APY vs APR: Key Differences Explained

Most people in India use digital banking daily. We compare loan offers. We evaluate FD interest rates. We switch apps for better savings returns. Yet very few actually understand one core concept: the difference between APY and APR.

These two numbers look similar. But they behave very differently.

One shows the real “earnings” you get when you save and interest compounds. The other reflects the real “cost” you pay when you borrow. In this blog, we’ll break down APY vs APR in simple language to help you make smarter financial decisions.

What is APY?

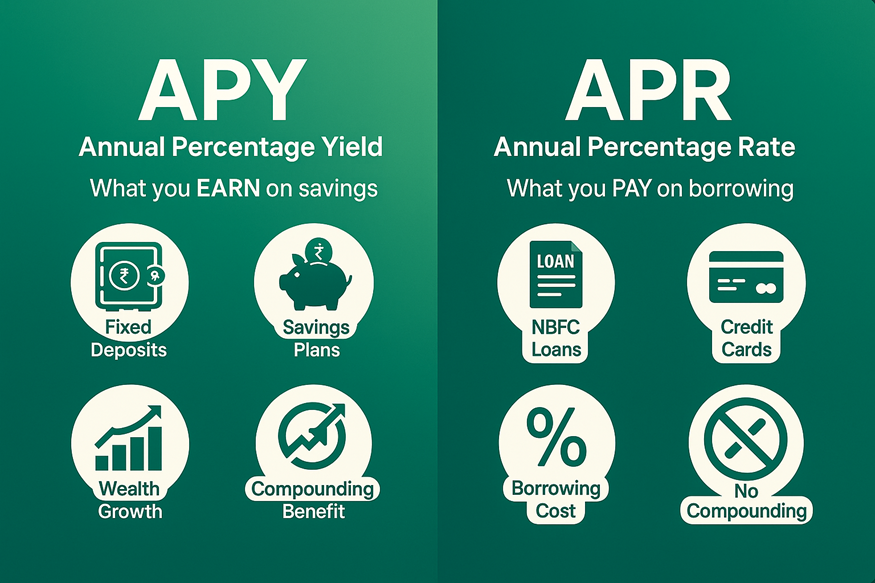

APY (Annual Percentage Yield) is the real yearly return you earn on savings or deposits after including the effect of compounding. It reflects how much your money truly grows over a year.

What is APR?

APR (Annual Percentage Rate) is the actual yearly cost you pay when borrowing money, including interest and applicable fees. It helps you understand the true cost of loans beyond the advertised rate.

APY vs APR Side-by-Side Comparison

Here’s the simplest way to look at it:

| Parameter | APY | APR |

| Full Form | Annual Percentage Yield | Annual Percentage Rate |

| Definition | Total yearly return earned on savings | Total yearly cost of borrowing |

| Used For | Earning money (like savings, FD-style returns, recurring deposit) | Borrowing money (like personal loans, credit cards, NBFC loans) |

| Includes Fees? | No, APY focuses on interest and compounding impact | Yes (processing fees, origination charges) |

| Compounding Counted? | Does include compounding impact | Does not include compounding impact |

| Best Viewed As | What you earn yearly when saving/investing | What you pay yearly when borrowing |

| Useful For | Comparing savings returns | Calculating true borrowing cost |

To summarise:

● APR is the cost of money. It matters when comparing loans.

● APY is your gain from money. It matters when comparing savings/FD-style returns.

Practical Examples from India to Illustrate APY and APR Differences

Let’s take a few examples to make this APY vs APR difference very real.

Example 1: APR Loan Cost Example (Borrowing)

Consider a case where you’ve taken a personal loan of ₹1,00,000. It attracts an interest rate of 18% per year and has a 1% processing fee.

Remember, APR considers both the interest and any fees. So:

Actual annual cost = Interest + Fee impact

Actual annual cost (for 1 year) = ₹18,000 + ₹1,000

Total cost to you = ₹19,000

That means your annual cost is 19%, not 18%. That 1% extra is exactly why APR matters when comparing loans.

Also Read: Top Factors that Impact Personal Loan Interest Rate

Example 2: APY FD/Savings Example (Returns)

Say you invest in an FD at 7% annual rate. The interest is compounded monthly.

APY formula (simplified):

APY = (1 + r/n)ⁿ – 1 [where r = annual interest rate and n = compounding frequency]

Here: r = 0.07, n = 12

APY ≈ (1 + 0.07/12)¹² – 1

APY ≈ 7.23% approx.

APY shows what you actually earn annually after compounding. So even though “7%” is advertised, you earn closer to 7.23% because the interest earns interest every month.

Why Understanding the Difference Between APY, APR, and Interest Rate Matters in India

Most people only look at the “interest rate” printed in bold. But that number does not tell the full story. That’s why understanding APR and APY makes you a smarter financial decision-maker. APR reveals the actual borrowing cost after fees. APY reveals the actual earnings after compounding. Both are far more accurate than the plain interest rate.

This matters today more than ever, because Indians are dealing with an increasing number of financial products. You have personal loans, BNPL, credit cards, FDs, liquid funds, digital savings, and the list goes on!

Knowing the difference helps you:

● Avoid misleading “discounted” interest claims

● Choose the right savings product for real returns

● Compare loan apps easily and confidently

● See the real picture beyond marketing headlines

How NBFCs Like Hero FinCorp Use APR and APY for Transparency

NBFCs such as Hero FinCorp use APR-based disclosures so borrowers know the all-in cost up front and not just the “headline rate”. Such transparency reduces confusion and helps borrowers make decisions confidently. Plus, as digital lending and personal loan apps become mainstream, transparent APR disclosures are the new hygiene factor.

Looking for clarity, transparency, and fast approval in personal loans? Apply online with Hero FinCorp and feel the difference!

Frequently Asked Questions

1. What is the primary difference between APY and APR?

APR shows the yearly cost of borrowing. APY shows the yearly return earned.

2. Can APR and APY be the same?

Technically yes. If no fees are applied and no compounding is involved.

3. How does compounding frequency affect APY?

Higher compounding frequency results in higher APY. That’s why monthly-compounding FDs look slightly higher than annual.

4. Are APR and APY terms regulated in India?

Yes. RBI guidelines dictate how lenders must disclose effective rates.

5. Which is more important for a borrower: APR or interest rate?

APR, because it shows the true cost, including fees.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.