List of Countries Where You Can Use UPI Payments

The Unified Payments Interface (UPI) continues to dominate India’s digital payments landscape. With over 85% of all such transactions being executed by UPI, one thing is clear: this payment system is here to stay. But what if we tell you, you can now also enjoy UPI’s convenience across borders?

That’s right! Now, you can easily send and receive money internationally via familiar UPI apps. In fact, it’s already being used by many Indians around the globe.

Keen to learn more? Read this blog as we discuss how many countries use UPI globally and walk you through its activation process.

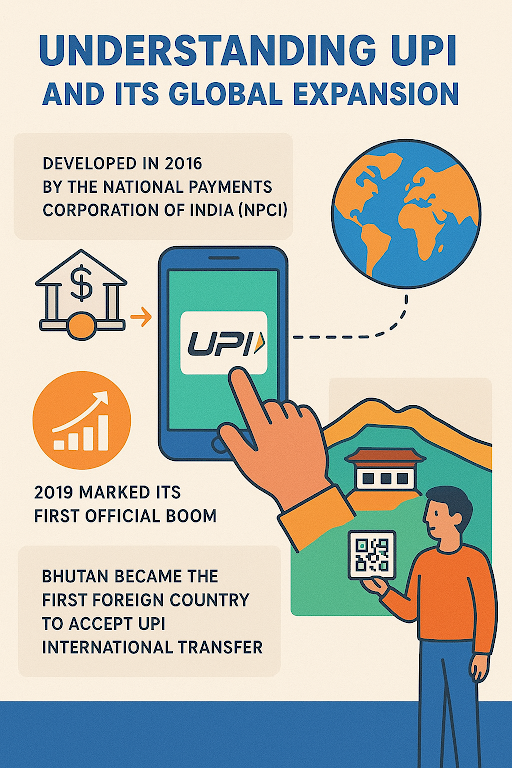

Understanding UPI and Its Global Expansion

Before we discuss how many countries use UPI, let’s understand its growth trajectory, from a domestic digital payment system to an emerging global financial revolution:

In 2016, the National Payments Corporation of India (NPCI) developed Unified Payment Interface, a digital payment system that enables instant money transfer between two bank accounts with just a mobile application.

Initially, the goal was to make domestic payments fast, secure, and simple. The year 2019 marked its first official boom, with UPI’s transaction volume surpassing ₹2 lakh crore in value for the first time. But over time, the goal became bigger.

Understanding UPI’s potential, the government planned to internationalise this digital payment infrastructure. So in 2021, they launched it in Bhutan.

With that, Bhutan became the first foreign country to accept UPI international transfer, empowering Indians to make QR-based payments with select merchants in the country. Since then, various countries have adopted this payment system, making travelling feasible for Indians across borders.

List of Countries Where UPI Is Accepted (2025 Updated)

Now, let’s come to the crux of the topic. Here are the countries accepting UPI payments in 2025.

| Country | UPI Launch Year | Key Partners | Modes of Acceptance |

|---|---|---|---|

| Bhutan | 2021 | NPCI International Payments Limited (NIPL), Royal Monetary Authority (RMA) of Bhutan | BHIM/UPI apps, QR payments |

| France | 2024 | NIPL, Lyra Network | UPI apps, QR payments |

| Cyprus | 2025 | NIPL, Eurobank Cyprus | QR payments |

| UAE | 2022 | NIPL, Mashreq Bank (NeoPay), Magnati | UPI apps, QR payments |

| Qatar | 2025 | NIPL, NETSTARS, Qatar National Bank (QNB) | UPI apps, QR payments |

| Oman | 2022 | NIPL, OmanNet, Central Bank of Oman (CBO) | QR payments |

| Malaysia | 2025 | NIPL, Razrpay Curlec | QR payments |

| Singapore | 2023 | NIPL, HitPay, PhonePe | UPI apps, QR payments |

| Nepal | 2024 | NIPL, Fonepay, Nepal Rastra Bank (NRB) | UPI apps, QR payments |

| Sri Lanka | 2024 | NIPL, LankaPay | QR payments |

| Mauritius | 2024 | NIPL, Bank of Mauritius (BoM) | UPI apps, QR payments |

Bhutan: The Pioneer UPI Accepted Country

Bhutan was the first country to accept UPI payments. This happened after NPCI International and the Royal Monetary Authority of Bhutan worked together to introduce UPI through the BHIM app. Now, Indians can quickly pay with QR codes at local shops, cafes, and tourist spots. This was UPI’s first successful step into other countries.

UPI Adoption in Europe: France and Cyprus

France and Cyprus are among the first UPI-accepted countries in Europe. They started using UPI through partnerships with NIPL and European payment companies.

France began accepting UPI at popular tourist locations through a partnership with Lyra, while Cyprus made it available in retail stores and restaurants. Both countries see UPI as a simple way for Indian tourists to pay.

Key Tourist Spots & Retail Locations

- Eiffel Tower area kiosks

- Paris museums and cafés

- French retail chains using Lyra terminals

- Cyprus beachfront restaurants

- Convenience stores near tourist districts

UPI in the Middle East and Asia: UAE, Qatar, Oman, Malaysia

The UAE, Qatar, and Oman are three countries accepting UPI payments in the Middle East. Malaysia is currently the only major country accepting UPI international transfers in Asia.

These regions embraced UPI to support India’s massive traveller population. UPI works across merchant networks via partnerships like Mashreq (UAE), QNB (Qatar), and NIPL-enabled QR integrations in Oman and Malaysia. It’s mainly used for dining, shopping, metro payments, local transport, and retail purchases.

Pro Tip - Always look for NIPL/UPI logos on QR stands. Keep international UPI enabled in your app settings.

Southeast Asia and South Asia: Singapore, Nepal, Sri Lanka, Mauritius

Major UPI-accepting countries in South Asia include Nepal, Sri Lanka, and Mauritius. In Southeast Asia, the only country currently accepting UPI payments is Singapore.

These countries offer smooth UPI payments through strong bilateral integrations.

- In Singapore, the UPI–PayNow cross-border link lets users send and receive money instantly.

- Nepal supports UPI through its UPI–Fonepay QR compatibility, making on-ground payments easy.

- Sri Lanka and Mauritius also accept UPI through NIPL partnerships with local banks, along with MauCAS hub and bank-level QR integrations aimed at tourists and business travellers.

How to Use UPI Internationally: A Step-by-Step Guide

As Indians, we’ve only experienced complicated and cumbersome forex transactions. But UPI International is different.

Here’s how to use UPI abroad:

Step 1: Open your UPI app and enable UPI international transfer. For example, if you use Google Pay, follow these steps -

- Tap on your profile picture in the top right corner

- Under “Set up payment methods,” select the bank account through which you want to use UPI internationally. Here’s the list of banks that support UPI international

- Select “Manage international payments”

- Enable “Pay with UPI International”

Step 2: When you visit a foreign country that accepts UPI, look for merchants with UPI-enabled QR codes.

Step 3: Scan the QR code using your UPI app, type the amount, and enter your PIN.

Note - Banks generally charge a 2%-4% forex fee plus a certain percentage of processing fee for every international UPI transaction.

Make Your Overseas Spending Smarter With UPI

If you’re someone who enjoys using UPI, the idea of travelling to any of the above-mentioned countries that accept UPI payments must feel delightful to you. And rightly so, with UPI crossing borders, it’s both a matter of pride and comfort for us.

Just remember that not all stores in these countries accept UPI yet. Always check with the store before assuming you can pay with UPI.

Need a personal loan to finance your next big vacation? Hurry up and apply for a personal loan with Hero FinCorp today!

Frequently Asked Questions

Which was the first country outside India to accept UPI payments?

The first foreign country to accept UPI was Bhutan.

Can I use UPI outside India without any additional registration?

No, you first need to activate “UPI International” in your UPI app and ensure your linked bank allows international UPI payments.

Are there any charges or forex fees when using UPI internationally?

Yes, banks usually charge a 2%-4% forex makeup fee and a processing fee for every international UPI transaction.

What are the major countries currently supporting UPI payments for Indian travellers?

Some major countries supporting UPI for Indian travellers include the UAE, Qatar, Sri Lanka, Bhutan, and Singapore, among others.

Is UPI linked with other international payment systems?

Yes. UPI is being linked with select international payment systems like Singapore’s PayNow and France’s Lyra network, enabling limited cross-border payments in supported regions.

How secure is UPI for international transactions?

UPI is considered highly secure for international transactions due to strong encryption, two-factor authentication, and constant RBI regulation.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.