Small Personal Loan or Mini Loan: How Are They Different?

- Small Loan vs Mini Loan: Side-by-Side Comparison

- How to Choose Between a Mini Loan and a Small Personal Loan?

- Benefits of Choosing Hero FinCorp for Your Small or Mini Loan

- Application Process for Small and Mini Loans with Hero FinCorp

- Get Access to Quick Credit With Hero Fincorp

- Frequently Asked Questions

If you need funds urgently, Google your options. You will most likely come across these two terms: mini loans and personal loans. While they may look the same, they are actually different options.

What makes the situation worse is that different lenders often refer to them interchangeably. Some refer to a small loan as a mini loan, while others brand them as small personal loans.

So what is the difference between a mini loan vs a small personal loan, and when should you opt for which? Read on to find out.

Small Loan vs Mini Loan: Side-by-Side Comparison

Mini loans are best reserved for small amounts for immediate or short-term needs. Small personal loans for higher amounts with more flexibility in repayment. Here is a side-by-side comparison of the two loan options.

| Aspect | Mini Loan | Small Personal Loan |

|---|---|---|

| Typical Loan amount | Between ₹1,000 to ₹50,000 | Between ₹50,000 to ₹5,00,000 |

| Interest Rates (per annum) | 18-36% | 19-30% |

| Repayment Tenure | 3 - 12 months | 12-36 months |

| Eligibility Criteria | Stable income proof, active bank account, etc. | Good credit score along with stable income proof |

| Average Approval Times | Under 2 hours | Under 24 hours |

| Documentation | Usually, Aadhaar and PAN (not all lenders ask for income proof) | Aadhaar, PAN, salary slips (6 months), bank statements (more if required) |

| Foreclosure Charges | Usually nil or minimal | Lender specific |

| Ideal Use Cases | Quick cash needs for emergencies or small purchases | Urgent medical needs or for planned expenses like weddings, education, or home improvement purchases |

How to Choose Between a Mini Loan and a Small Personal Loan?

Choosing between a mini loan and a small personal loan depends on -

- Your credit score

- The amount required

- How quickly do you need the funds?

If you need quick access to funds (under Rs 50,000) and don't have all your documentation on hand, or have a poor credit score, a mini loan will be a better option for you. They are usually approved in a matter of hours.

If you are looking for a larger amount, say for a planned medical expense or a wedding, you should opt for a small personal loan. You will need to have a good credit score here (preferably above 750+) and show documentation:

- Stable income lasts for about 3 to 6 months

- Bank statements

- Necessary KYC documentation.

Since you can opt for longer repayment tenures with personal loans, you will add less to your monthly expenditure.

Pro Tip - Always make sure that all your EMIs put together never exceed 40-45% of your monthly income. Use a loan EMI calculator to plan out your finances better before taking a loan of any kind.

Benefits of Choosing Hero FinCorp for Your Small or Mini Loan

Traditional banks make you visit branches. Fill physical forms. Wait days for approval. Submit original documents. With reputed NBFCs like Hero Fincorp, you enjoy the following benefits.

- Apply From Your Couch - With HeroFincop, you can apply for a loan straight from your phone, from the personal loan app on Android or the quick loan app on iOS. You can check your eligibility for a loan from here, too.

- Entirely digital process - The process is fully digital. You can scan and upload all required documents digitally. The verification process happens digitally, too.

- Know Your Rate Upfront - Hero Fincorp tells you the interest rate upfront before you apply. You will not get any surprises after approval.

- Zero Closure Penalty - Hero FinCorp charges nothing for pre-closing your loan after the first EMI.

- Instant Approvals - Since HeroFincorp's systems work 24x7, the approval process starts the moment you apply for them, regardless of the time of day.

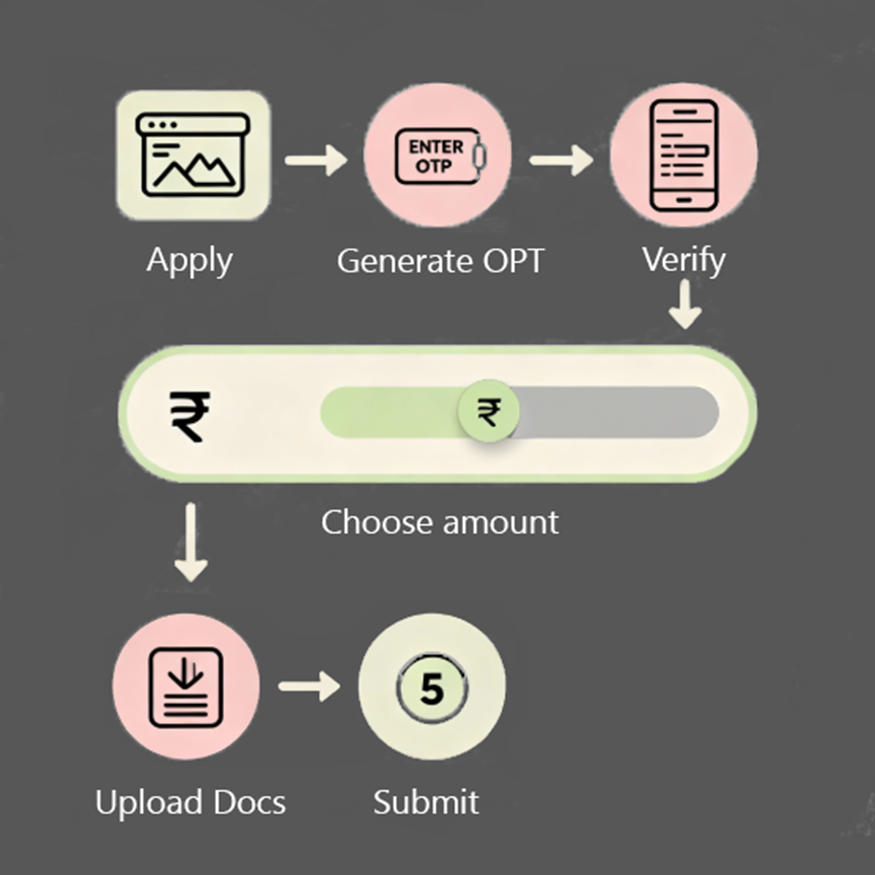

Application Process for Small and Mini Loans with Hero FinCorp

The process to apply for a mini loan online or a small personal loan is very easy and only requires a few steps -

- Go to Hero FinCorp's site and tap Apply Now under Personal Loans.

- Enter your phone number. Confirm it with the OTP you receive.

- Choose your loan amount. Unsure? Try the eligibility calculator before you continue.

- Upload the required documents as asked for, based on the type of loan.

- Hit Submit.

That's it. Once your loan is approved, you will receive all the details of the loan shortly.

Get Access to Quick Credit With Hero Fincorp

The choice between a mini-loan and a small personal loan comes down to your immediate needs. If you need a small amount quickly and don't have a credit history or have a low credit score, go for a mini loan. For relatively large amounts, a small personal loan is the better option.

Hero FinCorp offers both options with transparent terms and quick processing. Whether it's a mini loan or a small loan. Choose smart, choose Hero FinCorp. Apply now.

Frequently Asked Questions

1. Can self-employed individuals apply for mini loans and small personal loans?

Yes, self-employed individuals can also apply and get mini and small personal loans. Lenders will ask for additional documentation in this case.

2. Are there any prepayment or foreclosure charges on Hero FinCorp loans?

No. Hero FinCorp charges zero foreclosure fees on both mini loans and small personal loans.

3. What documents do I need to keep ready before applying for a mini loan?

For a mini loan, all you need are your Aadhaar card, PAN card, and the last 3 months' bank statements ready.

4. Can I use a mini loan or small loan for any personal expense without restrictions?

Yes, you can. These types of loans have no restrictions on where and how you use the funds.