What Is Equifax ePORT?

A credit team sits down to review a new application. Most details look fine, but a few questions remain. Has this borrower handled credit responsibly in the past? Are there any recent red flags? Instead of calling, emailing, or waiting for multiple reports, the team logs into a single portal to get answers.

This is how many lending decisions work today. Speed matters, but accuracy matters more. Equifax ePORT supports this balance by providing authorised businesses with a secure platform to view credit data, understand borrower behaviour, and move forward with clarity rather than guesswork.

Introduction to Equifax ePORT

Equifax plays a central role in India’s credit ecosystem. Lenders rely on their regulated bureau data to understand borrower behaviour, assess risk, and meet lending controls without relying on assumptions or incomplete information.

Consider how a typical lending team works. Before approving a loan, they need clarity on repayment history, existing obligations, and recent credit activity. The ePORT Equifax platform brings this information together through a secure, self-service environment built for authorised institutions.

Once users complete the Equifax ePORT India login, they land on business-focused dashboards designed for everyday decision-making.

These dashboards help teams handle tasks such as:

- Reviewing consumer and commercial credit profiles

- Generating structured credit reports

- Analysing risk indicators and repayment behaviour

Equifax ePORT also supports ongoing workflows beyond approvals. Risk and portfolio teams can monitor borrower trends, review accounts periodically, and flag changes early. This visibility helps organisations stay consistent, compliant, and responsible across different lending scenarios.

Key Features of Equifax ePORT

Equifax ePORT brings several tools together in one interface. These ePORT Equifax features help credit teams work faster and with more confidence. Users log in once and then move easily across modules.

- Unified Marketplace for Products: Businesses access consumer and commercial credit products from one place. Teams avoid juggling multiple platforms or formats.

- Secure Single Sign-on: Users get protected access through encrypted Equifax eport India login sessions. Admins can manage roles and entitlements centrally.

- Real-time Reports and Analytics: Credit teams can pull fresh bureau reports within minutes. Built-in analytics highlight trends, risk signals, and score movements.

- Fraud and Identity Checks: Modules support identity verification and fraud pattern detection. This helps reduce the risk of impersonation and the number of suspicious applications.

- Employment and Data Verification: Tools help validate employment details and key customer data. That improves accuracy before any credit decision.

- Compliance and Audit Support: Logs track who accessed which report and when. This helps with audits, internal reviews, and regulatory expectations.

- Process Integration: APIs and workflows can align with existing systems. That makes credit operations smoother and more productive.

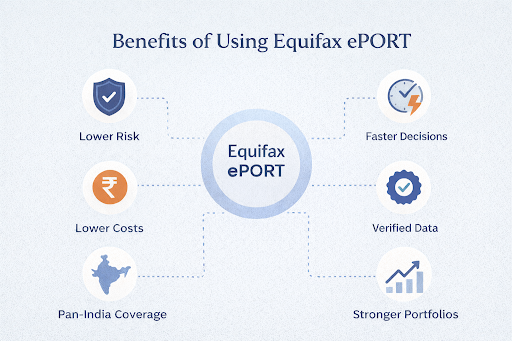

Benefits of Using Equifax ePORT

The benefits of eport Equifax go beyond simple report downloads. It strengthens risk control, speeds up processing, and supports better lending outcomes. For lenders and NBFCs, it becomes a core workflow engine.

- Cost Reduction in Credit Processing: Automated pulls cut manual effort and courier costs. Teams spend more time on analysis, not chasing documents.

- Faster and Sharper Decisions: Instant bureau access supports same-day approvals. Decision rules use consistent, structured data.

- Higher Customer Trust: Customers know lenders rely on verified histories. This supports transparent, fair decision-making.

- Lower Fraud and Credit Losses: Early checks flag unusual patterns or suspicious profiles. That reduces default and fraud exposure.

- Wider Data Coverage: Businesses access credit information from across India. This supports nationwide acquisition and portfolio growth.

- Stronger Portfolio Performance: Better screening improves long-term portfolio quality. Revenue growth becomes more sustainable.

If you are looking for any financial help, apply for a personal loan through our quick loan app. You get instant credit without much paperwork, making it convenient during emergency situations.

How to Register for Equifax ePORT?

Equifax ePORT is a B2B portal. Your organisation must first be an approved Equifax customer. Only authorised representatives should complete the registration process.

Step 1: Visit the official ePORT website at eport.equifax.co.in.

Step 2: Click the option labelled 'Register for ePORT' on the homepage.

Step 3: Enter the company details and the Equifax membership number carefully.

Step 4: Add business address, contact details, and authorised user information.

Step 5: Choose your preferred contact method for registration support.

Step 6: Submit the form and wait for an email confirmation from Equifax.

Step 7: Receive your User ID and initial password at the registered email.

Step 8: Complete your first Equifax ePort login and update the password.

Step 9: Set security questions, answers, and recovery details.

For safety, update passwords regularly and avoid sharing credentials. Use official channels only for Equifax login support or password resets.

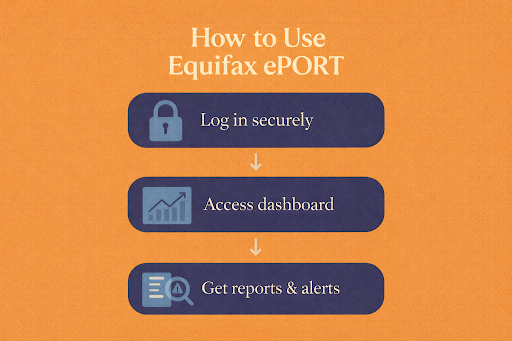

How to Use Equifax ePORT: Login and Navigation?

Users access Equifax ePORT through a secure sign-in page using their official User ID and Password. After logging in, they arrive at a central dashboard designed to support everyday credit evaluation tasks.

The dashboard typically allows teams to:

- Access consumer and commercial credit reports

- View analytics and risk indicators

- Receive alerts and system notifications

- Manage administrative and account settings

From this interface, businesses can request fresh credit reports, generate summaries, and download verified data for internal assessments. Teams can review repayment behaviour, credit risk patterns, and financial profiles using a structured, data-backed environment.

If access issues occur, users can:

- Follow the guided steps for password resets

- Troubleshoot temporary login errors

- Reach out to designated support channels for technical help

These support options help ensure smooth navigation and uninterrupted platform usage during routine operations.

Also Read: Difference Between CIBIL Score and Equifax

Make Equifax ePORT Work Harder for Your Credit Decisions

Equifax ePORT gives your business a structured way to use bureau data. When decisions rely on verified information, risk is reduced, and approvals feel more confident. Your teams work faster without compromising control.

If your customers need quick funding, digital journeys matter. At Hero FinCorp, we support seamless, end-to-end digital lending through secure tools that help customers check eligibility quickly and apply for personal loans with minimal effort. Get in touch with us for more info!

Frequently Asked Questions

What is Equifax ePORT, and who can use it?

Equifax ePORT is a bureau portal for businesses. Only approved institutional Equifax customers can access it.

How do I access Equifax ePORT if I am not an Equifax customer?

You must first onboard as an Equifax client. Then your organisation can request ePORT access.

What security measures does Equifax ePORT have in place?

The portal uses encrypted sessions, controlled logins, and detailed access logs. Admins can manage roles and permissions.

How often should I check my business credit report via ePORT?

Most lenders review portfolios monthly or quarterly. You can adjust frequency based on risk appetite.

What should I do if I forget my Equifax ePORT login credentials?

Use the official password reset options on the login page. If needed, contact your admin or Equifax support.

How can errors in credit reports be disputed through ePORT?

Raise a dispute request using available workflows or channels. Equifax investigates and updates valid corrections.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.