.

- In some states, an e-Way bill is required for distances exceeding 10 km.

- There are special provisions for exempted goods, handicrafts, and job work.

Companies need to know the e-Way bill thresholds in each state to avoid punishment.

E-Way Bill Generation- Documents and Details Needed

To generate an e-Way bill, the following documents are needed.

- Tax invoice

- Supplier and recipient GSTIN

- Description of goods

- HSN code

- Value of goods

- Transporter ID or vehicle number

- Mode of transport

- Distance and place of delivery

Ensuring accurate details helps avoid rejection or penalties during transit checks.

Also Read -How to get a loan if my company is not listed or recognised by the lender?

Turn Compliance into Business Growth

E-Way bills are generally considered a measure of GST compliance, but they also reflect how well a business is organised and its overall GST compliance. When your business regularly generates EWBs, files GST returns on time, and keeps clear invoices, it builds a strong digital record of its operations and cash flow.

When you are looking to obtain business loans, this existing compliance can work in your favour. Hero FinCorp’s unsecured loans are designed specially for growing enterprises that comply with GST norms.

Apply online today!

Frequently Asked questions

Do service transactions require an e-Way bill?

E-Way bills are prescribed for the movement of goods and not for services.

In what way can the validity of an e-Way bill be extended?

Validity can be extended by the transporter before or within 8 hours after expiry on the e-Way bill portal.

What happens if I transport goods without an e-Way bill?

It may result in GST penalties, including fines and possible detention of goods or vehicles.

Can unregistered transporters generate an e-Way bill?

Yes, by enrolling on the portal and obtaining a Transporter ID.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.