What Is A UPI Mandate? Meaning, Uses, Application & How It Works

Do you, despite setting up multiple reminders, always end up missing payment deadlines? EMIs and subscriptions are a way of life now, and if you add to this how hectic life is, the most common answer you'll get is 'yes.'

The good news is that we now have the convenience of making quick payments via UPI. No more logging into apps, pulling out debit cards, and waiting for OTPs. The even better news is that you can automate most of these recurring payments, ensuring you never miss a single one.

That's exactly what a UPI mandate does, and this blog will tell you everything you need to know about them.

What is UPI Mandate?

A UPI mandate is an automated payment mechanism via which you authorise merchants or services to debit fixed amounts from your account on specific dates. You can also set up a mandate to make periodic payments to pay your phone, electricity, or water bills.

Think of them as the UPI equivalent of the 'Auto-Debit' feature banks provide to clear credit card bills. For the older folks, it's the same as giving post-dated checks to ensure you never miss a payment.

The best part is that you set up everything via the UPI app on your phone.

How Does A UPI Mandate Work?

There are primarily two types of UPI Mandates:

- Merchant-Initiated Mandate: Here, a merchant (your loan provider, streaming service, or insurance company) sends you a mandate request, and you approve it.

- User-Created Mandate: Some UPI apps allow you to set up a mandate on your own to make recurring payments like your rent or gym fee.

Also Read: From Cash to Clicks: How UPI Is Changing the Way India SpendsIn both cases, the steps are similar:

- Receive or create the mandate request: You create a mandate or receive one from a merchant or service. This option is usually under an "AutoPay," "Mandate," or "Recurring Payment" section, depending on the UPI app.

- Review the details: You verify all the critical information, like the name of the merchant or recipient, the amount, the frequency, and the duration.

- Approve the mandate: If everything is as it should be, you authorise/initiate the mandate using your UPI pin.

- Mandate gets activated: You'll now receive a confirmation message stating that the mandate is active.

Note: You can also modify or cancel a mandate at any time. You again navigate to the mandate section on your app, select one from the list of active mandates, and then take the appropriate action.

Key Components Of A UPI Mandate

Every mandate in UPI has four major components.

- Authorisation: The approval you give by entering your UPI pin to activate the mandate.

- Frequency: How often (weekly, monthly, yearly) the payments are deducted or made.

- Amount: The specific amount that is to be deducted per transaction.

- Validity: The time period for which the mandate stays active.

Also Read: Set It and Forget It: Using UPI to Never Miss an EMI Again

Uses And Applications Of UPI Mandates

UPI mandates work best for repeat payments with fixed amounts. Some of their most common use cases are:

- Loan EMIs: Personal, car, and home loans all follow a strict payment schedule. Any delays here lead to expensive penalties. UPI mandates will ensure that never happens.

- Subscriptions: Renewals of your OTT platforms, post-paid phone plans, and gym memberships, all of which have fixed payment structures, can also be made via this method.

- Insurance Premiums: This is one payment you cannot afford to miss or delay, as it can leave you without critical coverage.

In short, any repeat payment whose value doesn't change every month can be automated with UPI mandates.

Benefits Of UPI Mandates

Using UPI mandates also offers several benefits over attempting to keep track and make payments manually. With them you:

- Save Money: With a UPI mandate setup, you never miss a payment and, as a result, never have to pay a late fee.

- Save Time: You also never have to spend time tracking your payments, nor have to log into multiple merchant/service apps or websites to make them.

- Maintain/Improve Credit Score: Timely payments will also mean that your credit score will improve over time, a major benefit if you ever apply for a loan in the future.

Security Features Of UPI Mandates

UPI mandates also ensure top-notch security.

- UPI PIN authorisation only: No one can activate a UPI mandate without your UPI PIN.

- Real-time debit notifications: You get real-time alerts every time there is a debit via a mandate.

- Absolute control: You stay in control, as you can pause or cancel a mandate at any time, even if it's one initiated by a merchant.

Limitations and Important Considerations for UPI Mandates

UPI mandates are convenient but come with certain limitations you should know about. UPI transactions are usually limited to ₹1 lakh per transaction. This, however, can vary by bank and the nature of the merchant. Your account needs a sufficient balance on the payment date; otherwise, the transaction will fail.

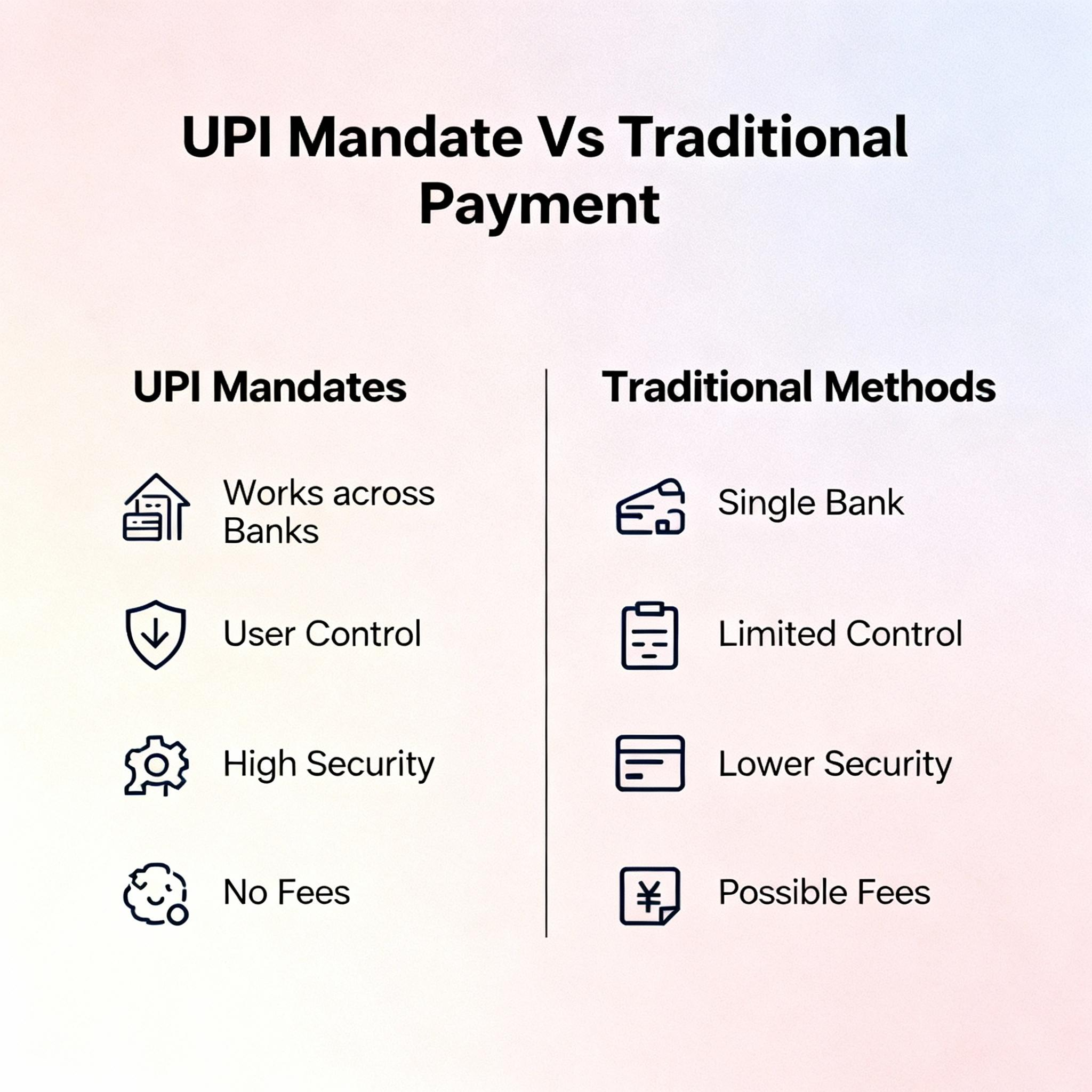

UPI Mandate Vs Other Payment Methods For Recurring Payments

UPI mandates offer clear advantages over traditional recurring payment methods, which are highlighted in the table below.

| UPI Mandates | Traditional Methods | |

|---|---|---|

| Works across Banks | Can set up mandates to work with all UPI-enabled banks. | Auto-debits or standing instructions only work within the same bank. |

| User Control (Modification/Cancellation) | Complete control over creation, modification, and cancellation of UP mandates. | Limited Control |

| Security | High as bank or card details are shared with merchants. | Low as auto-debit stores card details on merchants' websites. Physical cheques can be misused. |

Simplify Your Finances With UPI Mandates

UPI mandates simplify recurring payments by removing the stress of remembering due dates and manual transfers. You only need to set them up once, and then they take over. What's more, they don't involve a process fee, are structured flexibly, and you retain absolute control over them.

Now, if you are looking for secure credit to gain control over other aspects of your life, you can get an instant loan approved via Hero Fincorp in under 10 minutes. The entire process is paper-free, and you can get the funds in under 24 hours.

FAQs

1. Can you set up a UPI mandate for loan EMI payments?

Yes. Many lenders, including Hero FinCorp, allow UPI mandates for automatic EMI payments.

2. Can you modify the amount or frequency after creating a UPI mandate?

Some UPI apps allow you to do this. In the event yours doesn't, your only option is to cancel the existing one and create one with the new parameters from scratch.

3. What happens if there are insufficient funds during a mandate debit?

Some lenders retry the debit after a fixed amount of time. However, it's best to make the payment as soon as possible to avoid a late fee.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.