A Simple Guide to Scanning and Paying with QR Codes via Mobile Banking

QR codes are everywhere today, from shop counters and café tables to fuel stations and even on utility bills. What began as a small digital convenience has become one of India’s most trusted ways to pay.

With one quick scan, money moves directly from your bank account to the merchant’s. All you need is your smartphone and your mobile banking app. It’s swift, cash-free, easy to track, and secure.

This guide explains how QR payments work and helps you pay with confidence.

What is QR Code Payment?

A QR code payment is a contactless payment method that enables customers to pay for goods or services by scanning a two-dimensional barcode (QR code) displayed by the merchant using a smartphone mobile application.

How Does QR Payment Work in Mobile Banking?

Every time you scan a QR code with your banking app, it sets up a secure link between your account and the receiver’s. The transaction runs on the NPCI-regulated UPI network and stays protected with end-to-end encryption and two-factor authentication.

Here’s what really happens -

● The merchant creates a QR code with their UPI ID or bank account details.

● You open your mobile banking app and let the camera scan the code to fetch payment details.

● The app shows the merchant’s name and account info so you can confirm everything looks right.

● You approve the transaction by entering your UPI PIN or app password.

● The money moves securely, and both you and the merchant get instant confirmation.

You can make QR payments easily through UPI platforms like BHIM, Google Pay, PhonePe, Paytm, or your bank’s mobile app. Even trusted lenders like Hero FinCorp support digital payments, making money management effortless.

Types of QR Codes Used in Payments

QR codes may look identical, but their functions are not. Some stay fixed for every payment, while others refresh in real-time for each transaction. Here’s how they differ -

QR Code Type | What It Means | How You Use It | Common Use Cases |

Static | Fixed code that stores the merchant’s details permanently | Scan, manually type the amount, and complete the payment | Local kirana stores, street vendors, milk booths, cafés, parking lots |

Dynamic | A new code generated for each transaction | The amount and details appear automatically, no manual entry required | Supermarkets, e-commerce sites, restaurants, and government bill payments |

Benefits of Paying with QR Codes via Mobile Banking

The global QR code payment market is on a remarkable rise, set to hit US$61.73 billion by 2033. It’s proof that smart, secure digital payments are here to stay.

Here’s why more people are switching to QR payments every day -

● Pay in seconds using just your phone, no cash or card needed

● Stay protected with secure, bank-verified transactions every time

● Pay instantly at neighbourhood stores or national chains

● Track every spend effortlessly through your mobile banking app

● Go green with paper-free, contactless payments

Enjoy the ease of QR payments for your daily spending. And when it’s time for big-ticket purchases, check your personal loan eligibility with Hero FinCorp for quick, secure access to funds.

How to Scan and Pay with QR Codes via Mobile Banking Step-by-Step

Now that you’ve seen how QR payments work, using them through your bank’s app is quite simple. Just follow these steps to make a payment in seconds -

Step 1 - Open Your Mobile Banking App

Launch your bank’s official app on your smartphone. Then log in using your MPIN, password, or biometric authentication.

Step 2 - Select ‘Scan & Pay’

Look for the QR payment or scan option on the home screen. It’s usually visible at the top or under the “Payments” section.

Step 3 - Scan the QR Code

Hold your phone over the QR code on the counter, bill, or screen. The app will detect and decode the QR automatically.

Step 4 - Verify Payee Details

Check the merchant’s name, UPI ID, and amount. If something feels off, cancel the payment and check with the seller. Always scan codes you can see in person, not screenshots or forwarded links.

Step 5 - Confirm the Amount

If you see a static QR code, enter the amount yourself. For dynamic QR codes, the payment will appear automatically. You can also add a remark, such as “Groceries” or “Cab fare,” to help track your expenses later.

Step 6 - Choose Your Bank Account

Select the account you want to pay from, especially if multiple accounts are linked. Review the details carefully.

Step 7 - Authorise and Finish

Type in your UPI PIN or transaction password to confirm the transaction. You’ll see a success message on your screen, and both you and the merchant will get instant notifications of the payment.

Quick Tip - You can also use the Hero FinCorp Digital Lending App (Android) or iOS version to manage loan repayments and make secure digital transactions anytime.

Also Read: What Is a Payment Gateway and How Does It Work?

Your Next Step Toward Smarter Money Management

Paying with QR codes is more than a shortcut. It’s proof of how technology can simplify everyday life when used wisely. As digital payments continue to grow, confidence and control are what matter most. With Hero FinCorp, you get both through smarter tools, secure choices, and a partner that grows with you.

So, why wait? Explore our online personal loan options and turn your financial plans into progress.

Frequently Asked Questions

1. Is paying with QR codes safe for mobile banking transactions?

Yes, every payment is encrypted and verified by your bank instantly.

2. Do I need an internet connection to pay with QR codes?

Yes, you need a valid data or Wi-Fi connection. A steady network helps your QR payment go through quickly and safely.

3. Can I pay merchants who don’t have a QR code?

Yes, you can still transfer money via UPI ID, account number, or mobile number using your banking app.

4. Are there any charges for paying with QR codes?

No, most banks and NBFCs offer QR and UPI payments at no extra cost.

5. How can I avoid QR code scams?

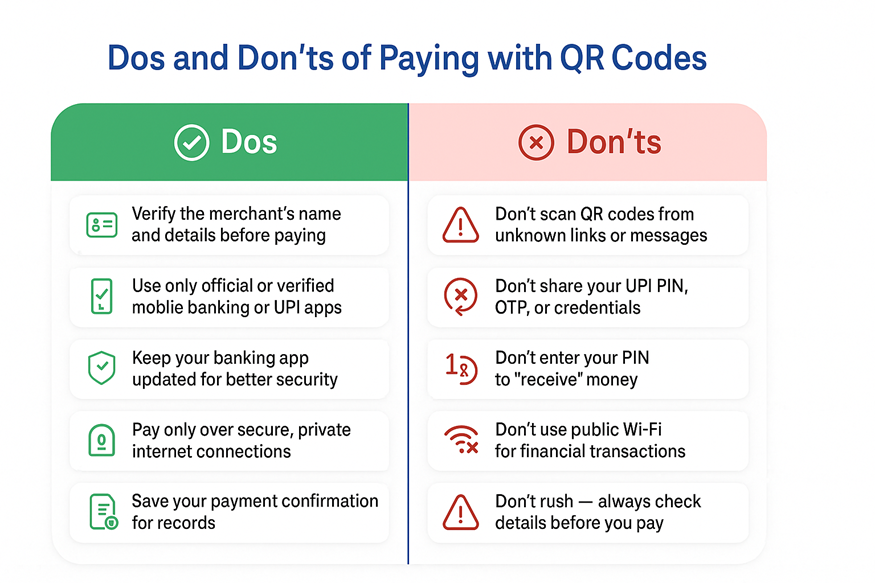

Scan only genuine codes and never enter your UPI PIN to receive money.

Also Read: UPI Payment Frauds

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.