Loan Restructuring: Meaning, Process, Benefits & How to Apply

Siya, a freelancer, dreams of a long holiday in the Maldives. It became a reality via a personal loan. The EMIs fit her steady monthly inflows.

Then life happened. One of her biggest clients suddenly paused payments, cutting her income by nearly 40%. Bills did not wait. The EMI date kept inching closer. With cash flow tight, Siya began to worry. A missed payment could damage her credit score and create long-term stress.

That’s when her brother told her about the loan restructuring option. Instead of defaulting, she could speak to her lender and adjust her repayment terms.

But what is loan restructuring? Let’s break it down in this blog.

What Is Loan Restructuring?

Loan restructuring refers to a lender-approved modification of existing loan terms to help borrowers manage repayments more comfortably.

The loan is neither cancelled nor waived. Instead, the repayment conditions are adjusted based on the borrower's current financial situation.

When Is Loan Restructuring Applicable?

An existing borrower who experiences temporary financial pressure affecting their repayment ability is eligible to apply for loan restoration. Common situations include:

• Changes in income or employment status

• Medical or family emergencies

• Short-term business or cash flow disruptions

Loan Restructuring Methods

Loan restructuring methods depend on the borrower's situation and loan type. They may be:

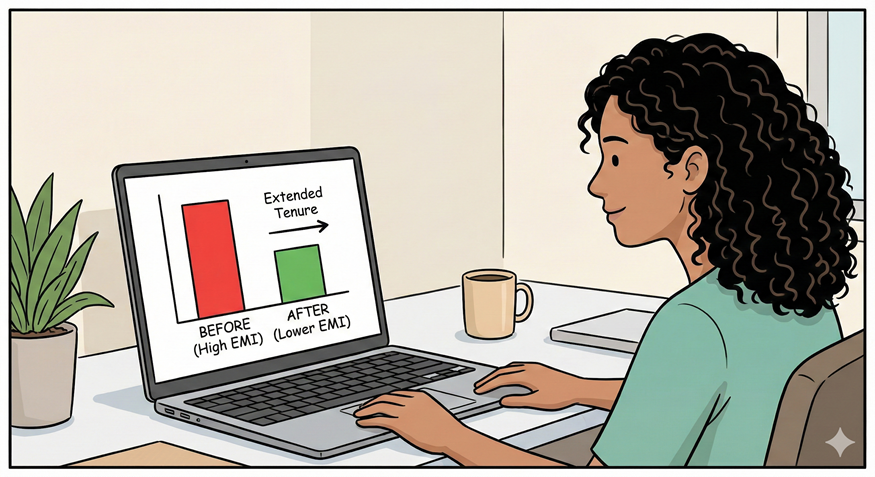

Loan Tenure Extension

The lender increases the loan tenure, spreading repayments over a longer period. This reduces the monthly EMI, making it easier to manage cash flow. But since the loan runs longer, the total interest paid over time usually increases.

Best when - Income is temporarily reduced but expected to stabilise later

Interest Rate Modification

Lenders temporarily lower interest rates or switch between fixed and floating rates. In some cases, lenders may offer a reduced rate for a limited period to ease repayment pressure.

Caution - While this can provide immediate EMI relief, borrowers should understand how rate changes may affect long-term costs.

Also Read: What Is a Loan Modification and How Does It Work?

Principal Repayment Restructuring

Lenders offer a moratorium period where you pay only the interest for a few months, or in rare cases, restructure principal repayment schedules.

Caution - Though this provides short-term breathing space, it may increase the total loan cost if interest continues to accrue.

Combination of Restructuring Approaches

Some lenders may offer customised options like tenure extension with temporary interest relief. This approach helps you balance EMIs without disrupting your financial journey.

Note - Loan restructuring is subject to lender policies and applicable regulations. If in compliance, the lender may also agree to consolidate all the borrowers' multiple loans into one for a lower interest rate or settle for a lump sum amount less than the outstanding amount.

Eligibility Criteria and Required Documents for Loan Restructuring in India

Loan restructuring eligibility depends on both borrower intent and loan performance. Here are the common criteria you need to meet -

● The loan should usually be standard and not already classified as a long-term default.

● The borrower must provide proof of temporary financial stress, such as income loss or business disruption.

● Applicants should apply for loan restructuring on time, rather than wait for several EMI delays.

Caution - If the borrower's loan type and credit history align perfectly with the lender's policies for loan restructuring, the process will be initiated.

Documents Required for Loan Restructuring

Though different lenders ask for different documents, here are the common ones -

● Income proof or salary slips showing reduced earnings

● Bank statements reflecting cash flow stress

● Loan account statements

● Identity and address proof

● Written request explaining the reason for restructuring

How to Apply for Loan Restructuring

1. Assess how much EMI relief you need.

2. Reach out before missing multiple payments.

3. Share details of financial stress and supporting documents. Submit a restructuring request. The lender reviews eligibility, credit profile, and repayment ability.

4. Negotiate the revised terms with the lender.

Once you agree with the terms, the new loan terms are formalised and approved. After this, you start paying EMIS, following the updated structure.

Also Read: Is a Personal Loan for Travel a Good Option for a Holiday?

Making Loan Repayments Stress-Free

Loan restructuring is a practical way to regain control when repayments feel overwhelming. However, adjust terms thoughtfully and act early to protect your credit health, handle short-term pressure and plan a steadier financial journey.

Some lenders, including Hero FinCorp, offer digital journeys that help customers understand available repayment support options.

Explore how personal loans are structured and what support features may exist.

Frequently Asked Questions

How does loan restructuring affect my credit score in the short and long term?

In the short term, restructuring may reduce your credit score as lenders report modified terms. But over time, with timely repayments under the new plan, you can improve your credit profile.

Can I apply for loan restructuring multiple times on the same loan?

Usually no. Loan restructuring is allowed only in genuine hardship cases. Multiple requests on the same loan are rare and depend on lender policy and regulatory guidelines.

Is loan restructuring applicable only to certain loan types, like home or personal loans?

No. Loan restructuring can apply to personal, home, business, and MSME loans, and is subject to lender eligibility, loan status, and RBI norms.

Can the loan restructuring process be completed online?

This depends on the lender. Some lenders offer partial or full digital processes. Check directly with your lender for available online options.