What is a Personal Loan? Meaning, Benefits & Uses

Most people think about personal loans only when an expense appears that their savings cannot comfortably handle. In those moments, understanding how a personal loan works becomes essential.

This guide clearly explains the meaning, purpose, and benefits of personal loans, helping you decide when they are a practical choice. Read on!

What Is a Personal Loan? Meaning and Definition

A personal loan is a flexible, unsecured credit that helps you cover planned or unexpected costs with ease. The best part is how simple the process has become. You apply online, upload a few documents, and get a decision in minutes. Once approved, the funds usually hit your account soon after.

Here’s what makes it stand out:

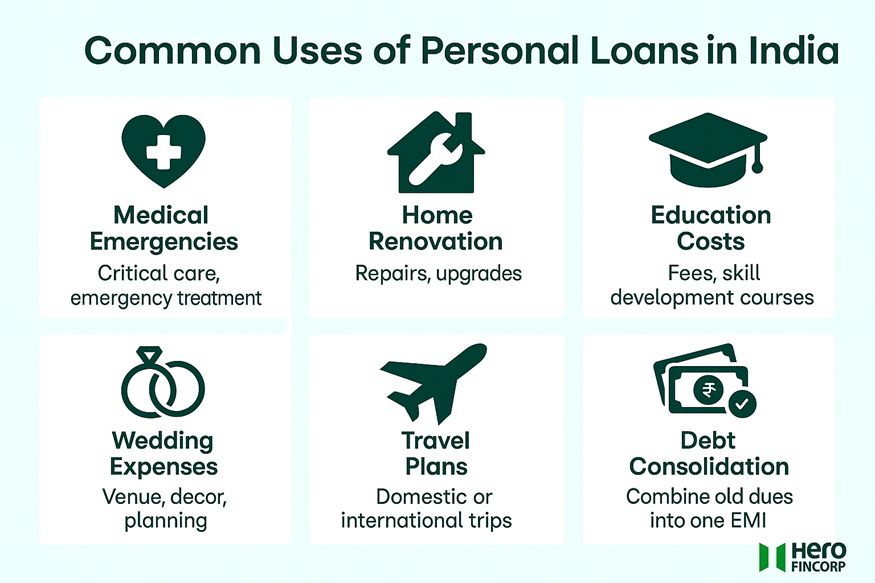

● Not bound to one goal—use it to fund big plans, handle surprises, or clear old dues

● Collateral-free, so approval depends on your income and credit score, not on assets

● 100% digital journey from application to disbursal, often done within hours

● Flexible tenure options (12 to 60 months) to keep EMIs within your comfort zone

● Fixed monthly repayments, so you always know how much you will pay and when

If you prefer a lender that keeps things straightforward, Hero FinCorp makes the entire personal loan journey smooth, transparent, and easy to navigate from start to finish. Download our instant loan app now!

Types of Personal Loans Available in India

Not all personal loan types work for every person. Your income, credit score, goals, and repayment comfort all play a part. Take a look at these options to see which one feels right.

1. Unsecured Personal Loan

This is the most common option. No need to pledge your gold, property, or any asset. Your income stability and credit score decide how much you qualify for.

Why choose it: fast approval, minimal paperwork, and complete freedom in how you use the funds.

2. Secured Personal Loan

A secured loan is a smart pick when you want extra borrowing power. Here, you back your loan with an asset you already own, such as gold or FDs. Works well for first-time borrowers, especially if you’re new to credit and need a stronger approval chance.

Why choose it: lower rates and bigger limits than most unsecured options.

3. Joint Personal Loan

If your income isn’t enough, adding a co-borrower helps. Two incomes add weight to your application and qualify you for a higher loan with manageable EMIs.

Why choose it: higher eligibility, shared responsibility, and often better loan terms.

4. Top Up Personal Loan

Already have a loan but need more funds? A top-up loan lets you borrow extra without going through a full new application. Since your lender already knows your repayment history, the process is much faster.

Why choose it: quick, seamless, and great for ongoing or unexpected expenses.

Also Read: Top-Up Loan Vs. Personal Loan: Which Is Better for You?

5. Specialised Personal Loans

Many lenders, including Hero FinCorp, offer purpose-based loans for things like weddings, travel, medical emergencies, education, or home renovations. They function like regular personal loans but are tailored to match your goal.

Why choose it: simple, predictable, and aligned to your exact requirements.

Benefits of Personal Loans You Should Know

A personal loan does more than fill a money gap. It gives you stability, choice, and room to breathe.

Here are the personal loan advantages that actually matter in everyday life:

1. Get Funds Exactly When You Need It

Emergencies and life events never follow a plan. When expenses pop out of nowhere, personal loans with quick approvals and same-day disbursal can be a real lifesaver.

2. Protect the Savings You Worked Hard For

You do not have to break an FD, stop an SIP, or disturb your emergency fund. Your long-term money stays safe while you manage today’s needs comfortably.

3. Plan With Confidence Through Predictable EMIs

Fixed EMIs make budgeting easier. You know the amount, and you can pick a tenure that fits your month—short if you want to finish fast, or longer if you prefer a lighter EMI.

4. Enjoy Competitive Interest Rates

Your rate depends on your income and credit score. A stronger profile usually gets a better deal, and since lenders share the APR upfront, you know the total cost before you decide.

5. Build a Good Credit Story Over Time

Every EMI you pay on time adds a small plus to your record. With consistency, your score grows, and lenders start seeing you as someone who manages credit responsibly.

6. Simplify Your Debts

Too many EMIs chasing you each month? Roll them into one smart personal loan. One due date, one interest rate, and a much less mental load.

Tip: Thinking of taking the next step? Try Hero FinCorp’s quick eligibility check first to see what fits your budget before you commit.

Eligibility and Documentation Criteria for Personal Loans

Before you hit apply, it helps to know what most lenders in India look for. A quick check can boost your approval chances and even help you get better loan terms.

Age | Typically 21 to 60 years |

Income | Regular monthly earnings as per your lender’s policy |

Credit Score | Around 700+ for higher approval odds |

Employment | Salaried or self-employed with a steady work record |

Current EMIs | Fewer ongoing loans for better eligibility |

Basic Documents | PAN, Aadhaar, proof of income/business, recent bank statements |

Want to simplify the paperwork? If your lender supports it, share your verified data via an Account Aggregator (AA). It’s faster, safer, and reduces the back-and-forth.

Your Easy Guide to Applying for a Personal Loan with Hero FinCorp

Meet Rahul, 29, from Bengaluru. His mother needed a medical procedure that left him with ₹1,20,000 short. He didn’t want to break his FD, so he took the smarter route and applied for a ₹2 lakh personal loan from Hero FinCorp.

The best part? The whole process was online, and the money came in a few hours after approval. Here’s how you can do it too.

Step 1: Check Where You Stand: Go to the Hero FinCorp website or app, enter your basic details, and you’ll quickly see what you’re eligible for.

Step 2: Shape the Loan Around Your Budget: Think about the amount you truly need and a monthly EMI you’re okay with. Hero FinCorp lets you borrow up to ₹5 lakh with flexible tenure options (12 to 36 months).

Step 3: Complete Your Application: Pop in your info, upload your docs, and finish a quick video KYC or AA verification. Once that’s done, your application moves ahead quickly.

Step 4: Get Fast Approval & Disbursal: Once you’re approved, e-sign the loan agreement. The funds usually land in your bank within 24–48 hours (sometimes even sooner).

And with that, you’re all set. When you need a personal loan that’s quick and easy to handle, Hero FinCorp is a solid place to begin.

When you’re ready, take the first step—it’s simpler than you think!

Also Read: Personal Loan Insurance: Everything You Should Know

Frequently Asked Questions

1. What is a personal loan processing fee?

It is a one-time charge for verifying your documents and setting up your loan. But the amount may vary by lender.

2. What happens if I miss an EMI?

It may incur a late fee and affect your credit score. Setting up UPI AutoPay helps you avoid slip-ups.

3. Can I prepay my personal loan without penalties?

Many lenders allow it. Some charge a small fee. So always check your loan terms before prepaying.