What Is A Personal Loan For Dental Care and How to Get One?

The month is over, all your bills are paid, your obligations are fulfilled, and your bank account is almost empty till the upcoming pay cheque.

Suddenly, you have excruciating oral discomfort. You can be certain that it's a root canal and that it will cost a lot of money if you visit the dentist. Your account is insufficient, and your credit card is almost completely charged.

Now what? You can receive the dental care you require without worrying about money, thanks to a personal loan.

Approval is fast, and funds are disbursed the same day, so you won't delay the necessary treatment. This guide covers everything you need to know, from eligible treatments to application steps.

What Is A Personal Loan For Dental Care?

A personal loan for dental care is an unsecured loan you can take at any point in time to cover all your oral care needs.

The funds can be used to cover all forms of treatments, from root canals to complex oral surgeries to orthodontic treatments. What makes this different from a generic personal loan is that, psychologically, you know exactly where the funds are going.

Why Choose a Personal Loan for Dental Care?

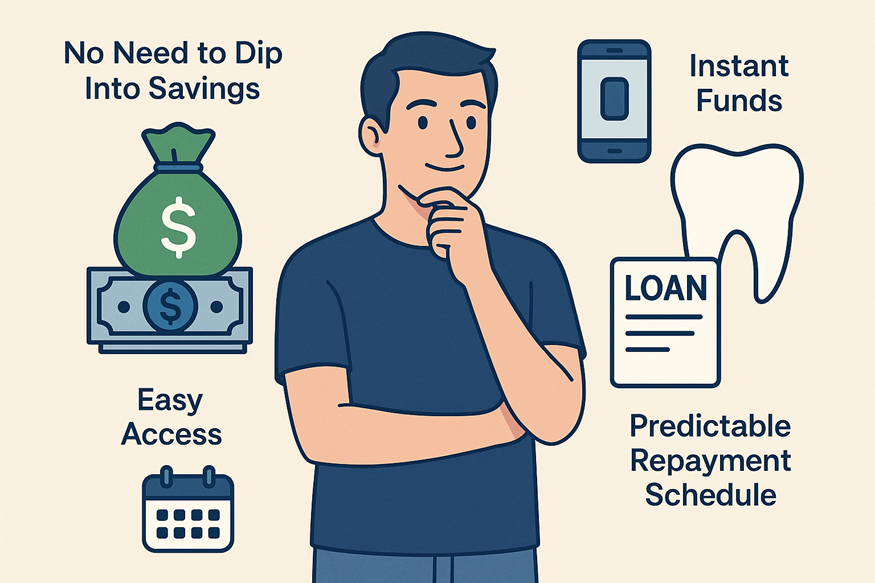

Personal loan benefits for dental care are several:

- Keep Your Savings Untouched: The most significant benefit of opting for a personal loan for oral care is that your savings and investments can remain as they are.

- Easy Access: You can apply for a loan directly via an app on your phone, whether it's an Android or iOS device. No need to hurry to the bank or deal with the nuisance of physical paperwork.

- Funds Ready in Minutes: Personal loans for dental care, especially from companies like Hero FinCorp, are usually approved in about 10 minutes (assuming you meet the eligibility criteria).

- Clear, Fixed Monthly EMIs: With this option, repayment is also predictable. You can choose a tenure based on your budget, and the interest rate remains fixed throughout the tenure of the loan. The EMI calculator can easily give you this figure in a few seconds.

The most important aspect is that you can begin your treatment immediately, along with the peace of mind that you will not be hit with a bomb of a bill at the end.

Types of Dental Treatments You Can Finance with a Personal Loan

Loans for dental care are available up to ₹ five lakhs.

Consequently, you are able to do it without much trouble and at the same time get financial support for dental care of various types, for instance:

- Any procedure that involves extracting a tooth but covering it with a filling, or placing a crown or bridge to restore the tooth's normal function.

- For regular procedures like examinations, cleanings, and preventive care, you can heed the dentist's advice.

- Orthodontic treatments like brackets, transparent aligners, and tooth retainers.

- Aesthetic dental surgery which includes veneers, inlays or overlays, and tooth bleaching.

- Trauma-related treatments, extractions or any emergency dental procedure.

Also Read - Personal Loan For Hair Transplant

Eligibility Criteria For Personal Loan For Dental Care In India

Hero FinCorp's personal loan eligibility for dental care is as follows:

- You should earn at least ₹15,000 a month in take-home pay and have at least 1 year of work experience.

- You should have been in business for at least two years if you work for yourself.

- If you are self-employed, you should have been in business for at least 2 years.

- A credit score of 700 and above is preferred.

In addition, you must provide all required KYC documents (and any others the lender requires).

The following are the basics:

- PAN and Aadhar card to verify your identity.

- Relevant address proofs.

- Your bank statement, going back at least six months.

- At least three months of salary slips or your ITR to prove your income.

How to Apply for a Personal Loan for Dental Care with Hero FinCorp?

Getting a Hero FinCorp dental loan takes less than 10 minutes.

Here's how to apply:

Step 1: According to your device, get the Hero FinCorp app for iOS or Android.

Step 2: Confirm your number using an OTP.

Step 3: Know your eligibility amount and choose it.

Step 4: After you upload all the required documents, click Submit.

Step 5: Automatic payment should be set up after the loan disbursement, so you won't miss any EMIs.

Pro Tip: Only borrow the amount that you actually need. This will enable you to have your EMIs within your budget, avoid paying extra interest, and nurture a better credit score in the end.

Get Your Much-Needed Dental Treatment With Hero FinCorp

Dental issues shouldn't be ignored. They usually get worse with time and become much more costly to treat. A personal loan for dental treatment allows you to receive the required treatment on time without worrying about the cost of treatment upfront.

At Hero FinCorp, you can explore flexible loan options, quick approvals, and same-day disbursals designed to make essential dental treatments accessible and affordable.

So why wait? Apply today and get the care you need!

Frequently Asked Questions

1. May I take a personal loan for any kind of dental treatment?

Definitely, a personal loan can be utilised for dental treatment. In contrast to car or home loans, you are free to use the money any way you want.

2. How quickly can I get a personal loan for dental care?

With Hero FinCorp, you can get a loan for your dental care needs approved in under 10 minutes. If your application is approved, you will even get the funds in your account on the same day.

3. Is collateral required for a dental care loan?

No, dental care loans, like all personal loans, are collateral-free.

4. Can I prepay the dental loan without penalties?

Hero FinCorp allows you to foreclose your dental loan with a marginal fee. The charges are waived for loans under ₹20,000; above that, it's 5% of the principal outstanding.

5. What happens if I have a poor credit score? Am I completely ruled out from getting a dental loan?

A score above 700 improves your chances, but a lower score doesn't mean automatic rejection. If you have a stable income, Hero FinCorp may still approve your dental loan. Connect with our team for more info.

6. Is there any tax deduction on personal loans for dental care?

No, tax deductions are not given for personal loans taken for dental care.

7. What is the highest amount I can borrow for dental care with a personal loan?

For your dental treatment, Hero FinCorp lets you choose the loan amount between ₹50,000 and ₹500,000.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.