What Is APY and How Is It Calculated?

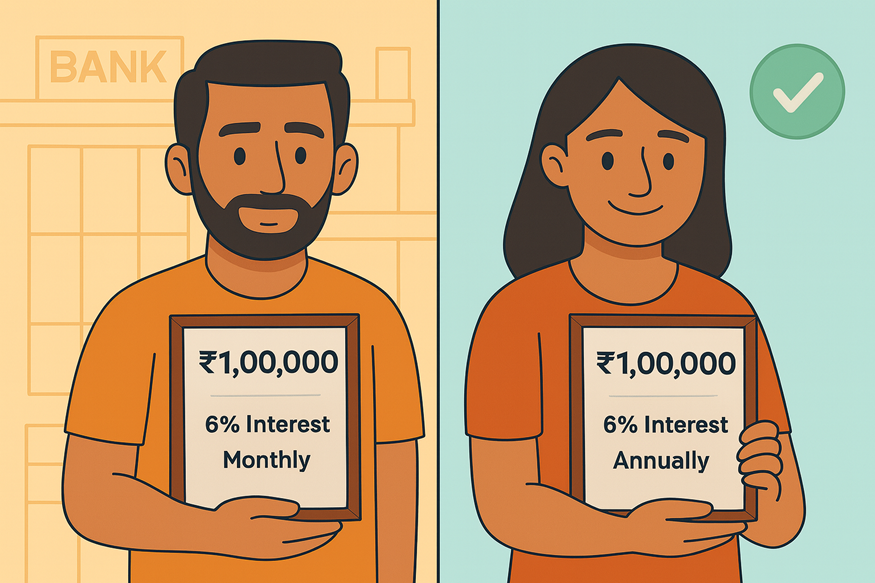

Ravi opened a fixed-deposit savings account last week. His friend Priya added money to hers around the same time. Both put in ₹1,00,000, but with two different banks.

One advertised a 6% interest rate with monthly compounding, while the other offered the same rate but compounded once a year. By the end of twelve months, one of them quietly earns a bit more.

The reason isn't complicated. It comes down to Annual Percentage Yield, or APY. This number shows how much you truly earn in a year once compounding is taken into account, instead of just looking at the basic interest rate.

We'll walk through what APY means, how it is calculated, and why knowing it can help you choose savings options that actually work in your favour.

What Is APY?

Annual Percentage Yield, or APY, is a way to see the yearly growth of money you keep in an interest-based account. It includes the effect of interest adding to itself over time. It factors in compound interest, giving you a clearer picture of your real yearly return.

Instead of looking only at a simple interest rate, APY reflects how interest builds on both your original deposit and the interest added during the year.

APY includes how often your interest is added, so it reflects your true yearly return. It's a useful way to compare accounts in India and find options that can build your savings more effectively.

Also Read: APY vs APR: Key Differences Explained

How Is APY Calculated?

APY is worked out using a simple formula that shows how much you truly earn once compounding is included. The formula is:

APY = (1 + r/n)^n – 1

Here, r is the annual interest rate written as a decimal, and n is the number of times the bank adds interest to your account in a year. Monthly compounding uses 12, quarterly compounding uses 4, and so on.

An example using an Indian fixed deposit

A bank offers a 6% interest rate, compounded quarterly.

- r = 0.06

- n = 4

- APY = (1 + 0.06/4)^4 – 1

- APY = 1.015^4 – 1

APY is about 6.14%

This shows that compounding slightly increases your actual yearly return compared to the basic interest rate printed on the product.

Types of APY: Fixed vs. Variable

Most savings and deposit products offer one of two APY types. Since they differ in how they work, it's smart to get familiar with them before choosing.

Fixed APY

- A fixed APY stays the same for the entire term.

- You normally see this in standard fixed deposits, where the bank locks your rate and compounding schedule at the start.

- It suits people who want steady, predictable returns and prefer knowing exactly how much they will earn by the end of the tenure.

Variable APY

- A variable APY can change from time to time based on market conditions or policy changes announced by the Reserve Bank of India.

- This is common in regular savings accounts, recurring deposits, and flexible deposit schemes that allow banks to revise rates.

- It can work in your favour when overall rates rise, but returns may drop if the market moves in the opposite direction.

Choosing Between the Two

A fixed APY is a good pick when you want stability and no surprises. A variable APY fits better if you're open to rate changes and want the possibility of earning more when conditions are right.

It mainly depends on how much uncertainty you're willing to accept and the period you want to stay invested.

How Does Compound Interest Affect APY?

Compound interest rate increases your overall return because interest builds on both your original deposit and the interest credited earlier. This is why APY tends to be higher than the stated simple rate.

When interest is added more frequently, your balance grows a little quicker. For example, if you put ₹1,00,000 in a deposit with a 6% rate and the bank compounds monthly instead of quarterly, each month's interest is added before the next round is calculated.

By the end of the year, this slightly boosts your return and results in a higher APY.

How to Use APY to Maximise Your Investment Returns

APY helps you compare different savings options and pick one that matches your plans. It reflects your true yearly return, which can make a real difference as the years go by.

1. Compare APYs Instead of Only the Stated Interest Rate

APY reflects compounding, so it gives a clearer picture of what you actually earn.

2. Look at How Often Interest Is Compounded

Monthly or quarterly compounding usually gives a slightly better outcome than annual compounding.

3. Consider Fixed APY If You Want Stability

Locking in a fixed rate works well when you plan to keep the money untouched.

4. Choose Variable APY Only If You Can Track Rate Changes

Variable accounts can improve your returns when rates rise, but they may drop as well.

5. Match the APY with Your Goal and Liquidity Needs

Keep flexible accounts for short-term use, and pick higher-yield options for longer-term savings.

Grow Your Money Confidently With the Power of APY

A clear understanding of APY helps you see how your savings actually grow. It makes it easier to compare different products, decide between fixed and variable rates, and understand the benefit of compounding.

If you are looking for simple and dependable ways to grow your money, Hero FinCorp has products designed to match everyday financial needs.

Explore Hero Fincorp's personal loan to plan your next step.

Frequently Asked Questions

1. What does a 5% APY mean in banking?

A 5% APY means you earn around 5% on your deposit over a year after compounding is taken into account.

2. How often is APY compounded in Indian bank accounts?

Compounding varies by product. Many savings accounts compound monthly or quarterly, while some fixed deposits compound annually.

3. Can APY rates change over time?

Variable-rate accounts can move up or down based on market conditions and bank decisions. Fixed deposits usually keep the same rate for the full tenure.

4. How is APY different from simple interest in deposits?

Simple interest applies only to your original deposit. APY includes compounding, which helps your balance increase more quickly.

5. Is a higher APY always better?

A higher APY is helpful, but it is still important to consider lock-in periods, liquidity, and how often the bank may revise rates.