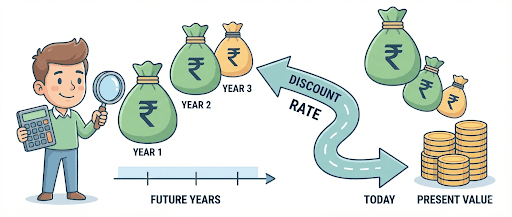

What is Discounted Cash Flow (DCF)?

₹20,00,000 ÷ 1.33 - ₹15,02,629.

Now that we have our Present value and Terminal Value, the DCF of this tea stall is:

₹90,909 + ₹99,174 + ₹1,12,781 + ₹15,02,629 = ₹18,05,493.

This amount represents the estimated present value of the business.

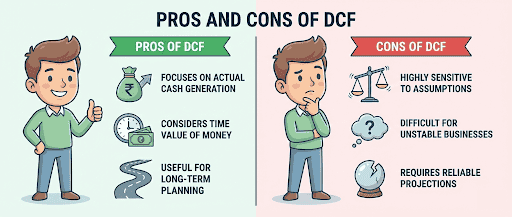

The Pros and Cons Of Using DCF As An Evaluation Method

Valuing a company using the DCF model has its pros and cons.

Its advantages are as follows:

- It focuses on actual cash generation.

- It considers the time value of money.

- It's useful for long-term planning.

- It encourages realistic financial forecasting.

- It's widely accepted by investors.

However, it also has its fair share of downsides, such as:

- It's highly sensitive to assumptions.

- Small changes in the discount rate can alter a valuation considerably.

- It's difficult to use for unstable businesses.

- It requires reliable financial projections.

Summing It Up

DCF is one among several models available to determine the value of a business. Its core ideal is simple: determine what a company's future value is in today's money. It's a figure that proves useful to investors and business owners alike, and more importantly it's a core figure lenders look at when you approach them for loans.

If you have calculated your DCF and require funds for your business, turn to HeroFincorp. You can have the funds disbursed in 48 hours, and the entire application process is digital and transparent. Apply using the business loan web app now.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.