Financing Your First Luxury Bike with a Personal Loan

Are you wondering whether to buy that luxury bike with your savings or wait? Spending your entire savings at once isn't wise; you should keep enough cash aside for unexpected expenses.

A smarter choice is to opt for a personal or vehicle loan, allowing you to split the cost into convenient monthly instalments. Read on as we discuss your alternatives for financing, including how to obtain a bike loan.

Understanding Vehicle Loans in India

A vehicle loan enables you to purchase the vehicle you need and pay the amount in EMIs over a specified period.

The EMIs include a portion of the principal amount and interest. Once you have repaid the vehicle loan in full, you will receive the vehicle registration in your name. With a vehicle loan, you own the bike without affecting your finances. Plus, with multiple repayment options, you can choose a loan tenure as per your affordability.

Let's find out the types of vehicle loans you get in India:

- Car loans: Get financing to buy a new car.

- Two-wheeler loans: Buy a new bike or other two-wheelers.

- Used vehicles loans: Purchase a used vehicle.

- Refinance on vehicle loans: Transfer the current vehicle loan to a new lender with lower interest rates.

- Commercial vehicle loans: Buy a vehicle, such as a mini truck, for business use.

But how do you get a personal loan for luxury bikes in India? Multiple factors affect the interest and eligibility of a vehicle loan in India.

Here's a list:

- Credit score

- Income level

- Loan tenure

- Vehicle type and age

Personal Loan for Luxury Bikes: Alternative Financing Option

A personal loan is an unsecured loan option that you can use to meet any financial requirement. This means that you do not have to provide security when you ask for a loan.

Plus, if eligible, you can get a personal loan for a bike for the full amount, so no down payment.

Here's a comparison of purchasing a bike via a personal loan and a vehicle loan:

| Parameter | Two-Wheeler Loan | Personal Loan |

|---|---|---|

| Purpose | Used for two-wheeler only | Flexible, can be used for any financial need |

| Collateral | The bike serves as collateral | Unsecured, no collateral required |

| Loan amount | You need to make a down payment | You may get a 100% loan based on eligibility |

| Income requirements | Higher | Lower. You can pay the loan in easy instalments if you have a good monthly income |

| Ownership | You get the registration after you pay the full loan amount | You get ownership at the time of purchase |

| Processing TIme | Takes a few days | You get instant approval with the instant loan app. |

When Should You Consider A Bike Loan Via A Personal Loan?

Here's when a personal loan is right for you:

- You need funds for insurance, registration, and gear, apart from the bike

- You want bike ownership from the first day

- You don't want to put your bike as collateral

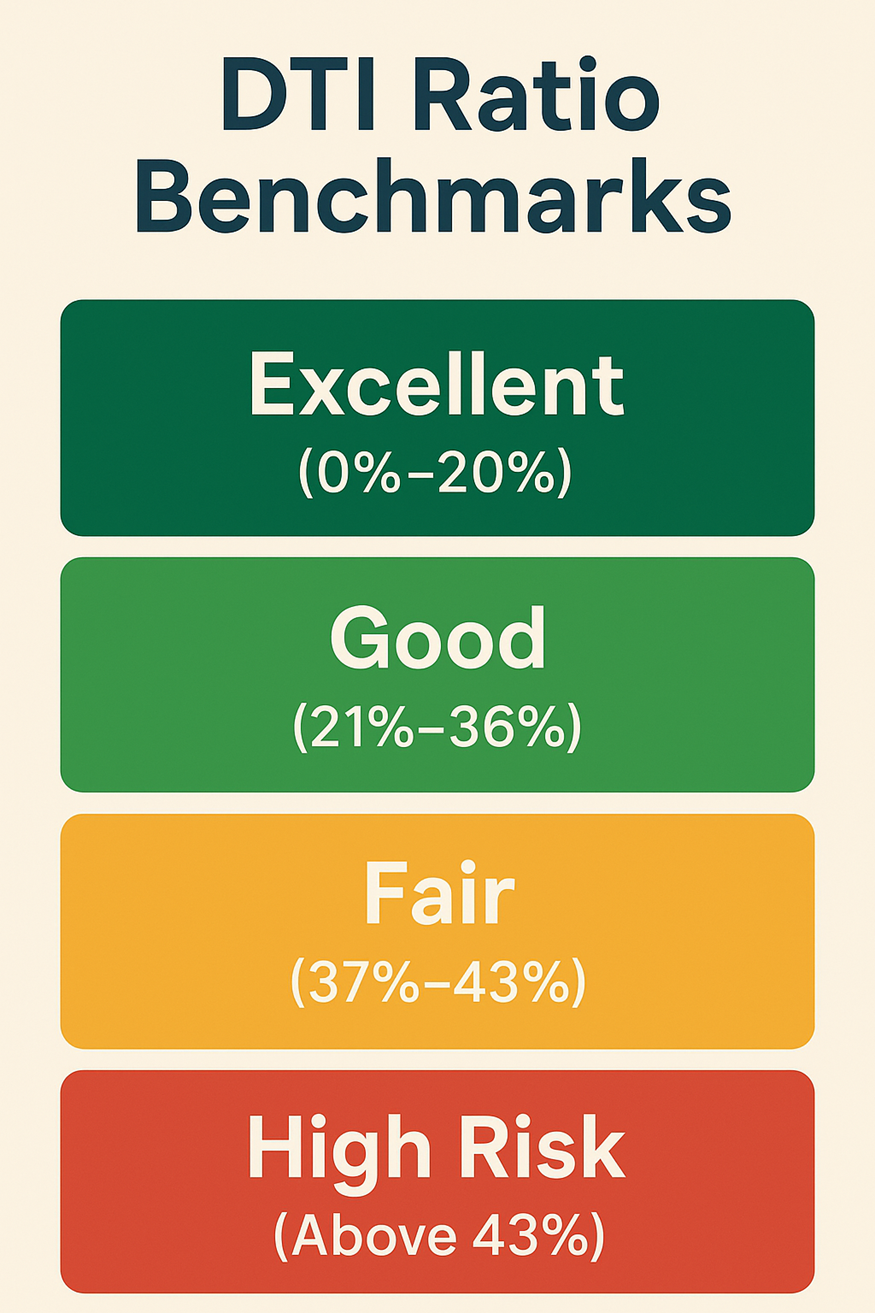

How Does the Debt-to-Income Ratio Impact Your Vehicle Loan Eligibility?

Debt-to-income ratio compares monthly debt payments with your monthly gross income. An ideal debt-to-income ratio is important to:

- Get loan approval

- Negotiate better loan terms

- Ensure a manageable debt level

Here's how it is calculated:

DTI ratio = (Total monthly debt payments ÷ gross monthly income) x 100

Say you make Rs. 20000 monthly before taxes and pay Rs. 5,000 toward credit card debt and car loans. Here's how to find your DTI ratio:

DTI ratio = (5,000 ÷ 20000) x 100

DTI ratio = 25%

Tips To Manage And Improve DTI Before Applying

DTI affects your vehicle and personal loan eligibility. Here's what you should do to improve your DTI:

- Pay off your debt before applying for a new loan

- Consider increasing your income with a freelance gig or a raise

- Check for errors in your credit reports

- Minimise credit card use and create a strict monthly budget

- Consolidate multiple loans if possible

Interest Rates, Tenure, and EMI: What You Need to Know

Compare the interest rate, tenure, and EMI. This helps you in choosing the right option that you can pay for comfortably, while saving money.

Let's explore the factors that affect interest rates and loan tenure, making it easier for you to compare.

Factors Affecting Interest Rate

Here's a list of factors that impact vehicle loan interest rates:

- Credit score and history

- Loan amount and duration

- Market conditions and RBI policy rates

- Job stability

- Monthly income

- City tier

- Lender-borrower relationship

Factors Affecting Vehicle Loan Tenure

Let's explore the factors that increase or decrease your loan tenure:

- Interest rates

- EMI amount

- Loan amount

- Your monthly budget

How Is EMI Calculated?

The vehicle loan EMI is calculated with this formula:

P × R × [(1+R)^N / (1+R)^(N-1)]

Where,

- P is the Principal Amount

- R is the interest rate

- N is the loan tenure in months

You can use the Hero Fincorp EMI calculator for personal loans and bike loans to receive a precise estimate of your EMI!

Documents Required for Vehicle Loan Application in India

Key car loan paperwork is required to confirm your identification, address, income, and occupation during the application procedure, whether you're applying for a personal vehicle or a two-wheeler.

Common documents include:

- Application for a loan and a photo: A completed application and a current, passport-sized photo

- Identity verification: Any official document, such as a driver's license, passport, PAN, or Aadhaar

- Proof of residence: In the form of utility bills, Aadhaar, a passport, or a ration card

- Proof of Income: salary stubs, bank records, or an ITR to determine the ability to repay

- Proof of employment or business: Pay stubs for those with salaries or business registration for those who work for themselves.

For personal loans for bikes, you also need proof of residence for salaried individuals and an office address for self-employed individuals.

Step-by-Step Vehicle Loan Process

Decided on the bike you want to get finance for? Here's how to get a vehicle loan:

- Choose the loan type based on amount, tenure, and interest

- Check eligibility

- Calculate EMI

- Keep the required documents in place

- Visit the branch or upload documents online

- Provide extra information needed

- Read the loan terms carefully

- Review and sign the loan agreement

Vehicle Loan Approval Tips to Improve Loan Approval Chances

To increase loan approval chances, here are some vehicle and personal loan approval tips:

- Increase credit score: Pay bills timely, keep credit balance low, correct credit score errors, and avoid getting a large credit amount at once

- Have income proof: Show proof of income, such as salary slips and ITR

- Apply with minimal existing debts: Keep existing debts minimal, so the lender does not consider you under the high-risk category

- Maintain the ideal debt-to-income ratio: Try to reduce your existing debt

- Offer collateral: If applicable, offer collateral. This reduces the risk on the lender's side, increasing approval chances

- Save for a down payment: If you pay a huge down payment, the loan amount decreases. This increases the chances of loan approval

- Apply for a few loans only: Every time you apply for a loan, it shows up on your credit history. Multiple applications decrease the chances of approval

Curious how to get a personal loan in just minutes? Download our instant loan app and apply today!

Common Vehicle and Personal Loan Myths

Let's find out some common personal and vehicle loan myths:

It's For High-Income Groups Only

You can apply for a loan with an income as low as Rs 15,000 a month.

High Interest Rates

The myth is that lenders impose a high rate to maximise profit. But lenders are only concerned about the credit risk. Interest rates vary based on the credit risk.

A Low Credit Score Means No Loan

A credit score is essential to assess eligibility, but it's not the only factor. In case your credit score is low, there are errors in the details, or you are a first-time applicant, lenders will approve the loan.

Buy Your First Luxury Bike Easily with Hero FinCorp

A personal loan makes it easy to get your first luxury bike without draining your savings. Maintain a high credit score and a low debt-to-income ratio to qualify for a higher loan amount at lower interest rates.

The process to get a loan is quick and hassle-free. With Hero Fincorp, you can get a personal loan online without even visiting the branch.

Apply for a loan now with the personal loan app and bring that bike you want home!

FAQs

1. How long does it take to get a vehicle loan approved?

The time for vehicle loan approval varies by the lender's processing time. A personal loan gets approved within a few minutes after you apply through the loan app.

2. How does my debt-to-income ratio affect my loan amount?

A low DTI increases the chances of vehicle loan approval. It also offers favourable terms, including higher loan amounts and lower interest rates. A high DTI limits loan options and increases the overall cost.

3. Can I prepay my vehicle loan without penalty?

The prepayment penalty depends on the loan terms and the lender.

4. What are the tax benefits of vehicle loans in India?

You are eligible for tax benefits only if you use the bike for business purposes. You can claim the interest paid, reducing your taxable income.