What Is a Letter of Credit? Definition, Types, and Step-by-Step Process

In trade, payment risk is always present, whether you’re selling across the street or across continents. That risk is exactly why businesses continue to rely on an LC, especially when large sums or new partners are involved.

The full form of LC is Letter of Credit. It refers to a bank-backed promise to pay, subject to certain conditions. Instead of relying solely on the buyer, the seller gains assurance from the bank issuing the credit.

The meaning of a letter of credit becomes clearer in international trade, where currency fluctuations, unfamiliar laws, and distance can complicate even straightforward deals. Despite newer payment methods, letters of credit still account for 41% of structured trade finance instruments globally, showing their continued relevance.

How Letters of Credit Work: The Core Mechanism

To really understand how a letter of credit works, it helps to look at who carries the responsibility. In an LC transaction, the bank steps in and takes over the payment obligation from the buyer.

Once the seller ships the goods and submits the required documents, the bank reviews them. If everything matches the LC terms, payment is released. This is the practical LC, meaning money flows based on paperwork accuracy, not promises.

A bank letter of credit works internationally because it follows globally accepted rules under UCP 600. That is also the simplest answer to what LC in banking is: it is a structured banking instrument designed to reduce payment risk and bring certainty to trade.

Also Read: Export Finance: Types, Benefits, & Why It Is Required for Small Business

Common Fees: How Much Do Letters of Credit Cost?

Security in trade comes at a cost, and a letter of credit is no exception. Knowing these charges early helps businesses avoid last-minute financial strain.

Banks charge issuance fees, usually calculated as a percentage of the LC value. This amount often depends on the buyer’s credit strength. If extra protection is needed, confirmation fees apply when a second bank guarantees the payment.

If a change is made after the document has been issued, such as a change of dates, values, or shipment terms, then amendment fees will be charged. In most cases, buyers and sellers agree on the division of the cost of these amendment fees in advance to avoid any misunderstandings later on.

Also Read: Business Credit Score vs Personal Credit Score

Key Types of Letters of Credit

Not all trade transactions look the same, and neither do letters of credit. Different types of LC exist to match varying levels of risk, frequency, and business needs.

Commercial Letter of Credit

This letter of credit is the one most frequently used in import-export trades. Payment is released as soon as the seller provides compliant documents, which is beneficial for maintaining a smooth flow of cash.

Standby Letter of Credit (SBLC)

A Standby LC acts as a backup. It is only used if the buyer fails to pay, which makes it useful when trust is still being established.

Revolving Letter of Credit

A Revolving LC automatically renews for companies that repeatedly trade with the same partner. This means less paperwork and a more efficient continuation of business relationships.

Confirmed Letter of Credit

When trading with buyers in higher-risk regions, a Confirmed LC adds another layer of security. A second bank guarantees payment, even if the issuing bank faces issues.

Traveler’s Letter of Credit

Traveler’s letters of credit were once used to cover overseas travel expenses. While now largely replaced by digital payments, they remain part of trade finance history.

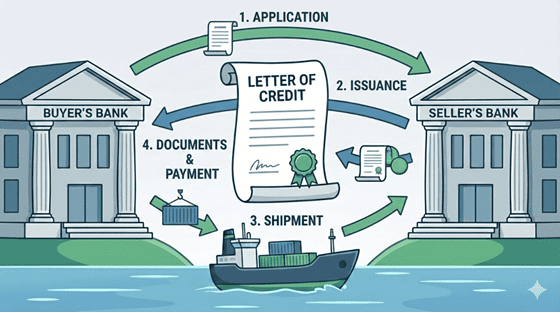

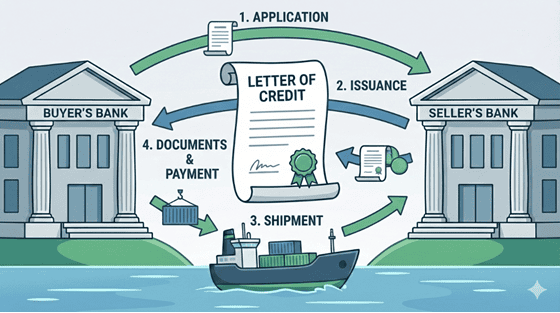

The LC Process in Action: A Practical Example

Understanding how a letter of credit works becomes much easier with a real example.

Let's say an Indian textile company is sending fabrics worth ₹50 lakh to a retailer in Germany. Although the letter of credit guarantees the payment, the exporter might still require money for manufacturing or shipping.

The process usually looks like this:

- Buyer and seller agree on trade terms, and the buyer applies for the LC.

- The buyer’s bank reviews their credit profile.

- The LC is sent to the exporter through SWIFT.

- Goods are manufactured and shipped.

- Documents such as the invoice and bill of lading are prepared.

- These documents are submitted to the exporter’s bank.

- Payment is released once documents comply with the LC terms.

- The buyer uses the documents to collect the goods.

Weighing the Options: Pros and Cons of Using LCs

Before choosing a letter of credit, it helps to weigh its strengths against its limitations.

Pros | Cons |

Payment security – The bank pays you once the documents are correct, guaranteeing your transaction | Bank fees – Issuance, confirmation, amendments, and document handling costs can add up |

Trust-building – Lets you trade with new or international partners confidently | Document strictness (discrepancy risk) – Even minor mistakes can delay or block payment |

Clear timelines – Deadlines for shipment, submission, and payment help with planning | Time-consuming – Multiple checks and approvals take longer than simpler payment methods |

Although letters of credit now make up only 20% of global cross-border payments, they remain a preferred option for large-value and first-time transactions.

Also Read: How to Improve Company Credit Score: A Comprehensive Guide for 2026

Managing Trade Risk with the Right Financial Structure

A letter of credit offers strong payment protection, but smooth cash flow is just as important for day-to-day operations. Balancing both allows businesses to trade with confidence and consistency.

With Hero FinCorp’s digital lending solutions, businesses can manage LC-related charges, production expenses, and short-term funding needs more easily. For fast and transparent support, explore Hero FinCorp’s personal loan options and stay financially prepared at every stage.

Frequently Asked Questions

1. What is the full form of LC?

The full form of LC is Letter of Credit. It is a commitment backed by a bank that secures the payment on fulfilment of all the agreed terms.

2. What is the difference between an LC and a Bank Guarantee?

An LC pays after documents are verified, while a Bank Guarantee is triggered only if the buyer defaults.

3. When does payment occur under a letter of credit?

Payment is released once the bank confirms that all submitted documents comply with the LC terms.

4. What are the primary risks?

The main risks are those related to documentation errors, processing delays, and amendment fees.

5. Which type of letter of credit is best?

There is no single best option. The right LC depends on transaction size, risk level, and trade frequency.