What is Loans Against Shares? How to Leverage it for Financial Emergencies

Many people invest in shares with a long view, hoping their portfolio will grow steadily over time. But life has a way of throwing in unexpected expenses. A sudden medical cost or a family situation can leave you needing money quickly.

Selling those shares on short notice often feels like the wrong move, especially if you want to stay invested for future gains. A loan against shares can help in moments like these. By pledging your shares as security, you can get access to funds without giving up ownership.

The process is usually quicker than applying for an unsecured loan, and the interest rates tend to be more manageable. We'll look at how loans against shares work and what to consider before using your portfolio to raise money when time is tight.

What is a Loan Against Shares?

A loan against shares (LAS), also known as a loan against equity shares, is a secured loan where you use your existing shareholdings as collateral. Your shares stay in your demat account, but the lender places a pledge on them while the loan is active.

The amount you can borrow depends on the market value of the shares, and lenders usually offer only a part of that value to manage risk. Because the loan is backed by your investments, the interest rate is often more comfortable than what you see with unsecured credit.

Your shares stay in your name even while they’re pledged, and the pledge is lifted once the loan is paid off. Many people turn to this option when they need money on short notice but don’t want to offload their investments. It’s especially useful for those who want to stay invested for the long term or continue receiving dividends.

Benefits of Taking a Loan Against Shares

Here are some practical loan against shares benefits that make this option appealing to investors looking for short-term funds:

1. Quick liquidity while keeping ownership

You can access money at short notice and still hold on to your equity shares. Nothing needs to be sold.

2. Continue earning dividends

Even though the shares are pledged, you remain the owner, so any dividends that come in are still yours.

3. Avoid selling shares during market dips

If market prices are low, a loan against equity shares lets you raise funds without locking in losses.

4. Flexible repayment options

Most lenders allow easy repayment structures, which gives you room to manage cash flow comfortably.

5. Low documentation and online processing

Since the loan is secured against your investments, the paperwork is usually simple, and many lenders offer online processing.

How Does a Loan Against Shares Work?

A loan against shares follows a simple and structured process that makes it easy to access funds without selling your investments. You begin by choosing a lender and selecting the shares you want to pledge from your demat account.

The lender then checks the eligibility and value of those shares and uses this to set the Loan to Value ratio, which decides how much you can borrow. Once the loan is approved, the money becomes available for you to use, often as an overdraft-style facility.

Interest is charged only on the amount you draw, and after repayment, the shares are released back to you.

Loan Against Shares Maximum Limit and Loan-to-Value (LTV) Explained

The loan amount you receive against your shares depends on how lenders assess their value and the limits they place on different categories of stocks. Most lenders offer a Loan-to-Value ratio in the range of 50% to 70%, although many stay close to the lower end for equity shares.

This means you can borrow only a part of the total market value of the shares you pledge. Because share prices move every day, lenders keep an eye on the value of your pledged holdings.

If the price drops and the LTV rises beyond the allowed level, you may get a margin call, which asks you to add more shares or repay part of the loan. Shares that are considered more volatile often get a lower LTV, so the lender can manage risk more carefully.

Example

If your shares are worth ₹10 lakh and the lender applies a 50% LTV, you can borrow up to ₹5 lakh. If the share value later falls to ₹8 lakh, the loan amount stays the same, but the LTV increases, which may trigger a margin call.

Also Read: Understanding Leverage Ratios:

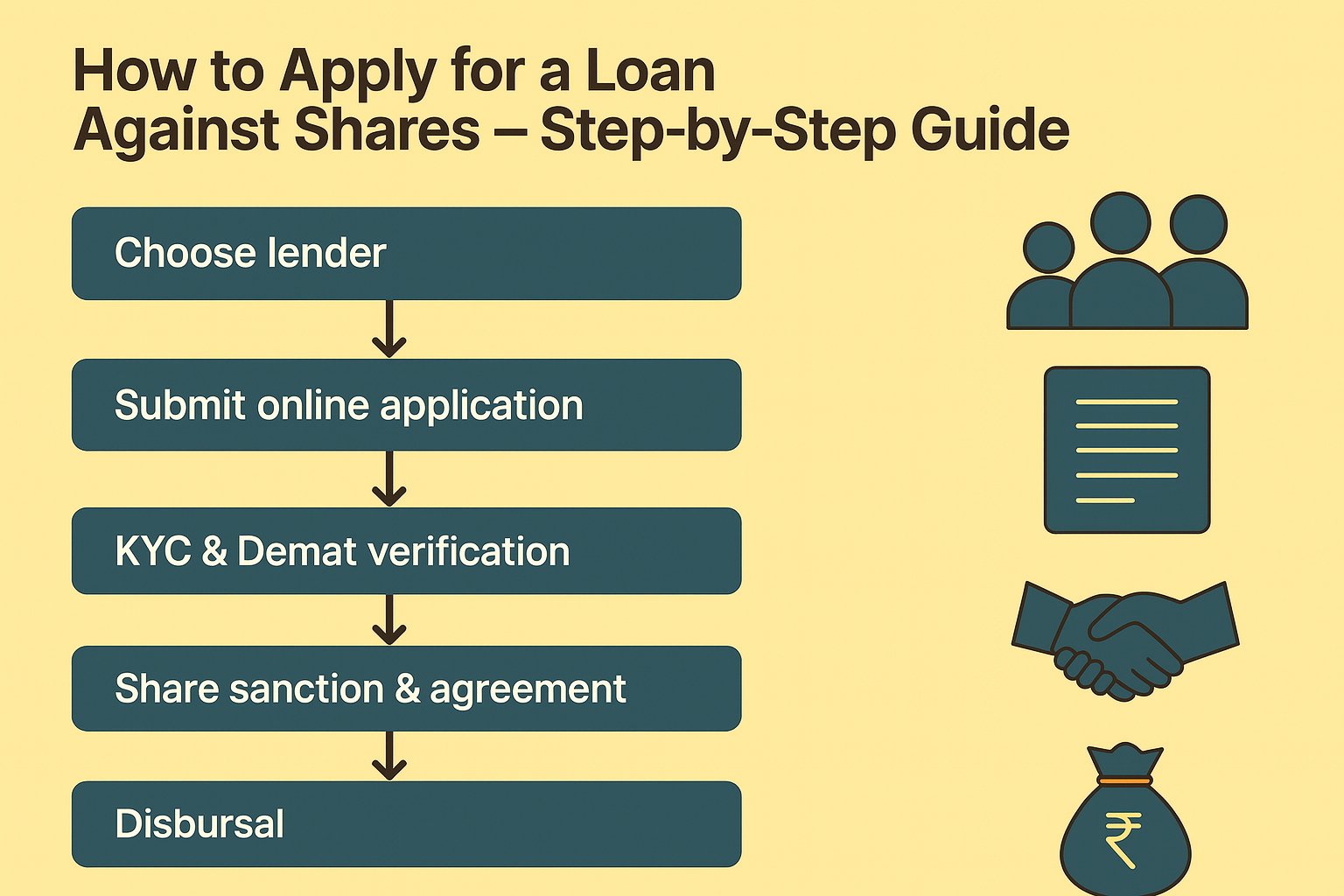

How to Apply for a Loan Against Shares – Step-by-Step Guide

The application process is mostly online and follows these steps:

Step 1: Choose a lender

Pick a bank or NBFC that offers this facility and check their interest rates, fees and LTV limits.

Step 2: Submit the online application

Go to the lender’s website or app and fill in your personal details along with your demat account information.

Step 3: KYC and demat verification

Upload the required documents and allow the lender to verify your identity and your shareholdings.

Step 4: Share pledge initiation

After verification, the lender sends a pledge request through NSDL or CDSL. You approve it, and the shares get marked as pledged.

Step 5: Loan sanction and agreement

The lender reviews the pledged shares, calculates how much you are eligible to borrow, and shares the loan agreement for your confirmation.

Step 6: Disbursal

Once you accept the agreement, the funds are sent to your bank account. Some lenders complete this within a day.

Step 7: Repayment setup

You pay interest as per your plan and clear the principal when required. After the loan is fully repaid, the shares are released back to your demat account.

Turn Your Share Portfolio into a Safety Net

A loan against shares can be a helpful way to access money when you need it, without selling the investments you have built over time. It gives you room to manage sudden expenses and still stay invested for the long run.

But not everyone wants to pledge shares or may have enough holdings to do so. In those situations, a simple personal loan can be the easier choice.

If you need quick funds without offering any security, Hero FinCorp’s personal loan can support you. Apply online today and get instant approvals.

Frequently Asked Questions

1. Can I get a loan against shares without selling them?

Yes. Your shares remain in your demat account while pledged.

2. What happens if share prices fall after taking the loan?

If the value drops too much, the lender may ask you to add more shares or repay a part of the loan to keep the LTV in check.

3. Are physical shares accepted for LAS?

No. Lenders require shares to be in demat form before they can be pledged.

4. Can I prepay the loan early?

Most lenders let you repay early without any extra charges. Once the amount is cleared, the pledge is removed.

5. How long does disbursal take?

Disbursal is usually quick and often completed within a day of approving the pledge.

6. Do dividends continue during the loan period?

Yes. You remain the owner of the shares, so dividends and other benefits still come to you.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.