What is Loan Overdue - How to Clear Overdue Loan Payments?

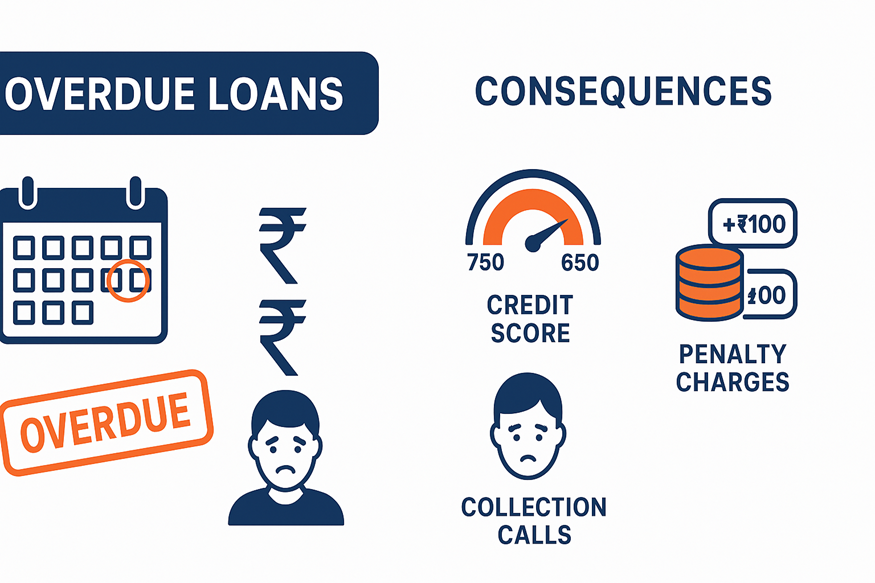

Missed EMI payments cause real worry. The phone starts ringing. Penalty charges appear. Questions about credit scores multiply. But an overdue loan doesn't mean the end of financial stability. Salary delays happen. Medical bills arrive unexpectedly. Forgetting a due date is easier than most people admit.

Understanding the problem and taking quick action to fix it is more crucial than the past-due payment. Continue reading to learn what a late loan actually means, how it impacts your finances, and the precise actions you can take to confidently and quickly make past-due payments.

What Is an Overdue Loan?

If the EMI (Equated Monthly Instalment) is not paid by the date specified in the loan agreement, the loan becomes overdue. Simple as that.

Different loan types all work this way:

- Personal loans need payment on specific dates each month

- Home loans follow their own schedules

- Vehicle loans have set payment days

- Education loans come with repayment dates, too

Miss the date? The status changes to overdue immediately.

Overdue vs. Default: What's the Difference?

Borrowers often confuse these two terms:

- 1–89 days overdue: The loan is simply overdue

- 90+ days overdue: The loan enters default and is classed as a Non-Performing Asset (NPA) under RBI regulations

Why is this important? Because NPAs get reported differently. Credit bureaus are notified, approval chances for new loans drop sharply, and lenders may charge higher interest rates in the future.

Common Reasons for Overdue Loans

Why do overdue loan problems develop? Several patterns show up repeatedly:

- Financial Emergencies: Hospital bills don't announce themselves weeks ahead. A sudden surgery costs ₹2 lakhs. The monsoon damages the roof. A family member needs urgent help. Emergency funds get wiped out fast. EMI payments then get pushed aside temporarily because there's simply no money left.

- Job Loss or Salary Cuts: The economy shifts. Companies let people go. Startups close their doors. Projects get cancelled without warning. Someone earning ₹50,000 monthly with a ₹10,000 EMI manages okay. Cut that salary by 30% to ₹35,000? The numbers stop adding up.

- Poor Money Management: Managing several credit cards, a few personal loans, and a vehicle loan with different payment dates can easily get confusing. Some borrowers also take new loans without checking whether their income can comfortably handle the combined EMI amount. The debt grows gradually, and over time it becomes difficult to manage.

- Legal or Regulatory Challenges: Business owners get hit differently. A big client goes bankrupt, owing ₹5 lakhs. Tax authorities freeze accounts during an audit. Licensing problems halt operations for months. Money stops flowing in, but the loan EMIs don't stop flowing out.

How to Clear Overdue Loan Payments?

An overdue loan needs immediate attention. Waiting makes things worse. Here's how to clear overdue loan payments:

Contact Lender Early and Negotiate

Call the lender now. Don't wait for them to call repeatedly. Why? Because options exist for borrowers who speak up early:

- Extending the loan period brings down monthly EMIs

- Payment holidays for one or two months give breathing room

- Restructuring changes the loan terms to fit current earnings

Wait until day 60 or 70? Those options shrink fast or disappear completely.

Create a Budget and Prioritise Overdue Payments

Pull up the last three months of bank statements. Go through every single transaction. Write down fixed costs like rent and utilities. Write down variable spending on groceries, fuel, and entertainment. Find what can be cut:

- Subscription services that rarely get used? Cancel them

- Eating out five times weekly? Drop it to once

- Expensive grocery brands? Switch to store brands

Put that saved money directly toward the overdue loan. Pay high-interest debts first because they cost more with each passing day.

Need quick funds to consolidate high-interest debts? Check your eligibility for Hero FinCorp's personal loan and get instant approval through a completely digital process!

Avoid Further Borrowing Until Overdue Payments Are Settled

Taking a new loan to repay an old one may feel like a solution, but it often creates a deeper debt trap. Monthly obligations increase, credit scores drop and financial stress escalates. The safest approach is to pause all new borrowing until your existing overdue payments are fully cleared.

Maintain Transparent Communication to Avoid Legal Consequences

Keep talking to the lender. Planning to pay by the 15th but realise it won't happen? Call them on the 10th.

Explain honestly what's happening. Most lenders prefer conversations over sending legal notices because legal action costs them money too. Staying transparent often gets grace periods or adjusted payment schedules.

Preventing Loan Overdue: Best Practices

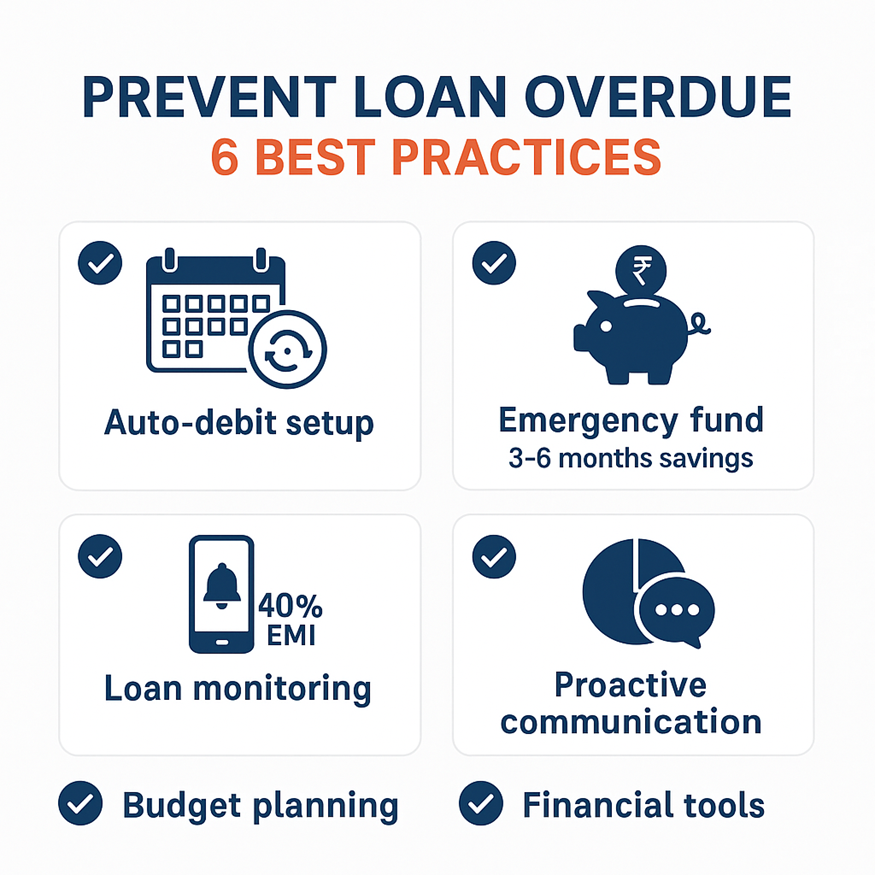

Avoiding an overdue loan takes less work than fixing one. These methods actually prevent problems:

- Set Up Automatic Payments: Connect the EMI to auto-debit from the salary account. Payment happens automatically each month without needing to remember dates. Just keep enough money in the account two or three days before the EMI date so the auto-debit doesn't fail.

- Maintain an Emergency Fund: Put up three to six months of living expenses in a separate savings account. This money lies there for emergencies only. Job loss? Use the emergency fund to cover EMIs until new work starts. Medical crisis? Emergency fund prevents loan payments from getting missed. Starting from zero? Save even 10% of your monthly income. It builds up over time.

- Regularly Monitor Loan Statements and Due Dates: Open the lender's app every week. Check the outstanding balance. Check the next due date. Check the interest charges. Set phone reminders three days before every EMI date as backup.

- Budget Wisely and Avoid Over-borrowing: Before applying for any loan, calculate the EMI first. Then ask honestly: Does this fit in the monthly budget comfortably? Financial advisors say total EMIs should stay under 40% of monthly income. Someone earning ₹50,000 monthly should keep loan payments below ₹20,000. Go higher, and default risk shoots up.

- Communicate With Lenders in Case of Financial Hardship: Salary getting delayed for two weeks? Call the lender right away. Explain what's happening. Ask for a short grace period. Most lenders say yes to one-time requests from borrowers with a clean payment history. The trick is calling before the due date passes, not after.

Hero FinCorp's Digital Lending App tracks loan information, calculates EMIs, and sends payment reminders. Download from Google Play or the App Store to keep everything organised!

Act Early, Stay Transparent, and Restore Financial Stability

The most favourable outcomes are the result of taking a prompt and honest approach to a missed EMI.

Taking the early intervention step will effectively reduce any fines, protect your credit rating, and give you the chance to continue with a flexible payment plan. Furthermore, building your lender's trust through clear communication could lead to an adjustment in payment terms or a temporary suspension.

Getting back on track? Completely possible. Quick action plus honest communication helps clear dues and fix credit profiles. At Hero FinCorp, we offer supportive solutions such as loan modifications, temporary moratoriums, and repayment rescheduling to help borrowers regain financial stability without added pressure.

So why wait? Download our app and manage your loans effortlessly, track EMIs, view statements, get reminders and access support whenever you need it!

FAQs (Frequently Asked Questions)

What qualifies as an overdue loan?

The loan becomes overdue when the EMI payment is missed by even one day past the due date in the agreement.

How long does a loan need to be overdue to affect a credit score?

Credit scores usually take a hit after 30 days because that's when lenders report delays to credit bureaus.

Can I clear my overdue loan with partial payments?

Yes, lenders take partial payments. But the account stays marked overdue until the full EMI plus penalties is paid.

What happens if I do not repay the overdue loan?

Penalties keep stacking up. The credit score declines significantly. Legal action becomes likely. Collateral for secured loans may be seized by the lender.

How do I find my loan's outstanding balance online?

Use the lender's application, visit their website, check their email statements, or get the most automated SMS alerts from the majority of lenders.

Will paying overdue charges improve my credit score immediately?

Paying clears the debt, but credit score recovery needs time. Status updates in 30-45 days. Full recovery takes 6 to 12 months of consistent on-time payments.