What is a Certificate of Deposit (CD)? Your Guide

Suresh received a lump sum after selling a small plot of land and deposited it into his savings account. He knew he would need the money after eighteen months for his daughter’s college fees, so spending it was not an option.

A few weeks later, while reviewing his bank statement, he noticed how little the balance had grown. When he spoke to his banker, the question was simple. If the money has a fixed purpose and a fixed timeline, why leave it idle? That conversation led Suresh to a certificate of deposit, where his savings stayed locked, earned a fixed return, and matched his plan perfectly.

If you also have money kept aside for future use and want it to grow safely, this guide will help. The sections ahead explain everything you need to know about a certificate of deposit and how it fits into everyday financial planning, without complexity or confusion.

Understanding the Certificate of Deposit (CD)

A certificate of deposit is a time-based savings option offered by financial institutions. You deposit a fixed amount for a defined period and earn interest at a predetermined rate. Unlike a savings account, a CD requires commitment until maturity.

People often search for the CD account meaning when they want predictability. A CD suits money with a clear goal and deadline, such as education costs, planned purchases, or future obligations.

Also Read: What is Personal Loan Disbursement and How Does It Work Online

CD Full Form and Its Essence in Banking

The full form of a CD account is Certificate of Deposit. In banking, this term refers to a formal commitment where the institution agrees to pay interest on a deposited amount for a fixed term. Questions about the full form of CD often centre on trust and stability.

The CD meaning for bank professionals focuses on discipline and structure. This setup helps savers avoid impulsive withdrawals while ensuring steady growth.

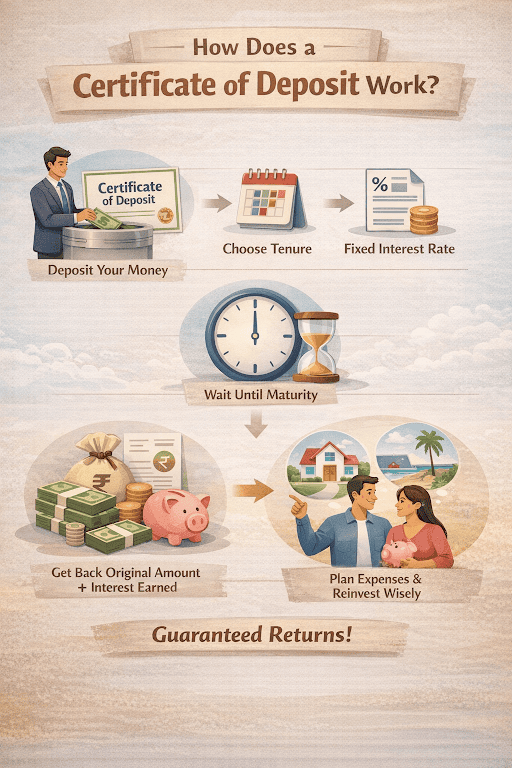

How Does a Certificate of Deposit Work?

To understand how a CD works, think of it as a planned savings arrangement. You decide the amount, choose a tenure, and place the funds into a certificate of deposit (CD). The interest rate stays fixed from start to finish.

Once the CD matures, you receive the original amount plus the interest earned. This certainty helps people plan expenses and reinvestments with confidence, especially for time-bound needs.

Types of Certificate of Deposit Accounts

Savings goals differ, and CD structures reflect that reality. Financial institutions offer multiple CD options to match varying timelines and access preferences.

Some CDs suit short-term requirements, while others support longer-duration planning. Digital access has also become an important factor for many savers.

Online Certificate of Deposit: Convenience and Access

An online certificate of deposit lets you open and manage your investment digitally. This process removes paperwork and reduces reliance on branch-based visits. Tracking deposits, interest, and maturity dates becomes easier through online access.

Hero FinCorp focuses on simple digital processes that align with modern, real-life financial planning needs.

Key Features of a Certificate of Deposit

A dependable savings product relies on clarity and consistency. HeroFincorp CDs offer:

- Fixed interest rates throughout the tenure

- Clearly defined maturity timelines

- Simple digital monitoring

- Goal-based savings structure

These certificate of deposit features support disciplined and predictable saving.

Benefits of Investing in Certificate of Deposits (CDs)

Many savers turn to CDs for stability. CDs focus on protection and planning rather than speculation.

- CDs deliver steady returns without market exposure

- The time-based lock encourages saving discipline

- Funds stay protected from everyday spending

- CDs suit conservative investors with defined goals

Anyone asking why to invest in a CD usually values certainty. Understanding what a certificate of deposit is explains its role in balanced financial planning.

Eligibility Criteria for a CD

HeroFincorp keeps eligibility simple to improve access. Most individuals who meet basic requirements can apply smoothly.

- Resident individuals can open a CD

- Applicants submit valid identity and address proof

- Age conditions apply as per product terms

People searching for CD eligibility or who can open a CD account often value this straightforward approach.

CD vs. Other Savings Options

Selecting the right savings option depends on how and when you plan to use the money.

| Feature | Certificate of Deposit | Fixed Deposit | Savings Account |

|---|---|---|---|

| Returns | Fixed and predictable | Fixed | Variable |

| Liquidity | Limited till maturity | Limited | High |

| Purpose | Goal-based saving | Medium-term saving | Daily use |

When comparing CDs vs FDs, CDs offer similar stability with clearer timelines. In CD vs. savings account decisions, CDs suit funds meant for future use rather than daily access.

Important Considerations Before Investing in a CD

Better planning leads to better outcomes. Thoughtful preparation avoids future inconvenience.

- Choose a tenure that matches your goal

- Review early withdrawal terms carefully

- Assess interest rate conditions before investing

- Keep separate liquid savings for emergencies

These CD account considerations help investors stay prepared. Practical CD investment tips always start with clarity.

Also Read: Personal loan for rent deposit and relocation with budgeting tips

Secure Your Savings with Certificate of Deposit

A certificate of deposit supports personal finance planning when savings need safety, structure, and predictable growth.

It works well for goal-based funds that should remain untouched while earning steady returns over a fixed period. Understanding CDs helps individuals in India make informed decisions about where to park surplus money and how to balance risk with certainty.

Making the right financial choice also depends on having a trusted partner. Hero FinCorp supports responsible money decisions through transparent processes and digital-first services.

Use the personal loan app to check eligibility before applying and manage financial needs without disrupting long-term savings. Apply here!

Frequently Asked Question

What happens if I need to withdraw money from my CD before maturity?

Early withdrawal is subject to a penalty under the agreed terms, as explained at account opening.

Are Certificates of Deposit taxable in India?

Interest earned on CDs is subject to tax under applicable income tax rules and must be declared while filing returns.

Can I choose different interest payout frequencies for my CD?

Some CD options offer flexible payout schedules based on the selected product and tenure.

Is a Certificate of Deposit a safe investment option during market volatility?

CDs remain unaffected by market movements. This stability makes them suitable during uncertain economic conditions.

What is the minimum and maximum tenure for a CD?

Tenure options vary by product. Institutions usually offer both short-term and longer-duration CDs.

How do I renew my Certificate of Deposit?

Renewal typically happens at maturity through digital or branch-based instructions, depending on the chosen option.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.