What Is CKYC? Meaning, Full Form & CKYC Number Explained by HeroFincorp

The majority of borrowers don't consider verification unless it causes delays. When you apply for a loan, you submit the necessary paperwork, wait for approval, and then proceed. The same requests are made in a different application years later. That repetition feels routine until it causes delays or confusion.

CKYC was introduced to remove this friction. It creates a single verified identity record that financial institutions can access with your consent, enabling future applications to proceed more easily.

Understanding CKYC

CKYC refers to a central system that stores verified KYC details in one secure registry. Instead of each lender collecting documents independently, authorised institutions rely on the same verified record.

When borrowers ask what CKYC is, they often wonder why identity verification needs to be restarted each time.

The central kyc framework addresses this concern by reducing duplication. It allows individuals to access multiple financial products without repeating the same verification steps.

CKYC Full Form and Its Core Purpose

The CKYC full form is Central Know Your Customer. The majority of borrowers don't consider verification unless it causes delays. When you apply for a loan, you submit the necessary paperwork, wait for approval, and then proceed. The same requests are made in a different application years later.

CKYC creates a shared standard. This ensures records remain accurate and verification stays aligned across institutions.

Also Read: Why are Documents Required for Online KYC Before Loan Preparation

The Role of CERSAI in CKYC

The Central Registry of Securitisation, Asset Reconstruction, and Security Interest of India oversees the Central KYC Registry's operations. Many borrowers see the term CERSAI CKYC without knowing that this body manages and oversees the entire CKYC framework.

As the CKYC regulatory agency, CERSAI helps to preserve systemic confidence by making sure that KYC records are accurate, safely preserved, and only available to registered financial firms.

What is a CKYC Number?

A CKYC number is the reference linking all your verified identity details in the central registry. This number is used when you apply for a loan, open an account, or access financial services that require KYC verification. Instead of resubmitting documents, lenders use this identifier to fetch your existing records, helping applications move forward without delay.

Features and Significance of Your 14 Digit CKYC Number

Understanding the 14-digit CKYC number highlights its long-term importance.

- The number remains unique to one individual

- Financial institutions access verified records through this identifier

- The CKYC number's significance lies in fewer verification discrepancies

- Centralised storage improves data accuracy and security

Benefits of CKYC for HeroFincorp Customers

CKYC reduces friction during loan applications by limiting repeated verification. The benefits of CKYC become noticeable when borrowers apply for HeroFincorp loans.

- Faster processing for CKYC for HeroFincorp loans

- Reduced document submission across applications

- Clearer visibility into verification status

- More predictable approval timelines

Faster Loan Applications and Financial Product Onboarding

Time-sensitive financial needs require efficient processes. Faster loan application timelines become possible when verified records already exist. Herofincorp onboarding uses CKYC to reduce delays caused by repeated checks.

Applicants experience smoother progress from application to approval.

Reduced Paperwork and Enhanced Security

Paperless kyc reduces reliance on physical documents and manual handling. CKYC security relies on encrypted systems and controlled access.

This approach protects personal information while maintaining efficiency.

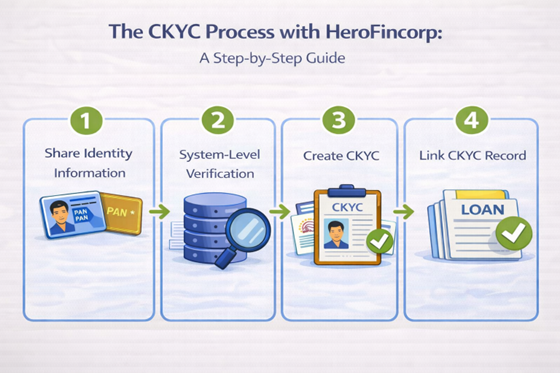

The CKYC Process with HeroFincorp: A Step-by-Step Guide

Hero Fincorp's CKYC procedure is borrower focused. Applicants can better understand what occurs at each level by being aware of these stages. Accuracy and transparency are supported at every stage.

Step 1: Providing a basic identity

Borrowers use the digital platform to submit vital personal and identifying information during the loan application process.

Step 2: System-level verification of existing records

The platform checks whether a CKYC record already exists using authorised databases and identifiers.

Step 3: When necessary, create a new CKYC record

In the case that no record is found, submitted documents are checked, and a secure new CKYC entry is made.

Step 4: Connecting the loan application to verified records

The CKYC record is connected to the loan after verification is finished, enabling seamless processing.

Essential Documents Required for CKYC Registration

Documents for CKYC focus on identity and address validation.

- PAN card as identity proof

- Aadhaar or passport as CKYC identity proof

- Utility bill or driving licence as CKYC address proof

Verification and Generation of Your CKYC Number

After submission, CKYC verification takes place through authorised systems. Once validation is complete, the platform generates CKYC number and links it to your profile for future use.

How to Check Your CKYC Number and Status Online?

Knowing how to check a CKYC number online helps borrowers prepare before applying for any financial product. Authorised portals make it easy and accessible to check your CKYC status using basic information like your date of birth or PAN.

In order to help you avoid delays later, this check verifies whether your CKYC record is active, verified, and prepared for use for loan or account applications.

Making Borrowing Clearer with CKYC and HeroFincorp

By guaranteeing that each borrower's identification is confirmed and safely documented, CKYC plays a crucial part in enhancing financial transparency. This centralised procedure lessens redundancy, promotes regulatory compliance, and guards against fraud for both clients and lenders.

When applying for a personal loan, CKYC allows verification to happen quickly and accurately through digital systems. With this foundation in place, you can check eligibility confidently and move ahead with your loan application through a reliable personal loan app!

Frequently Asked Question

Is CKYC mandatory for individuals applying for financial products from HeroFincorp?

Regulatory guidelines require CKYC for most financial products. HeroFincorp completes the process during onboarding if no record exists.

Which documents are deemed Officially Valid for CKYC?

According to regulations, officially valid documents include PAN, Aadhaar, passport, driver's license, and voter ID.

After submitting, how long does it usually take to get my CKYC number?

After a successful verification, the majority of CKYC records are created in a few working days.

After my initial registration, is it possible for me to amend my CKYC information?

Updates are allowed through authorised institutions by submitting revised documents.

What should I do if I do not have a CKYC number but need to apply for a loan?

The lender initiates CKYC registration during the loan application itself.

Does CKYC only apply to individuals or does it also apply to non-individual entities?

According to legal requirements, CKYC is applicable to both individuals and some non-individual entities.