Debt-to-Income Ratio Meaning and Formula

- What Is the Debt-to-Income Ratio?

- Debt-to-Income Ratio Formula and Calculation

- What Does Debt Include and What Income to Consider in DTI?

- Ideal Debt-to-Income Ratio for Loan Approval in India

- How to Improve Your Debt-to-Income Ratio?

- Common Myths About Debt-to-Income Ratio

- Keeping Your Debt-to-Income on Track

- Frequently Asked Questions

Alfiyah and Samrat worked in the same city and earned almost the same monthly income. When both applied for a personal loan of ₹3 lakhs, Alfiyah’s loan was approved quickly at a 19% interest rate. Samrat’s journey was slower. He got an approval of ₹2 lakh and was asked for additional documents.

The difference wasn’t their salary. It is their existing repayment commitments. Lenders look closely at how much of your monthly income already goes toward EMIs and credit dues. To assess this fairly, they use the Debt-to-Income Ratio, which helps them judge affordability in a clear, structured way before approving another loan.

Let’s find out how lenders calculate the debt-to-income ratio and what factors they consider to decide loan terms.

What Is the Debt-to-Income Ratio?

The Debt-to-income ratio, or DTI ratio, shows how much of your monthly income goes towards existing repayments. Lenders use it to understand whether your income has enough room to afford another EMI without affecting other financial obligations.

This measure does not judge lifestyle choices or daily expenses. It looks only at fixed commitments that repeat every month. By separating income strength from repayment capacity, lenders get a realistic view of financial balance.

Consider a simple situation. You earn ₹70,000 a month and pay ₹28,000 towards loans and card dues. A large share of income already stays locked into repayments. This limits flexibility and raises caution for lenders.

Unlike a credit score, this measure focuses on present repayment pressure. That focus makes it especially important in loan assessments in India.

Debt-to-Income Ratio Formula and Calculation

The formula to calculate the debt-to-income ratio is:

(Total Monthly Debt Payments ÷ Gross Monthly Income) × 10

Let’s understand this with Alfiyah’s and Sameer’s scenarios:

Alfiyah’s case:

Alfiyah earned ₹50,000 per month. Her existing EMIs totalled ₹12,000.

DTI = (12,000 ÷ 50,000) × 100 = 24%

That means she had enough capacity to manage another EMI comfortably. The result? Faster approval.

Samrat’s case:

Samrat earned ₹50,000 per month but was paying ₹25,000 towards existing EMIs and card dues.

DTI = (25,000 ÷ 50,000) × 100 = 50%

That's why lenders applied stricter checks. The result? A lower loan amount.

What Does Debt Include and What Income to Consider in DTI?

The accuracy of the DTI ratio depends on what goes into it: monthly debt payments and gross monthly income.

Monthly debt payments include:

● Home, personal, and vehicle loan EMIs

● Business loan or overdraft repayments

● Credit card minimum dues

Gross monthly income includes:

● Salary before tax

● Documented business earnings

● Verified rental income

Lenders exclude daily household expenses because they fluctuate. Fixed obligations matter more for repayment assessment.

Ideal Debt-to-Income Ratio for Loan Approval in India

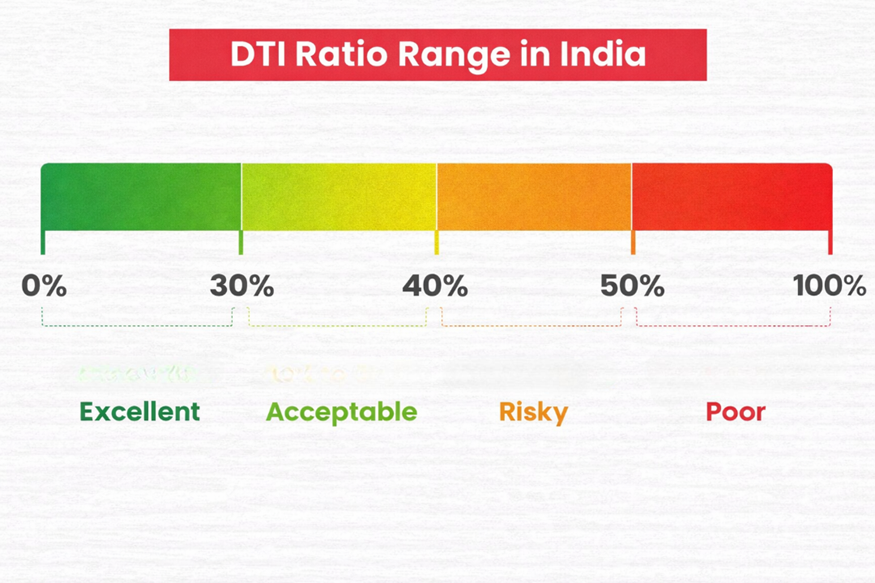

Indian lenders follow broad ranges while assessing DTI, though exact limits vary by loan type.

● Below 30%: Excellent

● 30% to 40%: Acceptable

● 40% to 50%: Risky

● Above 50%: Poor

How to Improve Your Debt-to-Income Ratio?

Improving the DTI ratio requires awareness and consistency. Small changes create meaningful impact over time.

Once you track monthly obligations clearly, here’s what to do next -

1. Pay high-interest debt first to reduce the monthly burden.

2. Avoid new loans or unnecessary credit usage.

3. Look for passive income options that provide stable, documented income.

4. Review loan tenures to balance EMI pressure wisely.

Common Myths About Debt-to-Income Ratio

Several myths often confuse borrowers. Let’s debunk the myths to help you approach loans with clarity.

1. Myth: Debt-to-Income matters only for large loans.

Truth: Lenders check this ratio for all types of credit.

2. Myth: Higher income guarantees approval.

Truth: Income helps only when debt remains manageable.

3. Myth: Savings improve Debt-to-Income.

Truth: Savings do not affect the ratio unless they reduce debt.

4. Myth: All income counts automatically.

Truth: Lenders consider only stable and documented income.

Keeping Your Debt-to-Income on Track

Debt-to-Income rarely feels important until you plan a loan. At that point, it quietly decides how comfortable borrowing will be. When this balance stays healthy, approvals feel smoother, and decisions feel clearer.

If you are planning ahead or need financial support to manage expenses, the right loan can make things easier. Hero FinCorp offers instant personal loans with minimal paperwork. Apply today and move forward with confidence.

Frequently Asked Questions

What is a good Debt-to-Income Ratio to get a loan in India?

Most lenders prefer a ratio below 40% for comfortable approval.

Does DTI affect my credit score?

DTI does not affect a credit score, but it impacts a loan approval decision.

How often should I calculate my Debt-to-Income Ratio?

Check it before applying for any loan or taking on new debt.

Is it better to pay off debt or save money to improve DTI?

Pay off debts to improve DTI faster.

What is the difference between DTI and FOIR?

DTI covers total debt, while FOIR focuses on fixed obligations only.