What is Debt Trap? Meaning and How to Get Out of It

Suyash is a college graduate. Two years ago, he took a loan to buy his first bike. But he couldn’t handle the high monthly EMIs. So, he took another loan to pay off the first one. However, the second loan also had high interest.

Before he could realise, he was trapped in a cycle of borrowing to pay off debts.

This is a classic example of a debt trap. What’s more terrifying? As per RBI’s data, 5-10% of India’s middle-class population is stuck in a similar situation.

So in today’s blog, let’s understand what is debt trap, its indicators, and ways to overcome it.

What is Debt Trap?

A debt trap is a situation where a person borrows more money to repay existing loans, leading to continuous borrowing and increasing debt that becomes hard to repay.

How Does a Debt Trap Work?

Suyash’s story is one of the many examples illustrating the meaning of debt trap. This financial quicksand can creep into your finances in several ways.

It usually begins when you borrow money but can’t repay it in full, so you take another loan to cover the first one. Before you know it, interest piles up, EMIs multiply, and managing all those payments turns into a never-ending cycle that’s tough to break.

Even credit cards or personal loans can pull you in if you’re not careful. For instance, using a credit card for monthly bills might feel convenient at first, but those high interest rates can make the debt snowball fast. And taking a personal loan to clear an old one? That just adds another layer to the trap.

Need funds but can’t afford to wait too long? Try our Instant Loan App today!

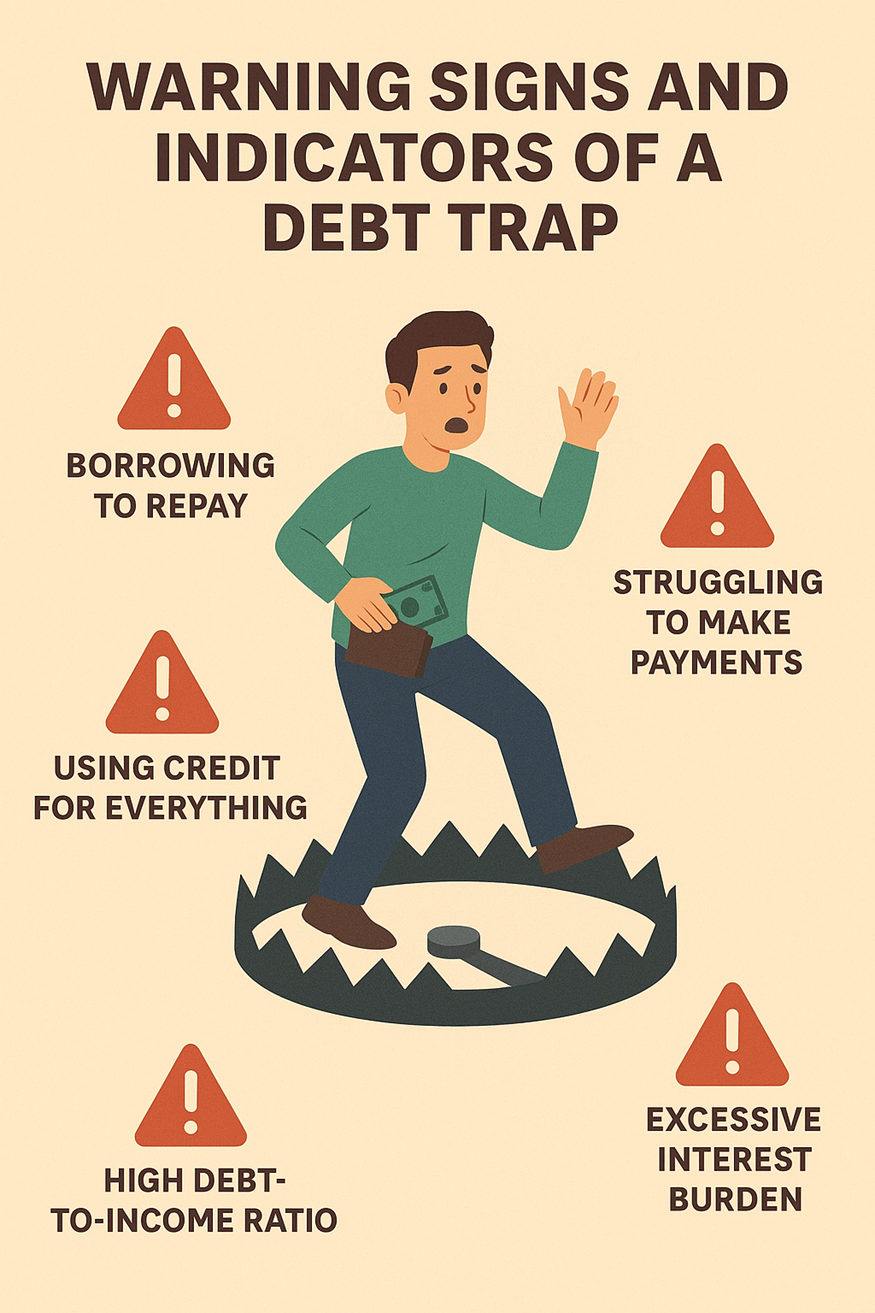

Warning Signs and Indicators of a Debt Trap

No one falls into a debt trap all of a sudden. Here are a few red flags that show up first:

1. Borrowing to Repay

If you find yourself taking on debt only to repay an older one, you could be on the verge of a debt trap. This is usually how the vicious cycle begins.

2. Using Credit for Everything

This is an extension of the previous point. Basically, if you’re pulling out your credit card to make ends meet, it could mean you’re well on your way to a debt trap.

3. Struggling to Make Payments

The earliest sign of a debt trap is a financial crunch. That is, managing even basic expenses, such as groceries and utility bills, becomes a burden.

4. Excessive Interest Burden

If your loan’s interest rate is high, most of your EMI payments go toward it instead of reducing the principal amount. This not only pulls you but keeps you locked in the debt trap.

5. High Debt-to-Income Ratio

It’s often seen that people who get stuck in a debt trap have a debt-to-income ratio exceeding 50%. If you catch yourself going down that lane, expect financial turbulence in the near future.

Keep an eye on your loan application from your smartphone. Download the Hero Digital Lending App now!

How to Avoid Falling Into a Debt Trap

Getting out of a debt trap can take weeks, even months, if you don’t follow the right strategies. So, better be safe than sorry. Here’s how to avoid a debt trap:

1. Borrow What You Can Pay

Don’t overburden yourself with debt. Deliberately evaluate your needs and only borrow the amount you can comfortably repay without taking another loan. It’s the easiest way to prevent a debt trap.

2. Focus on Budgeting

Aim to develop a monthly budget that lets you track your income, expenses, and savings. It also makes it easy to plan debt repayment and avoid a debt trap.

3. Create an Emergency Fund

75% of Indians don’t have an emergency fund. But did you know that having it can help you cover unexpected expenses without taking on debt, minimising the risk of a debt trap.

4. Read Loan Terms

Always read the loan fine print carefully to understand interest rates, fees, penalties, etc. This way, you can lower the risk of surprise charges and high EMIs that create a debt trap in the first place.

5. Develop Financial Discipline

Financial discipline means handling your finances in a conscious, future-forward manner. This involves setting goals, saving, investing, budgeting, etc. These practices can keep you from falling into a debt trap.

Practical Ways to Get Out of a Debt Trap

Wondering how to get out of a debt trap you’ve been stuck in for a while? Well, here are a few ways:

1. Opt for Debt Consolidation

Instead of juggling multiple loans with varying interest rates, consolidate your debt with a single personal loan from Hero FinCorp. This will help you manage just one EMI at a lower rate, making repayments easier and helping you get out of a debt trap faster.

2. Prioritise High-Interest Debt

Pay off your high-interest loans first. This will reduce the total interest you’ll pay over time and help you become debt-free faster. It’s one of the most effective ways to escape a debt trap.

3. Negotiate with Your Lender

Request your lender to reduce your interest rate. This will ease your repayment burden and help you close your loans faster.

4. Lower Your Expenses

The last thing you’d want to do while in a debt trap is spend excessively. So don’t make impulse purchases or unnecessary splurges. Focus only on paying off your loans.

5. Increase Your Income

If you don’t want to take on additional debts to repay old ones, you have to increase your income. So, try building a passive income source through freelancing or part-time jobs.

Borrow Responsibly, Live Stress-Free

Anyone can fall into a debt trap, as it’s more common than you think. The trick is to spot it early and act fast. Borrow only what you can repay, monitor your spending, and don’t take another loan just to close the old one. These simple habits can save you a lot of stress later.

Want to make your repayments easier? Apply for a personal loan with Hero FinCorp and take control of your finances, one EMI at a time.

Frequently Asked Questions

1. What exactly is a debt trap, and why is it dangerous?

A debt trap is a cycle of borrowing new loans to repay old ones. It’s dangerous because the debt keeps piling up, leading to financial instability and stress.

2. How can I know if I am currently stuck in a debt trap?

If you’re borrowing to pay off old loans, using credit for everyday needs, or most of your income goes into EMIs, you’re probably in a debt trap.

3. Can a debt trap ruin my credit score permanently?

No, it won’t ruin it forever. But it can hurt your credit history for a long time.

4. Is debt consolidation always the best solution to escape a debt trap?

No. If you can’t control spending or manage debt responsibly, debt consolidation can make the problem worse.

5. How long does it take to get out of a debt trap?

Depending on your total debt amount, income, and repayment strategy, it can take several months to a few years to get out of a debt trap.

6. Can Hero FinCorp help me get out of a debt trap?

Yes, Hero FinCorp can help you get out of a debt trap through personal loan–based debt consolidation. We also provide loan settlement and restructuring options for those facing repayment challenges.