How to get an Instant Cash Loan in 1 Hour Without Documents

Financial emergencies often arise without prior notice. A sudden medical expense, urgent home repair, or an unexpected bill can create pressure within hours. In such situations, waiting several days for loan approval is simply not practical. Traditional banks often require multiple documents, detailed paperwork, and long verification processes. This can delay access to funds when time matters most. As a result, many people start searching for an Instant Cash Loan in 1 hour. While the promise sounds convenient, it is important to understand how it works and what steps are involved. Proper knowledge can help you secure an Instant Cash Loan, safely and responsibly.

What Is an Instant Cash Loan?

An Instant Cash Loan is a short-term loan that provides quick access to funds, often within a few hours of approval. It is designed to help people handle urgent financial needs, such as medical bills, emergency travel, or sudden repairs. Unlike traditional bank loans, the process is usually simple and fast. Many lenders offer online applications with minimal paperwork and quicker verification.

Instant Cash Loan in 1 Hour Without Documents: Benefits to Explore

Applying for an Instant Cash Loan in 1 hour without documents offers several practical benefits, especially during urgent financial situations. Here are some important advantages to consider:

- Funds are usually credited within an hour, making it suitable for emergencies.

- The process involves minimal or no paperwork.

- Verification is completed digitally, saving time and effort.

- No property or collateral is required to apply.

- The loan amount can be used for any personal or emergency expense.

- Simple online forms and instant loan apps make the application process smooth and convenient.

- Approval is generally based on proof of income.

In certain cases, you may be able to get an Instant Cash Loan in 1 hour without a PAN card.

Instant Cash Loan in 1 Hour Without Documents: Eligibility Criteria

Understanding the requirements before applying for an Instant Cash Loan makes the application process easier.

| Particulars | Details |

| Age | You should be 21-58 years old |

| Citizenship | Indian citizen |

| Work Experience | 1. Salaried Individuals: Minimum 6 months 2. Self-employed Individuals: Minimum 2 years of stable business operations |

| Monthly Income | You must have at least a monthly income of Rs 15,000 |

| Credit Score | A score of 725 or above is preferred |

Also Read: How Can I Get an Instant Cash Loan for Urgent Requirement?

How to Get An Instant Cash Loan?

Applying for an Instant Cash Loan is simple and can be completed online in just a few easy steps.

- Visit the official Hero FinCorp website and click on the Personal Loan page.

- Please enter your mobile phone number to get an OTP. You can use it to verify your number.

- Choose the desired loan amount.

- Provide digital consent and keep PAN & Aadhaar.

- Click 'Submit' to finish your application.

- Once verified, the loan is approved immediately.

- You get your funds in your bank account within an hour.

Alternatively, download the personal loan app to apply for an instant loan.

Interest Rates and Charges for Instant Loans

Instant Cash Loans typically carry higher interest rates than traditional loans. Typical charges include:

| Particulars | Details |

| Interest Rate | From 18% p.a. |

| Loan Processing Charges | Minimum 2.5% + GST (non-refundable) |

| Prepayment Charges | As per the loan agreement |

| Foreclosure Charges | Up to 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1% - 2% of the Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Fine |

| Loan Cancellation | 1. No cancellation charges 2. The interest amount and processing charges are non-refundable |

Also Read: Small Personal Loan or Mini Loan: How Are They Different?

Risks and Precautions of Instant Cash Loans

Instant Cash Loans may offer quick access to money, but they also carry certain risks that borrowers should understand before applying.

- High Interest Rates: These loans often come with higher interest rates compared to regular personal loans, increasing the overall repayment burden.

- Short Repayment Periods: Many instant loans require quick repayment, which can strain monthly budgets.

- Hidden Charges: Processing fees, late payment penalties, and other charges may increase the total cost.

- Impact on Credit Score: Missing payments can negatively affect your credit score.

Precautions to Take:

- Read all terms and conditions carefully.

- Check the lender’s credibility and approval status.

- Borrow only the amount you truly need.

- Ensure you can comfortably repay on time.

Careful evaluation helps avoid financial stress and unnecessary debt.

Get Instant Funds When It Matters Most

Instant Cash Loans in 1 hour without documents are an easy and trustworthy way to fulfil your urgent financial needs. Be it a medical emergency, home repair, or travel plans, these super-fast loans take care of your requirements without you having to use your savings.

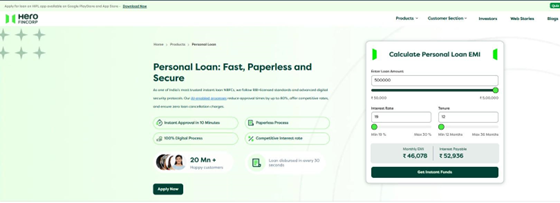

You can get an instant loan from Hero FinCorp for amounts between Rs 50,000 and Rs 5 lakh. The entire loan process is online and paperless, without documents or branch visits required.

So why wait? Explore our loan options today and get quick access to funds when you need them most.

Frequently Asked Questions

Can I get a cash loan within 1 hour without any documents?

You can get Instant Cash Loans in one hour without documentation. However, you may need to provide digital consent while applying.

How long does it take to receive the money once approved?

After approval, your loan amount is disbursed to your bank account within a few hours.

What is the preferred credit score for an Instant Cash Loan?

The preferred credit score for Instant Cash Loans is 725 or above.

Is a PAN card needed for these loans?

A PAN card is required in most cases. Lenders use it to verify your identity and check your credit score.

How much money can I borrow instantly?

Your income and credit score determine loan amounts. Lenders often lend larger amounts to borrowers with strong credit histories.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.