What Is the Moratorium Period in a Loan? Meaning and Benefits

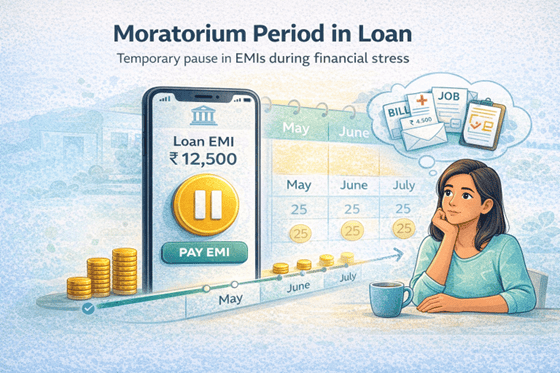

Life is unpredictable. A sudden job change. A medical emergency. A temporary business slowdown. During such moments, even well-planned finances can get out of hand.

This is often when people come across the term moratorium period in a loan and wonder what it actually means. Is it a break from EMIs? Does it increase loan cost? And should you opt for it?

In this guide, we explain what a moratorium period in a loan is, how it works, and when it can truly help.

Moratorium Meaning in Banking and Finance

A moratorium period is a temporary pause or reduction in loan repayments. During this time, the lender allows the borrower to either delay EMIs fully or pay only the interest portion.

The goal is to ease short-term financial stress without treating the account as overdue and to offer flexibility. It offers borrowers breathing room during periods of uncertainty.

Moratorium vs Grace Period

A moratorium period is usually longer and planned. It allows structured repayment relief for months. A grace period, on the other hand, is short. It typically lasts a few days after an EMI due date and prevents late payment penalties.

Also Read: Missed a Digital EMI Payment? What to Do Next

Key Features of a Moratorium Period

Understanding these features of the moratorium period helps borrowers make informed decisions instead of choosing relief blindly. Its key characteristics include:

- Temporary pause or reduction in EMI payments

- Interest continues to accrue during the period

- Loan tenure may be extended

- Total loan cost may increase

- Available for both existing and new loans

- Offered during financial hardship or special situations

- Requires lender approval

Types of Moratoriums: From Scheduled to Emergency

You'll need different forms of relief in different situations. The following types of moratorium ensure repayment flexibility without long-term financial damage:

Scheduled Moratorium: Pre-defined pauses offered during loan structuring, often at the start of repayment.

Emergency Moratorium: Relief provided during financial crises, job loss, medical emergencies, or economic disruptions.

Structured Moratorium: Planned EMI reduction or deferment based on borrower income cycles, common in business or seasonal income loans.

How the Moratorium Period Impacts Your Loan: EMIs and Total Cost

A moratorium reduces short-term pressure but changes the overall repayment structure. During this period, interest continues to accumulate. This is known as accrued interest during the moratorium. As a result, either the EMI amount increases later, or the loan tenure gets extended. In some cases, both happen.

Let's understand the impact of the moratorium on EMI and total loan cost using two real-world scenarios.

Option 1: Paying Only Interest During Moratorium

In this option, you pay only the interest component. Principal repayment resumes later.

Example:

You have a ₹5 lakh loan at 12% interest. Your monthly EMI is ₹11,100. During a three-month moratorium, you pay only interest of about ₹5,000 per month.

Result:

Short-term EMI burden reduces. Total interest cost remains largely controlled. Loan tenure may extend slightly.

This option suits borrowers who can manage partial payments.

Deferring Both Principal and Interest

Here, you skip EMIs entirely during the moratorium.

Example:

Using the same loan, you pay nothing for three months.

Result:

Interest compounds. Outstanding balance rises. Either EMIs increase later or tenure extends further. Total loan cost goes up.

This full EMI moratorium offers maximum short-term relief but costs more over time.

Benefits and Drawbacks of Opting for a Moratorium

A moratorium can be helpful. But it also has trade-offs. Understanding the pros and cons of a moratorium helps borrowers decide wisely instead of reacting emotionally.

Benefits of Moratorium | Disadvantages of Moratorium |

|

|

Also Read: How Do EMI Payments Impact Your Credit Score?

Eligibility and How to Apply for Moratorium

Lenders assess both financial need and repayment history before approving a moratorium. Moratorium eligibility usually depends on:

- Temporary financial hardship

- Good repayment track record

- Active loan account

- Supporting income or stress documentation

As for the application process, it is fairly straightforward and typically digital. Here's how to apply for a moratorium:

- Contact your bank or NBFC through app, website, or branch.

- Submit a moratorium request with a reason.

- Share or upload the required documents.

- Await approval and revised repayment schedule.

Also Read: What is a Loan Overdue - How to Clear Overdue Loan Payments?

Navigating Financial Stress with Smart Loan Choices

A moratorium period offers short-term relief when finances feel tight. But it works best when used thoughtfully. Understanding how it affects EMIs, tenure, and total cost helps you stay in control of your money.

At Hero FinCorp, we offer flexible loan options designed to adapt to real-life financial situations. Explore our solutions and manage your finances with confidence to stay a step ahead.

Frequently Asked Questions

Does a moratorium period affect my credit score?

No. If duly approved and followed correctly, a moratorium does not harm your credit score.

Is it always advisable to opt for a moratorium period?

No. It is best used during genuine financial stress, not as a routine option.

Can I get a moratorium for an existing loan?

Yes. Many lenders allow moratoriums on existing loans based on eligibility.

What happens if I miss an EMI after the moratorium ends?

If you miss an EMI after the moratorium ends, the lender will apply normal late payment charges. It will also impact your credit score.