What an Account Aggregator Is and How It Helps With Personal Loans

Ever found yourself stuck in paperwork just when you needed money fast? Sorting through salary slips, bank PDFs, and KYC proofs can wear you out before you even hit “Apply.”

Account Aggregators (AA) are rewriting that story. Backed by the RBI, this system securely connects your verified financial data with trusted lenders, with your consent. The outcome? Speedy approvals, fewer documents, and full control over what you share.

Let’s look at what an Account Aggregator is and how it’s changing the way Indians apply for personal loans today.

What Is an Account Aggregator?

An Account Aggregator in India is an RBI-approved framework that links multiple financial institutions on a secure network. It helps lenders access verified details instantly (with your permission) so they can check eligibility and process your loan faster, without the usual paper trail.

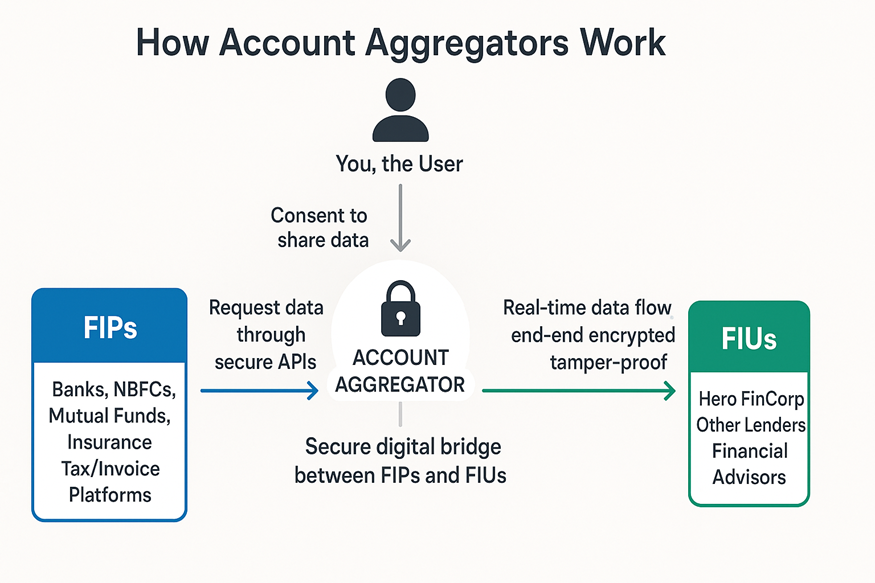

How Does an Account Aggregator Work?

When you apply for a personal loan, lenders need to verify your financial profile (income, repayment habits, ongoing EMIs). Earlier, that meant endless uploads, follow-ups, and long waits for verification.

The same checks take place in seconds with the AA system, a secure, RBI-regulated network. Here’s how account aggregators work in real life:

1. You - The User

You’re at the centre of the AA ecosystem. You choose what to share, who can see it, and why (whether it’s to check personal loan eligibility or fast-track approval).

2. Financial Information Providers (FIPs)

These include banks, NBFCs, mutual fund platforms, insurers, and wealth managers that hold your financial data. Today, more than 780 such institutions are active on the AA network and can securely share verified details with a lender once you give consent.

3. Financial Information Users (FIUs)

These entities tap into your shared data to deliver faster financial services. For example, Hero FinCorp acts as an FIU when you apply for a personal loan. With your approval, it accesses your verified info through the AA network to speed up processing.

4. Account Aggregator

The AA is a digital link between you, the FIPs, and FIUs. It never stores, reads, or alters your data. It only transfers encrypted information once you say yes.

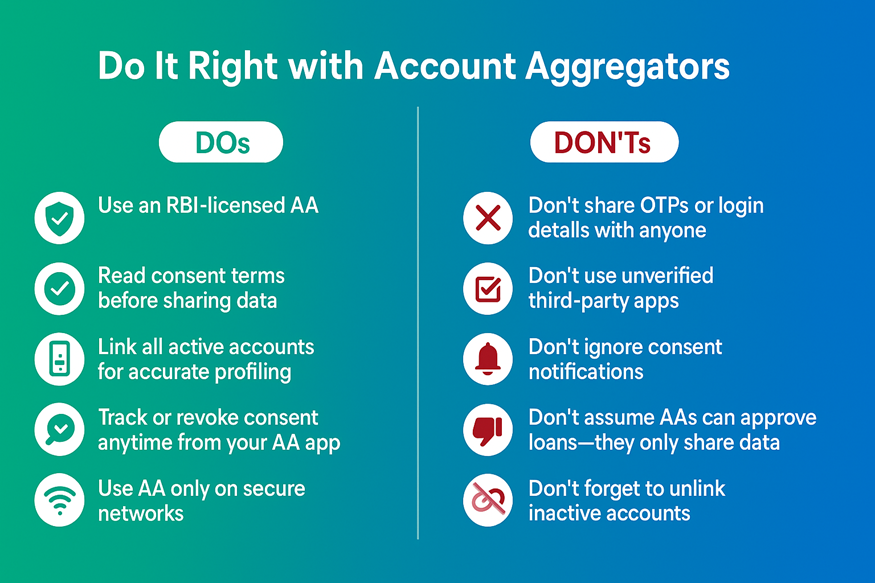

Pro Tip: You can track or revoke consent at any time in your AA app. The best part? Every step is built on the Data Empowerment and Protection Architecture (DEPA), ensuring complete transparency and safety.

Benefits of Using Account Aggregators for Personal Loans

UPI made paying effortless, and now Account Aggregators are making borrowing just as easy. Already, over 5 crore Indians use this network for faster, smarter financial access.

Here’s why borrowers (and lenders) can’t stop talking about it:

1. Approvals in Hours, Not Weeks

What once took days now happens almost instantly. Verified financial data moves in real time, helping lenders green-light your loan within 48 hours, sometimes even sooner.

2. Paperwork? Practically Gone

No more scanning PDFs or emailing statements. Once you give consent, your bank records and KYC details move digitally and securely, with minimal manual effort.

3. Smarter Loan Matches

Lenders get a real-time view of your finances, so the loan offers you receive actually fit your repayment comfort. The result? More fairness, less guesswork.

4. Broader Financial Inclusion

Even routine digital transactions now count toward eligibility. It allows MSMEs to unlock working capital and provide new-to-credit borrowers instant, customised loans.

5. Trust That Scales with India

In FY 2025, AAs helped facilitate nearly ₹1.6 lakh crore in loans. They now stand alongside Aadhaar and UPI as pillars of India’s citizen-first digital public infrastructure.

6. Win-Win for Everyone

Borrowers enjoy speed and control. Lenders gain precise, fraud-safe API-driven data flows. It’s a faster, safer, and more transparent way to credit.

Want to experience these benefits? Begin your personal loan journey with Hero FinCorp and unlock the Account Aggregator edge.

How to Register and Use an Account Aggregator

Wondering how to use an Account Aggregator? It’s simpler than you think. The setup is fully digital and takes only a few minutes.

● Pick an RBI-approved AA, like Finvu, CAMS FinServ, or OneMoney.

● Sign up using your bank-linked mobile number to create your unique Account Aggregator ID.

● Link your savings, loan, and investment accounts under one encrypted platform.

● Allow consent when applying for a loan, so your verified data reaches the lender safely.

● Stay in control by using your AA app to track, pause, or withdraw consent anytime.

Why wait weeks for approval? Use your Account Aggregator ID to share data securely and get quick personal loans up to ₹5 lakh with Hero FinCorp.

How Account Aggregators Help Expedite Personal Loan Applications with Hero FinCorp

Meet Aisha and Rohit. Both needed quick funds for emergencies and applied for personal loans through Hero FinCorp.

Aisha took the regular route: uploading documents, verifying KYC, and waiting. Safe and simple, but it took some back-and-forth before her loan was finalised.

Rohit chose the smarter way. Using his AA ID, he shared verified data in seconds. Hero FinCorp reviewed his profile and cleared his loan within just a few hours. By the time Aisha received her update, Rohit had already used his funds.

Ready to experience smarter borrowing? Download the Hero FinCorp app to apply digitally, share your data securely, and get approvals faster.

Frequently Asked Questions

1. Is it mandatory to register with all Account Aggregators in India?

No. One RBI-licensed AA ID connects you to the entire network.

2. Can I revoke consent once given to an Account Aggregator?

Yes. Open your AA app at any time to pause, track, or revoke consent instantly.

3. Are Account Aggregators safe and RBI-approved?

Absolutely. They’re RBI-regulated and use end-to-end encryption to keep your data protected.

4. How do Account Aggregators help in faster loan approvals?

They cut the wait. Verified data reaches lenders in seconds, so approvals happen faster.

5. Does sharing data via AA affect my credit score?

No. It only shares information and doesn’t impact your score.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.