UPI Lite Transaction Limits: Daily Caps and Usage Rules Explained

UPI has become the go-to payment mode across the country today. It's fast and convenient, but at the same time, it's dependent on the internet and bank servers. But what if you could make small everyday payments without needing the internet or entering your PIN?

This is UPI lite, the next evolution in digital payments for quick, low-value payments with no fuss. However, it does have its daily caps and limitations like UPI does, and this blog will tell you everything you need to know about them.

What Is UPI Lite?

UPI Lite is a lightweight version of UPI designed by the National Payments Corporation of India (NPCI) under the RBI's guidance. It allows you to make small-value digital payments instantly, without entering your UPI PIN each time.

Despite the name, it is significantly different from the standard UPI we are now accustomed to. Here is how -

- Instead of direct debits from your main account, here money (up to ₹5,000) is loaded into a small wallet.

- Transactions don't need real-time bank validation. They work even if the bank servers are down.

- Only the top-ups to this wallet show up on your bank statements.

Understanding UPI Lite Transaction Limits in 2026

There have been several changes to the transaction limits when it comes to UPI Lite and UPI Lite X (the offline version). The following are the latest revisions per NPCI -

| Limits | UPI Lite | UPI Lite X (offline) |

|---|---|---|

| Per Transaction | ₹1,000 | ₹500 |

| Total Wallet | ₹5,000 | ₹2,000 |

| Daily Cumulative | ₹10,000 | ₹4,000 |

Note: You can make up to five auto top-ups per day.

How Does UPI Lite Work?

UPI Lite works like a mini-wallet within your UPI app. Here is the generic process of how it works -

Step 1 - Activate UPI Lite in your UPI app and link your bank account.

Step 2 - Load funds (up to ₹5,000) from your bank using your UPI PIN.

Step 3 - Make payments up to ₹1,000 without re-entering the PIN.

Step 4 - The Auto top-up restores balance automatically once it dips below your chosen threshold.

Each payment happens in under a second because there is no dependency on banking servers.

How to Set Up and Use UPI Lite on Popular Apps

Setting up UPI Lite is a simple process. Here is how you can do this on the most popular UPI apps.

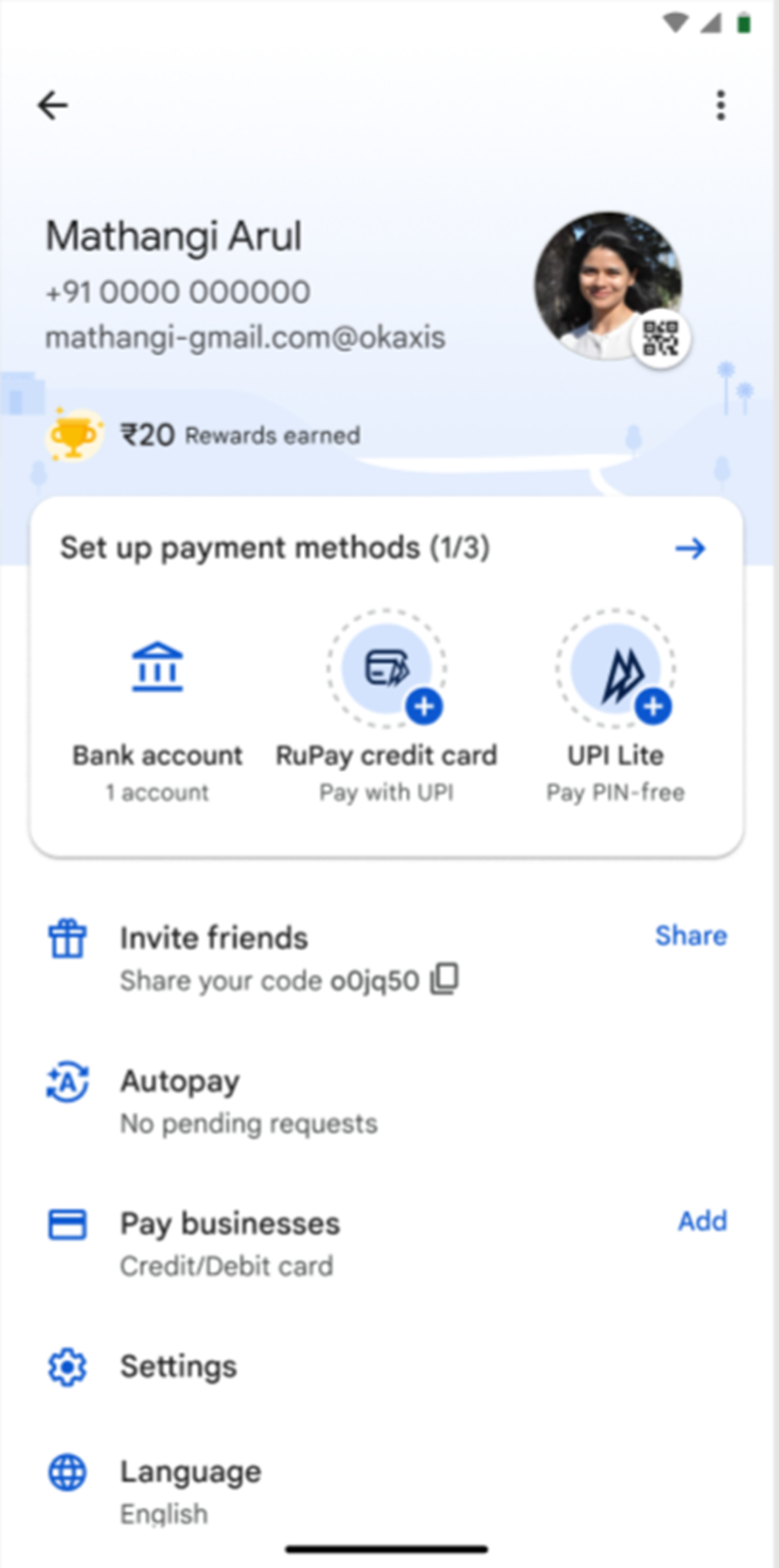

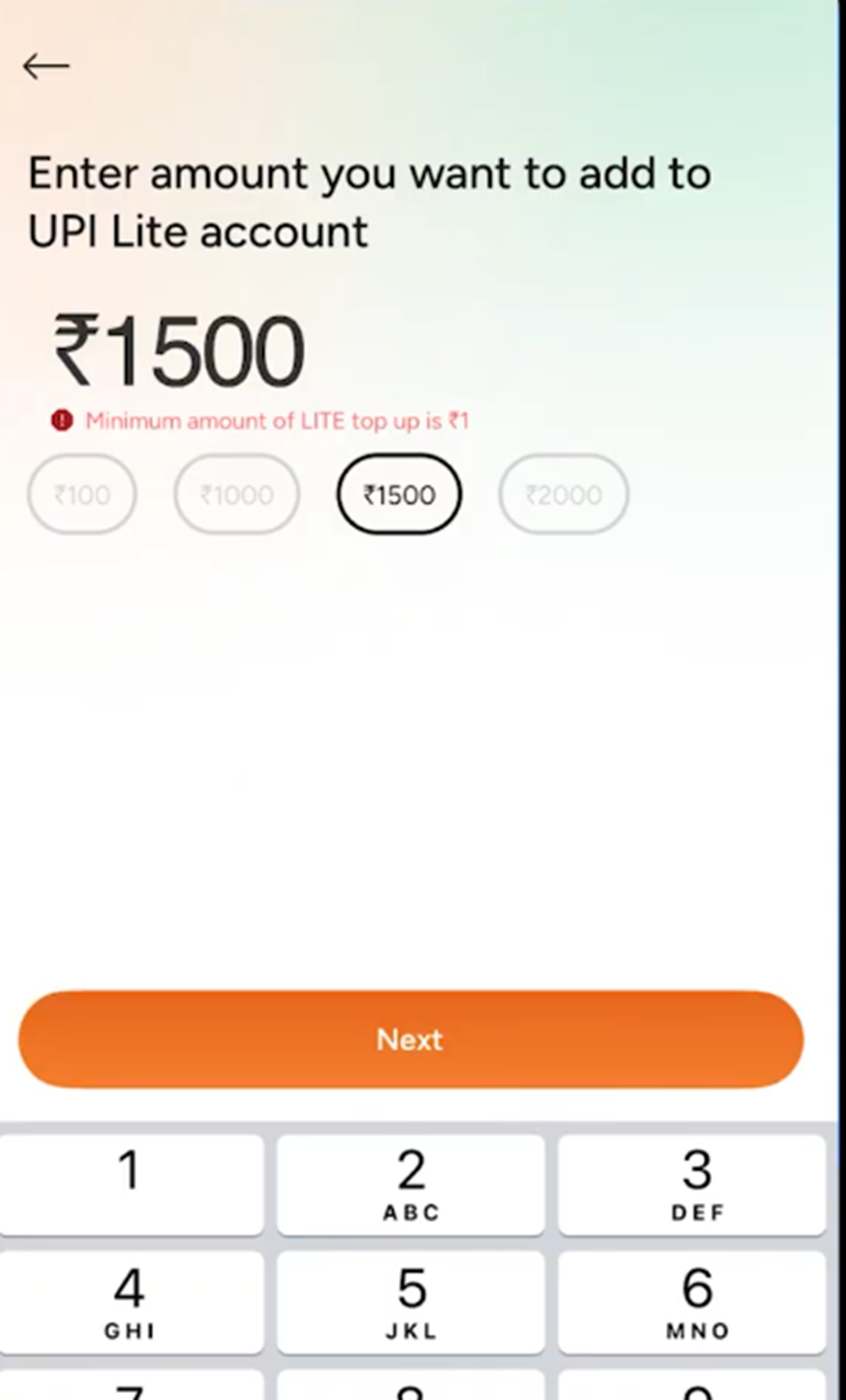

Google Pay

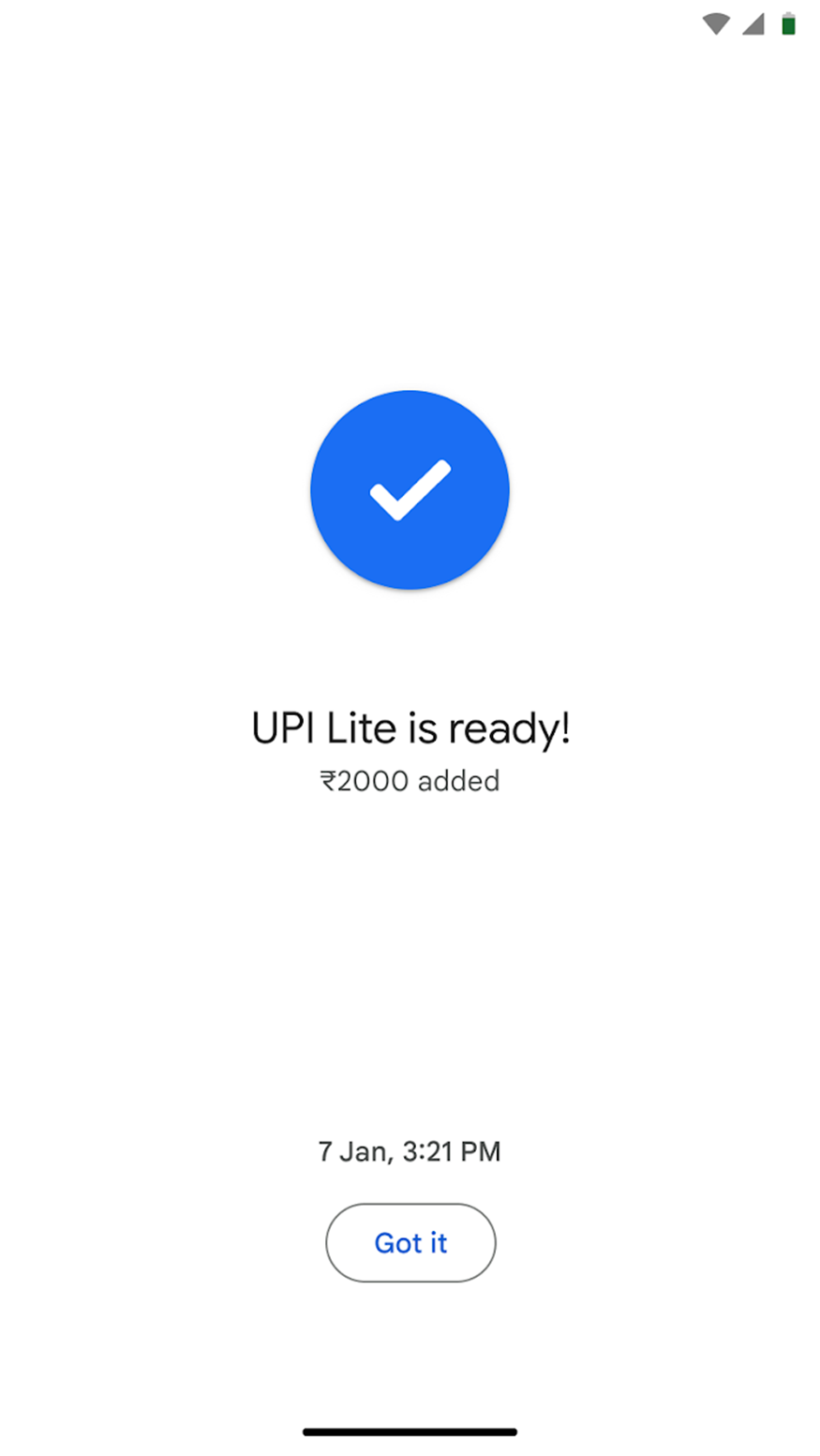

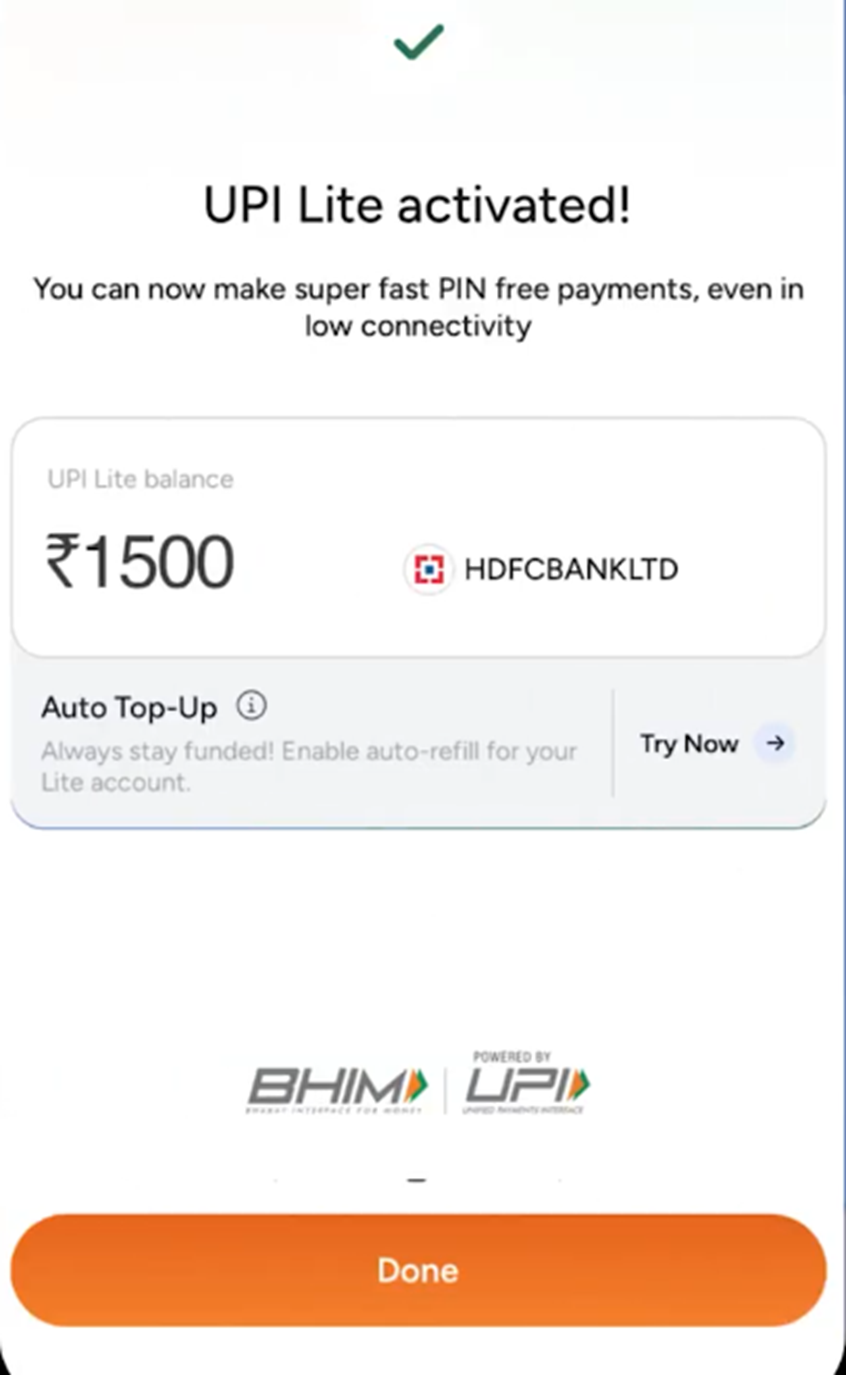

Open the Google Pay app, tap your Profile photo (on the top right corner of the screen), and click on UPI Lite.

On the next screen, enter the amount you wish to add to your UPI Lite Wallet and confirm this action by entering your UPI PIN when prompted.

And that's it. Your UPI Lite is active.

PhonePe

- Launch the PhonePe app. On the home screen, you will see an option to enable UPI Lite.

- Enter the amount you want to add to your wallet and click on "Add Money". You will then be prompted to choose which bank account you want to link to the wallet.

- Confirm the action using your UPI PIN, and your UPI Lite account on PhonePe is ready to use.

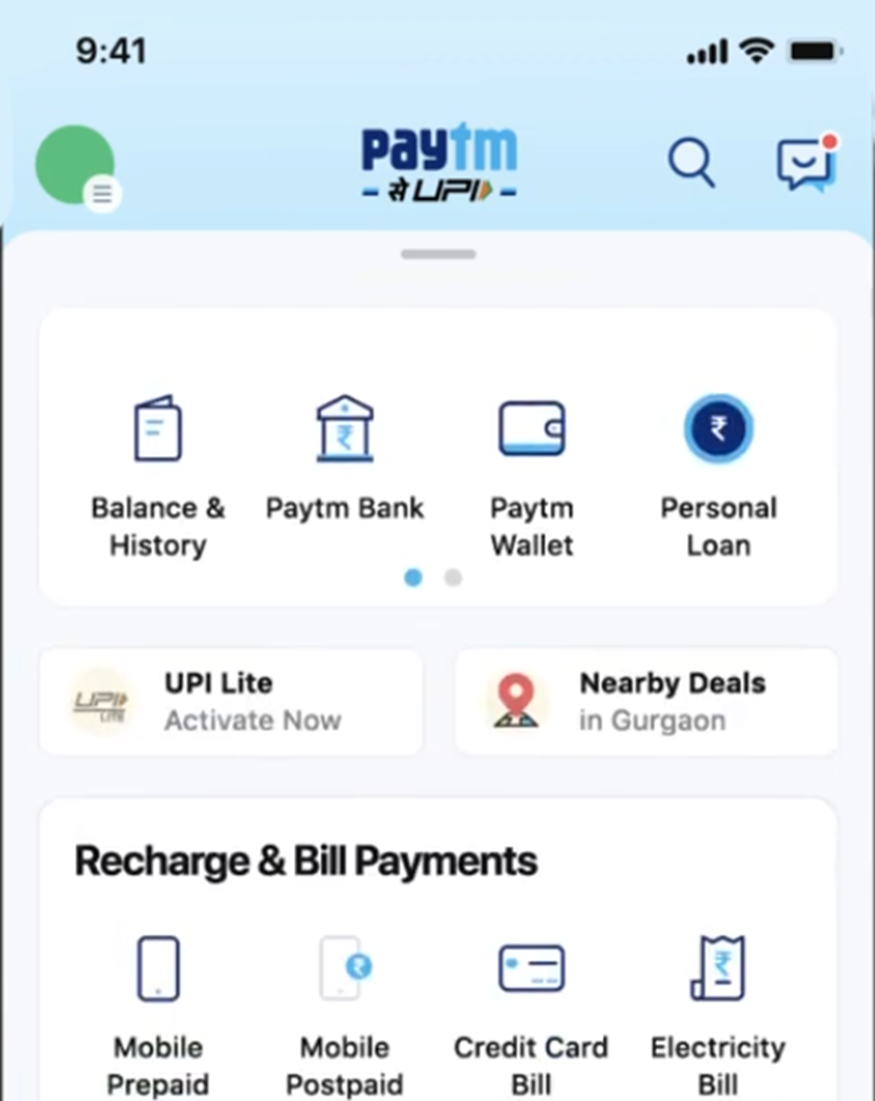

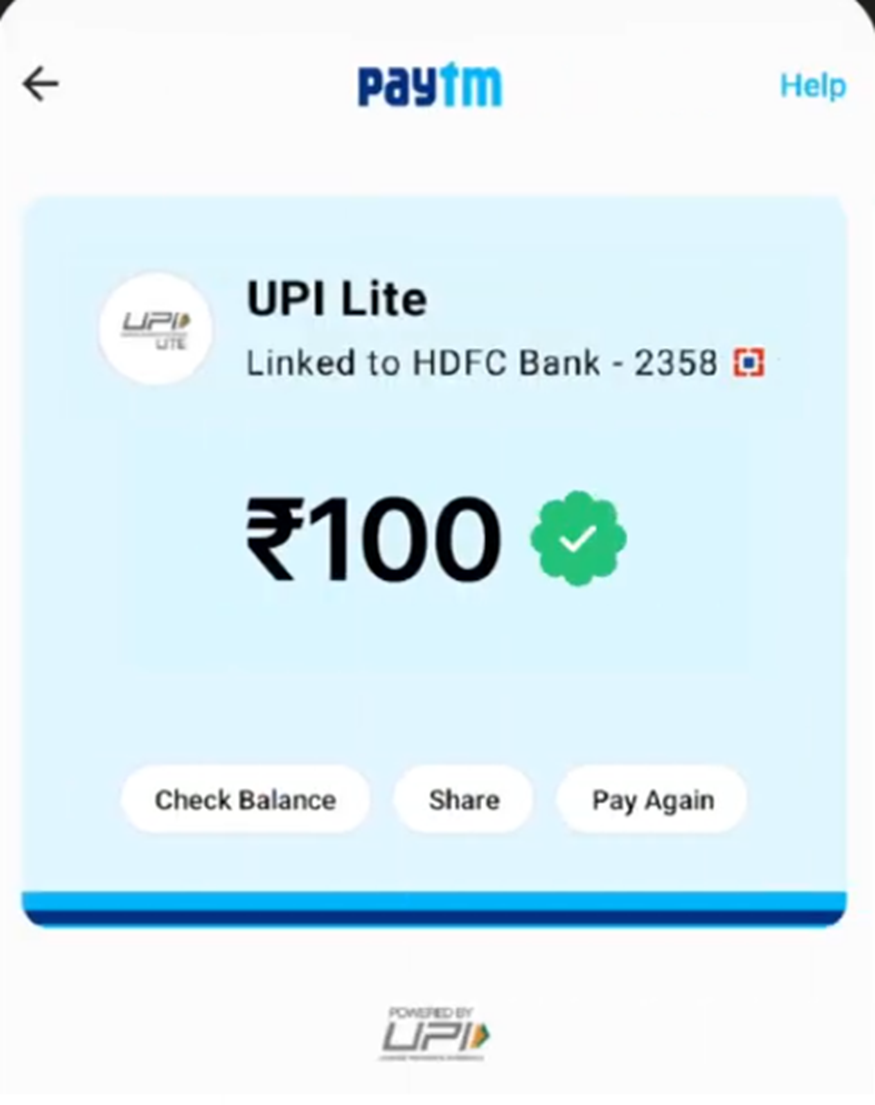

Paytm

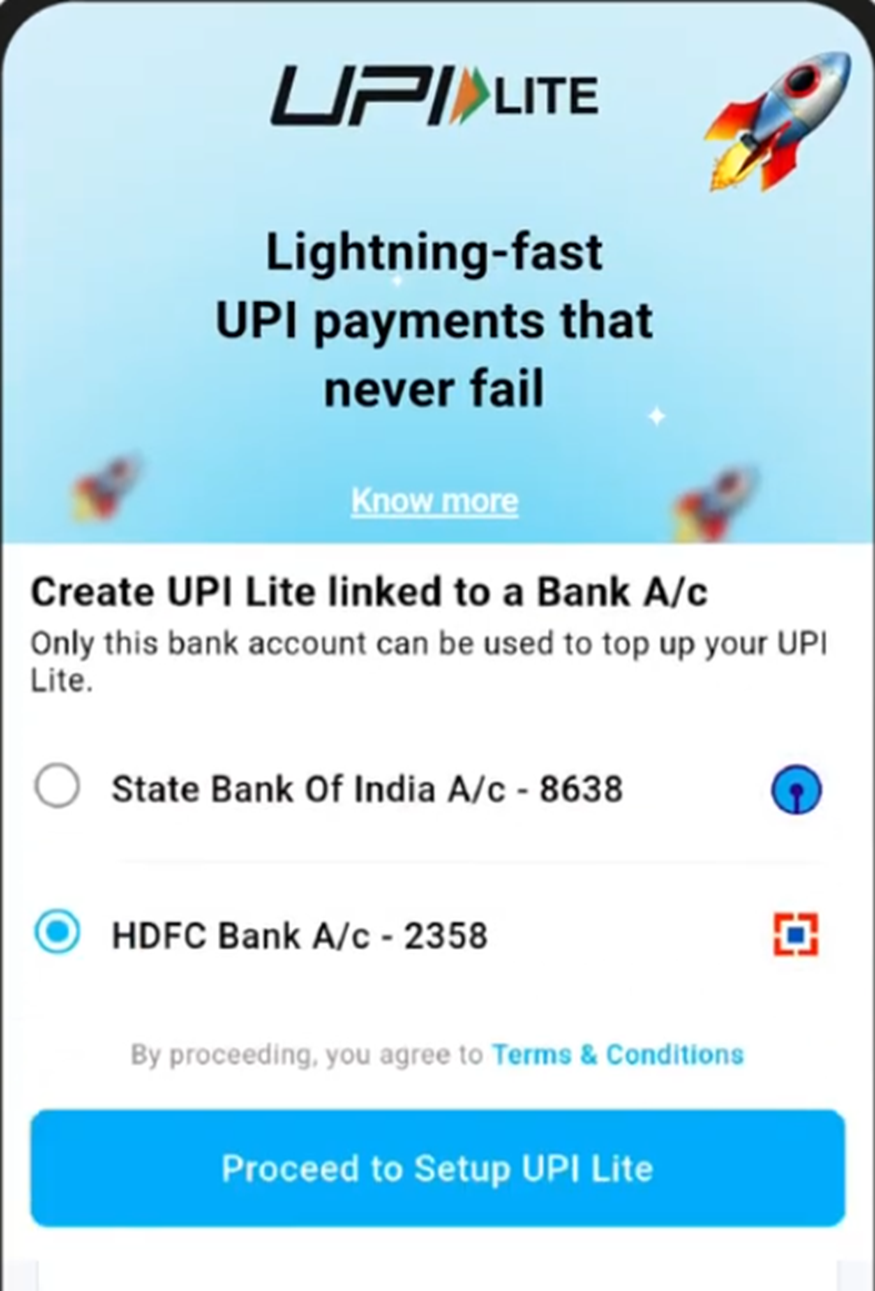

Open the Paytm app, scroll down till you see the Activate UPI lite option and click on it.

Then, select a bank account from the available list and click "Proceed to Setup UPI Lite".

Pick an amount to add to your wallet. You can either choose from one of the options given or enter a specific number yourself.

Once done, click "Add Money to UPI lite", enter your UPI pin, and you are all set.

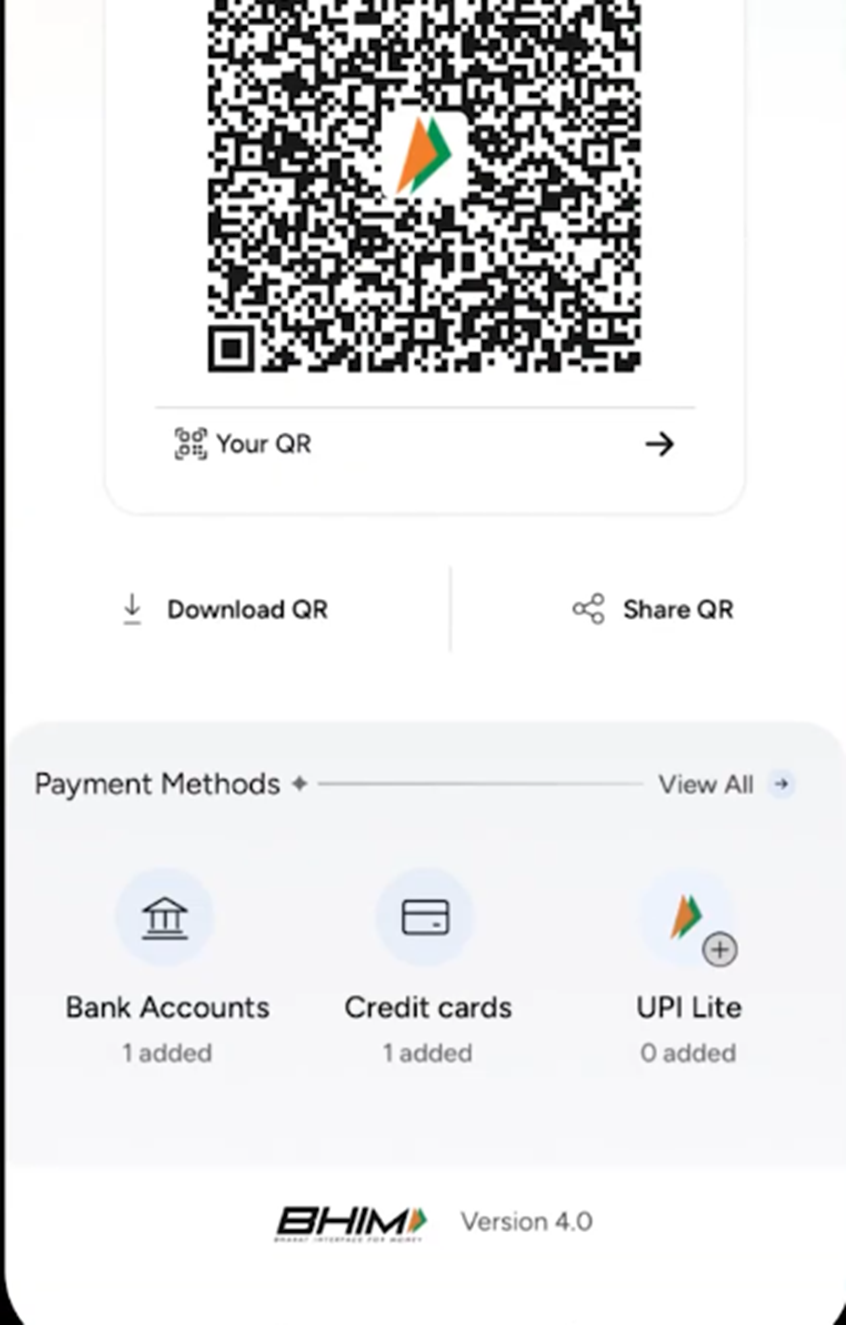

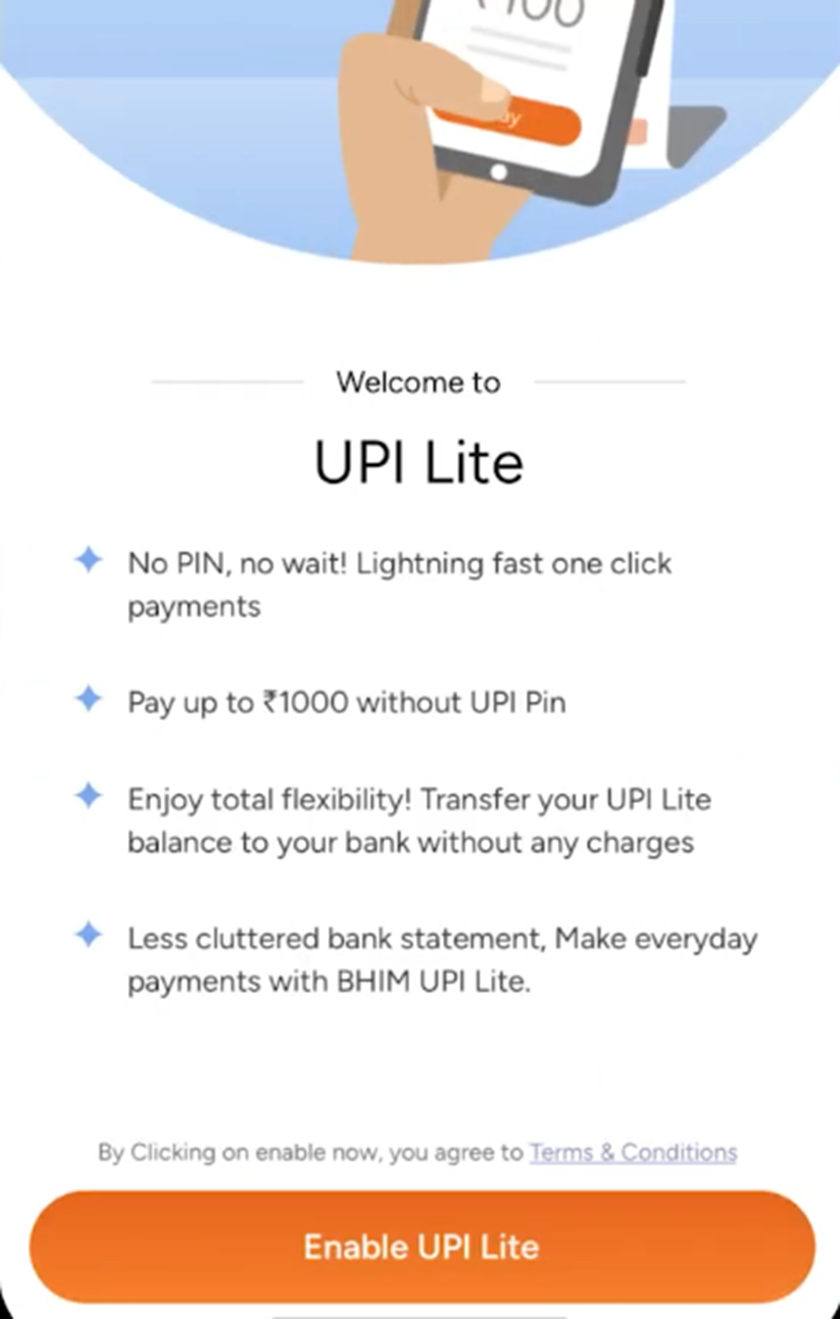

BHIM UPI / UPI Lite X

Make sure you have the latest version of the app. Then click the profile icon on the top left corner of the screen, scroll down, and click on the UPI Lite option.

Click on Enable UPI Lite on the next screen.

You will then be taken to a screen where you can add funds to the UPI Lite wallet. Enter the amount, select the bank account you want to link to the wallet.

Enter your UPI PIN, and UPI LITE is now active on your BHIM app.

UPI Lite X: Offline Transactions Simplified

UPI Lite X is the next evolution of UPI Lite. It extends the benefits of making small transactions without a PIN, but in this case, even without the need for an internet connection. It uses NFC technology to make payments. The limits of this payment method are as follows:

- Limit per payment - ₹500

- Daily offline limit - ₹2,000

Also Read: UPI Tap and Pay: The Future of Contactless Payments in India

Benefits of Using UPI Lite for Daily Transactions

UPI Lite offers several advantages when it comes to daily transactions, such as -

- Instant payments without the need for a PIN

- No dependency on bank servers

- UPI LITE X ensures you can still pay even if your mobile network is down

- Finally, it reduces the load on the UPI network

Differences Between UPI Lite and Standard UPI

UPI Lite is not a replacement for standard UPI. Each serves a different purpose, and knowing the differences will help you pick the right payment option depending on circumstances.

| Parameters | UPI LITE | UPI |

|---|---|---|

| Per transaction limit | ₹1,000 | Up to ₹1 lakh (varies by bank) |

| Daily cap | ₹10,000 | Depends on individual bank rules |

| PIN requirement | No PIN needed | PIN required for every payment |

| Internet requirement | Optional (Lite X works offline) | Always needed |

| Transactions shown in the bank statement | Only top-ups and refunds | Every transaction is listed |

| Receiving funds | Not supported (yet) | Supported |

Common Rules And Restrictions For UPI Lite Transactions

Now, before you start using UPI Lite, there are some restrictions and rules that you must be aware of, such as -

- You can link only one bank account to your UPI Lite wallet.

- The wallet balance can't exceed ₹5,000 at any time.

- Auto top-up triggers only when your balance goes below the preset threshold (which you can set).

- You can't receive money through UPI Lite.

- If you disable UPI Lite, your balance returns automatically to your linked account.

- If your UPI account goes dormant, the money will automatically be refunded to your source account.

Also Read: UPI Transaction Limit Per Day

Make Payments With Ease With UPI Lite

UPI Lite is a big leap forward in digital payments. Your payments are faster, independent of bank servers, and in the case of UPI Lite X, the internet. Whether you're a frequent UPI user or new to digital payments, UPI Lite is a new practical alternative to make low-value payments with ease.

That said, managing daily expenses is one thing, but what do you do about larger financial needs? In case of a medical emergency or a wedding, having easy and quick access to funds can make all the difference.

Hero Fincorp can make that happen. With a fully digitised process, you can check your eligibility instantly and have access to funds in minutes.

Unexpected expenses can't wait. Apply for a personal loan today and get funds in minutes.

Frequently Asked Questions

1. Can I perform UPI Lite transactions without an internet connection?

Yes, you can, via UPI Lite X. However, in this case, your payment limit is capped at ₹500 each, and you can only make up to ₹2,000 worth of offline payments per day.

2. How does the auto top-up feature work?

The auto-top-up feature refills your UPI Lite balance automatically once it dips below a set limit. This limit can be set based on your needs.

3. Is UPI Lite safe for everyday payments?

Yes. UPI Lite is as secure as UPI, as it uses bank-level encryption and runs as per RBI and NPCI guidelines.

4. Can I receive money into my UPI Lite wallet?

No. UPI Lite does not support the functionality of receiving funds at the moment.

5. What happens if my UPI Lite wallet is inactive for months?

If your account does not have any transactions for six consecutive months, it will be considered dormant, and the balance will be refunded to your linked bank account.