What Is OVD in Banking? Meaning, Full Form, and Documents

You submit documents when applying for a loan or opening a bank account, expecting the process to proceed smoothly. Instead, a message requests OVD even though you have already shared proof of identity and address. That pause feels confusing because nothing appears incorrect, yet the application does not move ahead.

This situation happens because most borrowers never receive a clear explanation of what banks actually need. Once you understand what OVD means in banking, the verification process becomes easier to follow and less frustrating.

Understanding OVD

Banks cannot provide financial services without confirming a borrower’s identity and address. This requirement explains why some documents matter more than others during verification. OVD refers to the specific set of documents banks rely on to complete identity checks in a regulated manner.

Rather than reviewing multiple informal papers, institutions follow a defined list approved by authorities. This keeps the process consistent across banks and reduces confusion for borrowers.

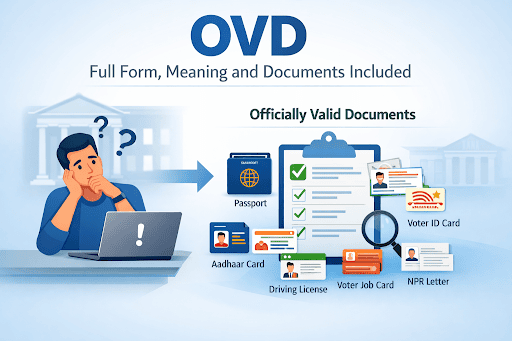

OVD Full Form: Officially Valid Documents Explained

OVD full form stands for Officially Valid Documents. These are government-issued records used to confirm identity and residential address. Authorities issue them only after proper verification, which makes them suitable for financial use.

Because these documents come from recognised sources, banks can rely on them without asking for additional proof for the same details.

The Significance of OVDs for KYC Compliance

Identity verification forms the base of KYC compliance. Official documents ensure that banks rely on verified records rather than assumptions or manual judgement.

This approach protects both the borrower and the institution by keeping records accurate throughout the financial relationship.

Types of OVD Documents Accepted by HeroFincorp as per RBI Guidelines

Borrowers may hold different documents depending on their personal or regional circumstances. The accepted list follows guidelines issued by the Reserve Bank of India, which Hero Fincorp follows to maintain uniform verification standards.

Comprehensive Proof of Identity and Address

A passport confirms both identity and address. Authorities issue it only after detailed background checks, which makes it reliable for verification.

Borrowers who submit a valid passport usually face fewer clarification requests during document review.

Driving License: A Common OVD for Individuals

A driver's license serves as proof of address when it reflects the current residential address. Many individuals already hold this document, which makes it widely used.

Banks verify its validity and issuing authority before accepting it for verification.

Aadhaar Card or Letter: The Primary OVD for Indian Residents

An Aadhaar card or UIDAI letter links identity through biometric verification. The issuing authority maintains centralised records, which allows faster digital checks.

This proves useful when borrowers apply through digital platforms where processing speed matters.

Voter ID Card: For Electoral Identity and Address Verification

A voter ID confirms identity by linking to electoral records maintained by authorities. Local level verification adds credibility to this document.

Banks accept it when address details remain clear and up to date.

NREGA Job Card: Specially Recognized OVD

An NREGA job card supports individuals enrolled under rural employment schemes. Local government offices issue it after verification.

It helps borrowers access financial services when other standard documents are unavailable.

Letter from National Population Register: Another Valid OVD

An NPR letter comes from population registration records maintained by government agencies. Authorities issue it after data checks.

Banks accept it when other officially recognised documents are not available.

Importance and Purpose of OVDs in the Financial Sector

Verified documents help financial institutions maintain accurate borrower records over time. Clear identification reduces disputes that can arise in long-term financial relationships.

These documents also ensure that financial services rely on confirmed information rather than incomplete or outdated records.

Role in Fraud Prevention and Regulatory Adherence

Accurate identification reduces the risk of impersonation and misuse. Identifying inconsistencies early helps prevent fraud before it affects borrowers or lenders.

Following standard documentation also supports regulatory requirements without adding unnecessary operational pressure.

Streamlining Services like Loan Applications at HeroFincorp

Loan applications move forward more smoothly when documents meet verification standards. Clear paperwork allows teams to focus on eligibility assessment instead of correcting documentation issues.

This structured approach helps keep the application process organised for both borrowers and service teams.

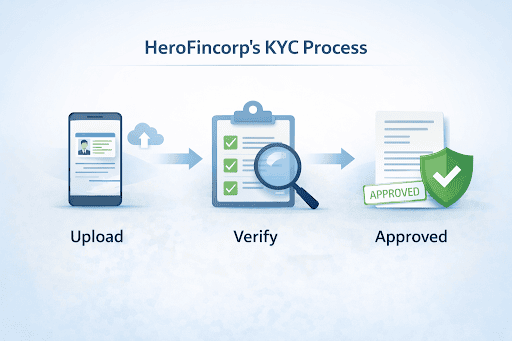

HeroFincorp’s OVD Submission and KYC Process

HeroFincorp follows a structured verification process that balances accuracy with efficiency. Document submission forms the foundation of this process and supports timely application review.

Clear guidance helps applicants understand what to submit and when to submit it.

Preparing Your OVDs for a Smooth Application

Applicants should check document validity and ensure personal details match across records before submission. Consistency across documents reduces resubmission requests and follow-ups.

Preparing documents in advance helps keep the verification stage predictable.

Handling Address Discrepancies in OVDs

Address mismatches can slow approval when details differ across documents. Additional proof may be requested to confirm the correct address.

Resolving this early helps the application continue without unnecessary pauses.

Clear Documentation Leads to Faster Decisions

Understanding OVD makes the loan application process feel clearer and easier to handle. When you know why certain documents are required, the steps ahead feel more predictable.

Choosing the right lender helps reduce confusion from the start. HeroFincorp offers personal loans supported by a clear KYC process and simple digital access. You can use a trusted personal loan app to check eligibility before you apply. Once approved, the same app helps you manage your loan in one place with clarity!

Frequently Asked Question

What does OVD stand for as per RBI guidelines?

OVD stands for Officially Valid Documents approved for identity and address verification.

Can I use an expired OVD for KYC with HeroFincorp?

Expired documents are usually not accepted because their validity cannot be verified.

Are digital copies of OVDs accepted by HeroFincorp?

Digital copies are accepted in many cases, subject to verification requirements.

What happens if I cannot provide any of the listed OVDs?

Alternative verification options may be suggested based on eligibility.

How often do I need to update my OVDs with HeroFincorp?

Updates are required whenever personal or address details change.

Is a PAN Card a standalone OVD for both identity and address?

PAN works for identity verification but does not serve as proof of address.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.