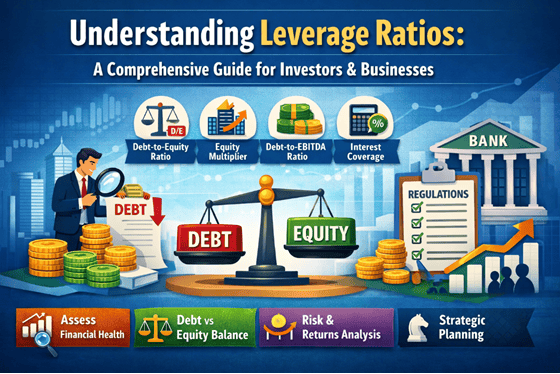

Understanding Leverage Ratios: A Comprehensive Guide for Investors and Businesses

A business needs capital to function, and one source of raising capital is through debt. But debt hurts the financial metrics of a business. So, it is essential to know the degree of the impact, so the business can plan accordingly. This is where leverage ratios help. These ratios help an organisation know about the dependence on debt, its utilisation, and its ability to meet financial obligations.

Let’s find out what leverage ratios are, how they work, and the different types of leverage ratios.

What is a Leverage Ratio?

A leverage ratio helps define the relationship between a company’s assets and debt. It measures the capital in terms of debt and loans, and a company’s ability to meet its financial obligations.

It helps lenders, shareholders, and management know about the financial position of a company.

Lenders know if the company poses a high lending risk or a low risk. If the debt relative to the earnings is high, lenders will charge higher interest rates or take time in approvals

Shareholders know if the company is using debt effectively. If there is a healthy amount of leverage, it boosts returns. An excessive amount of debt reduced profitability

For management, leverage ratios help form a financial strategy as to whether the business should borrow for growth or it needs to focus on reducing debt

How Leverage Ratios Work?

Leverage ratios assess the ability of a company, individual, or institution to meet its financial obligations. A higher leverage ratio hurts the company, but if it can generate a higher return than interest rates, it helps fuel the growth.

It can also be used to measure the mix of operating expenses, so the company knows how output changes impact operating income.

Also Read: Debt-to-Income Ratio Meaning and Formula

Banking and Regulatory Scrutiny

A leverage ratio is an important supplement to risk-based capital requirements. So, banks are required to disclose exposure measures, Tier-1 capital, and leverage ratios quarterly. In 2019, the RBI mandated a leverage ratio of 3.5% for banks except domestic systemically important banks (D-SIBs). These banks will have a leverage ratio of 4%.

Also Read: Loan Settlement vs Loan Closure: Key Differences, Rules & Impact

Key Types of Leverage Ratios

Debt-to-Equity (D/E) Ratio

The Debt-to-Equity Ratio compares the debt and equity of a company. A higher ratio indicates that the operations are financed through more debt.

With a higher ratio, the earnings are volatile due to the interest expense. Plus, if the interest expense goes too high, it may increase the chances of bankruptcy or default.

Here’s how to calculate it:

Debt-to-Equity Ratio = Total Liabilities ÷ Total Shareholders’ Equity

Also Read: Debt-to-Income Ratio Meaning and Formula

The Equity Multiplier

The equity multiplier ratios calculate the amount of assets that are financed by shareholders’ equity. A higher ratio shows that more assets are financed through debt than equity. A lower ratio implies that the company depends less on debt.

Here’s how to calculate it:

Equity Multiplier = Total Assets / Shareholders’ Equity

Degree of Financial Leverage (DFL)

The degree of Financial Leverage assesses the sensitivity of a company’s earnings per share to changes in the operating income as per the capital structure. A higher ratio indicates greater sensitivity to changes in operating income.

Here’s how to calculate it:

Degree of Financial Leverage = % Change in Earnings Per Share / % Change in Earnings before interest and tax

Debt-to-EBITDA Ratio

The Debt-to-EBITDA Ratio calculates the income available and generated to pay debts before accounting for interest, depreciation, taxes, and amortisation expenses. It helps determine the probability of defaulting. A higher ratio shows that the company has trouble paying debt. A lower ratio shows that the company has more cushion to pay debt.

Here’s how to calculate it:

Debt to EBITDAX Ratio = Total Debt / EBITDAX

For oil and gas companies, it adds back exploration expenses to EBITDA to better measure the cash flow.

Interest Coverage Ratio

The Interest Coverage Ratio calculates how easily a company can pay interest on outstanding debt. A higher ratio shows that the company can more easily pay interest. A lower ratio shows excessive debt and difficulty in fulfilling it.

Here’s how to calculate it:

Interest Coverage Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

Consumer Leverage Ratio

The consumer leverage ratio compares the amount of debt payments for consumers to their disposable income. It measures how effectively consumers can manage debt payments.

A higher ratio means that consumers are taking on more debts to their income. This signals a reduction in consumer spending. An increasing ratio shows potential economic downturn, as consumers will have less left for discretionary expenses.

A declining ratio shows that sustainable debt loads, continued consumer spending, and a healthy economy.

Here’s how to calculate it:

Consumer Leverage Ratio = Total Consumer Debt Payments / Disposable Personal Income

Leverage Ratios: A Tool for Financial Planning

Leverage ratios help assess the financial position of a business or institution. This helps management create a financial roadmap to grow the business. By calculating leverage ratios, a company gets a direction about growth and how much debt it can sustainably handle.

Hero Fincorp helps you manage your finances better with quick personal loans. With Hero Fincorp's personal loan, you can consolidate your debt payments to improve your leverage ratio.

Explore personal loan options now and get a loan when needed.

Frequently Asked Questions

How can I improve the leverage ratio?

To improve the leverage ratio, focus on reducing debt by repaying it or restructuring and increasing equity.

What is a "good" leverage ratio?

The good leverage ratio depends on the type of leverage ratio and the company. To find an acceptable level, look at the ratios of a specific industry.

How does high leverage affect stock prices?

High leverage means high risk, so the share price is more volatile. It might lead to higher returns, but the investments are at higher risk.

How to use leverage ratios effectively?

To use leverage ratios effectively, track multiple ratios to spot trends and compare them with industry standards.