What is a Flexible Personal Loan? Flexi Personal Loan Meaning & Benefits

At times, you may need additional funds but are unsure about the exact amount. In such situations, you can consider a Flexible Personal Loan. It provides a pre-approved credit limit. However, unlike a traditional loan, you can use only the funds you need, when you need them, and repay just that amount. Let’s understand more about these loans.

What are Flexible Personal Loans?

A Flexible or Flexi Personal Loan provides a pre-approved credit limit (not just a lump sum disbursal). Unlike traditional loans, it allows you to withdraw funds partially, repay in instalments, and adjust EMIs according to income patterns. This flexibility ensures you only pay interest on the amount used rather than the entire sanctioned sum.

This loan is helpful for individuals managing multiple short-term financial requirements, such as household expenses, debt consolidation, or one-time purchases. Features like partial repayment, redraw facilities, and adjustable EMIs make flexi loans a practical alternative to conventional loans.

By offering flexible terms, these loans enable you to manage your finances efficiently. They do so without the constraints of rigid repayment obligations.

Key Features of a Flexi Loan

Flexi loans come with several benefits that traditional loans do not provide. Key features include:

- Flexible loan limits and withdrawal options: You can withdraw money as needed, instead of taking the entire amount upfront.

- Partial repayment and re-borrowing facility: Repay part of the loan and re-borrow to manage cash flow efficiently.

- Interest charged only on used funds: Reduces total interest cost compared to full disbursal loans.

- Tenure flexibility and redraw facility: Extend or shorten the repayment period according to financial circumstances.

- EMIs and smart repayment options: Opt for EMIs that align with your income patterns for easy management.

These features make flexi loans a convenient solution for diverse financial requirements while maintaining cost-effectiveness.

How Does a Flexible Loan Differ From Traditional Loans?

Here’s a Flexible Personal Loan vs a traditional loan comparison:

| Feature | Flexi Loan | Traditional Loan |

| Interest charged | Only on the used amount | On the entire loan sanctioned |

| Prepayment | Partial or full, anytime | May involve charges |

| Loan utilisation | Withdraw as needed | Full amount disbursed upfront |

| Repayment flexibility | Adjustable EMIs and tenure | Fixed EMIs and tenure |

| Ideal for | Various short-term needs | Planned financial requirements |

Benefits & Drawbacks:

- Flexi loans offer control and reduced interest rates, but may have slightly higher rates.

- Traditional loans suit predictable expenses with fixed payments.

- Flexi loans are preferable when expenses vary or repayment timing is irregular.

Flexible Loan Plans – An Overview

A flexible loan from Hero FinCorp offers competitive interest rates and user-friendly repayment options for Indian borrowers. Key features include:

- Quick approval and disbursal: You can apply online through the instant loan app or website.

- Transparent terms: You can clear information on interest, tenure, and processing fees.

- Flexible repayments: You can choose a tenure (12 to 36 months) and make your EMI payments accordingly.

- Technology-enabled loan management: You can track your loan status via the loan app.

- Customer-centric approach: You only need your KYC details for an online loan application.

These Flexible Personal Loans are designed for those seeking both convenience and financial control.

Eligibility and Application Process for Flexi Loans

Here are the eligibility criteria to apply for a flexible loan from Hero FinCorp.

- Age: 21–58 years

- Minimum Monthly Income: Rs 15,000

- Citizenship: You should be a citizen of India

- Credit Score: 750 or more

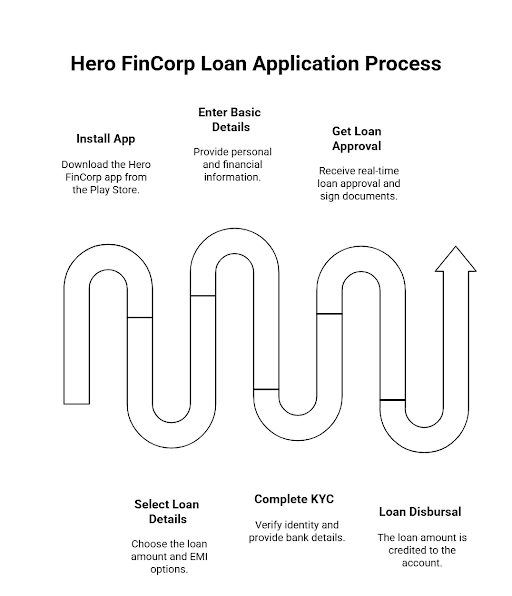

Online Application Process

- Install the Hero FinCorp app from the Play Store.

- Select a loan amount (up to Rs 5 Lakh) and preferred EMI.

- Enter basic details: Name, Income, Loan Purpose, and PAN.

- Complete the KYC process and provide bank details.

- Get real-time loan approval and digitally sign the e-Mandate and agreement.

- The loan amount is credited directly to your account.

Benefits of a Flexible Loan

Flexible loans offer several advantages over traditional loans. Let's look at the key benefits of these loans:

- Customisable repayment schedules: You can adjust EMIs according to your income.

- Interest payable only on utilised amounts: You only pay interest on the funds utilised.

- Easier management of finances: You can use these loans for different expenses without touching your savings.

- Faster loan closure options: Partial repayments allow you to repay the loan sooner.

- Suitable for short-term requirements: You can use these loans for several expenses, such as purchases or debt consolidation.

Potential Drawbacks and Considerations for Flexi Loans

While flexible loans offer flexibility, there are a few points you should consider:

- Slightly higher interest rates: Compared to some traditional loans, flexi loans may have slightly higher interest rates.

- Complex terms for first-time borrowers: Features like partial repayment and redraw can be confusing initially.

- Risk of mismanagement: Frequent withdrawals without planning can lead to financial mismanagement.

- Responsible usage required: You should track your repayments responsibly to avoid financial strain.

Conclusion

Flexible loans allow you to borrow and repay as needed, making them ideal for covering short-term expenses. Hero FinCorp offers easy-to-apply, Flexi Personal loans online without hassles. However, before applying, you must evaluate your needs. Once borrowed, use these loans responsibly for effective financial management.

Frequently Asked Questions

What is the minimum and maximum loan amount for a Flexi Personal Loan?

At Hero FinCorp, you can apply for a flexi loan from Rs 50,000 to Rs 5 Lakh online.

Can I prepay or foreclose a Flexi Personal Loan?

Yes, you can make a prepayment or even foreclose your loan after checking the lender's terms.

How is interest calculated in a Flexi Personal Loan?

The interest is charged only on the utilised amount, not the total sanctioned loan.

Is collateral required for a Hero FinCorp Flexi Personal Loan?

No, flexi loans are unsecured, so you do not need to provide any security or collateral.

Can I withdraw funds multiple times with a Flexi Personal Loan?

Yes, as the name suggests, flexible loans allow you to withdraw funds as needed.

What documents are required for applying with Hero FinCorp?

You only need your KYC details (PAN and Aadhaar) to apply online.