8 Key Benefits of Personal Loans

Life does not always go as planned. One month you might be planning a family trip, and the next month you may face a sudden medical expense or home repair. In such situations, arranging money without disturbing your savings can be stressful, especially if you are a salaried individual. That's where a Personal Loan can help. However, before applying, it’s important to know its advantages. Let’s explore these benefits in detail.

What are Personal Loans?

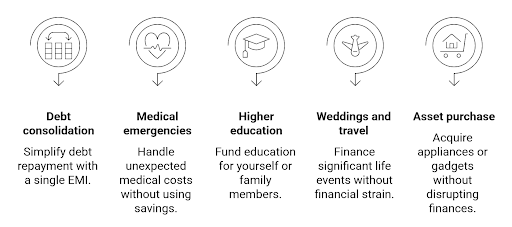

These are unsecured loans offered by financial institutions and non-banking financial companies (NBFCs). You can use them for any planned or unplanned purpose, such as higher education, home renovation, travel, wedding-related expenses, and medical emergencies. You can get approval instantly when you apply online with paperless documentation.

Key Benefits

Here are the key benefits of a Personal Loan you should know before applying.

1. Quick Loan Approval

An instant Personal Loan can be approved within minutes when you apply online. Once approved, the funds are credited directly to your bank account within a few hours.

2. No Collateral Required

These loans do not require collateral, as they are unsecured.

3. Flexible Tenure & Repayment Options

You can choose a repayment tenure as per your monthly income and expenses. A Loan EMI Calculator can help you select a suitable tenure.

4. Paperless Documentation

You only need your KYC details to apply for a loan. This speeds up the approval process.

5. Versatility in Usage

You can use the loan amount for various purposes, like travel, home repairs, weddings, or consolidating debts, without restrictions from the lender.

6. Improve Credit Score Through Timely Repayments

Paying your loan EMIs on time helps improve your credit score, which can make it easier to get better terms for future borrowings.

7. Competitive Interest Rates & EMI Options

The interest rates are competitive, making your EMIs more affordable and manageable.

8. Useful for Emergency Financial Needs

With the instant approval process, you can use a Personal Loan for sudden expenses, such as medical bills or urgent travel.

Read Also: Raise Loans for Medical Emergencies: 5 Key Reasons to Choose a Personal Loan

Benefits - Personal Loan vs Other Loan Types

Still wondering why you should take a Personal Loan? Let’s look at how it differs from home loans, car loans, and credit card borrowing.

| Benefits | Personal Loan | Home Loan | Car Loan | Credit Card Borrowing |

| Collateral | Not required | Property | Vehicle | Not required |

| Disbursal Speed | Quick, often with a few hours | Slow, may take weeks | Moderate | Instant but limited |

| Usage | Flexible | Property purchase only | Vehicle purchase | Limited to the credit limit |

| Tenure | From a few months to a few years | Up to 30 years | 1–7 years | Revolving |

| Interest Rate | Competitive rates | Lower, secured | Moderate | High |

As you can see, Personal Loans stand out due to their flexible usage, no collateral requirement, and quick approval, which sets them apart from other borrowing options.

How do the Loan Benefits Affect Your Financial Planning?

Personal Loans are more than just borrowed money. They can help you plan your finances better. You can use them purposefully for various needs:

Using these loans wisely helps you stay in control, manage expenses, and make important life moments more affordable.

Is There a Tax Benefit on a Personal Loan?

Many people wonder whether these loans offer any tax benefits. Unlike home loans, Personal Loans generally do not provide tax advantages. The interest you pay on a Personal Loan for expenses like travel, weddings, medical emergencies, or education is not eligible for any deductions under the Income Tax Act. The loan helps you manage finances and handle urgent needs, but it does not reduce your tax liability. These loans are for financial flexibility, not tax savings.

Conclusion

Now that you know the advantages of a Personal Loan, you can apply for one with Hero FinCorp. You can get up to Rs 5 Lakh at competitive interest rates starting from 19% per annum, with a flexible repayment tenure of 12–36 months. What’s more, you can get approval within minutes when you apply online.

Read Also: Find Best Personal Loan for You: A Comprehensive Guide

Frequently Asked Questions

What are the main benefits of taking a Personal Loan?

Some of the benefits of a Personal Loan include: instant approval, quick disbursement, no collateral requirement and paperless documentation.

How quickly can I get an instant Personal Loan after applying?

You can get the loan approval within minutes after applying, with funds disbursed in just a few hours.

Can I use a Personal Loan for any purpose in India?

Yes, you can use this loan for any purpose, as long as it is not used for any illegal activities.

Does availing a Personal Loan affect my credit score positively?

Yes, timely EMI payments of your loan can help improve your credit score over time.

What documents are required to apply for a Personal Loan?

To apply for a loan, you will need your KYC details (Aadhaar number and PAN number).

Are there any prepayment charges on Personal Loans?

Some lenders may charge prepayment fees. At Hero FinCorp, there are no such charges. Do check the terms and conditions.