Personal Loan vs. Salary Advance Loan: Key Differences

Rohan was in a financial pinch. His car broke down two weeks before his salary day. His cousin said, “Just take a personal loan.” His colleague said, “Why don’t you get a salary advance loan?” Both sounded like smart options.

But which one actually fits his needs?

Most borrowers get stuck here. Personal loan vs salary advance loan can sound similar, but they are not the same. In this blog, we’ll break it down so you can choose smarter.

When Should You Choose a Personal Loan?

A personal loan is a structured borrowing product. You get a fixed loan amount with a proper tenure, EMI structure, and predictable repayment plan. The benefits of a personal loan over a salary advance include flexibility, higher loan amounts, and the ability to build a credit score over time when you repay every EMI on time.

Get a personal loan when you -

● Need a higher loan (₹50,000 to ₹5 lakh or more)

● Want easy EMIs rather than lump-sum repayment

● Have a planned expense (education, medical, gadget, travel, renovation)

● Want to improve or build a credit score

● Need structured financing, not a temporary patch

Also Read - List of 10 Personal Loan Uses

When Should You Opt for a Salary Advance Loan?

Salary advance loans are short-term loans. You borrow a part of your salary before payday. They are fast, easy, and need minimal credit checks. But their repayment is usually immediate, often deducted from their next salary. So, repeated usage can trap you into a payday-style loop.

Choose a salary advance loan when you -

● Need small cash quickly

● Have a sure, confirmed salary incoming

● Want a one-time short-term fix only

● Can repay in one shot without stress

● Need money only till payday, not beyond

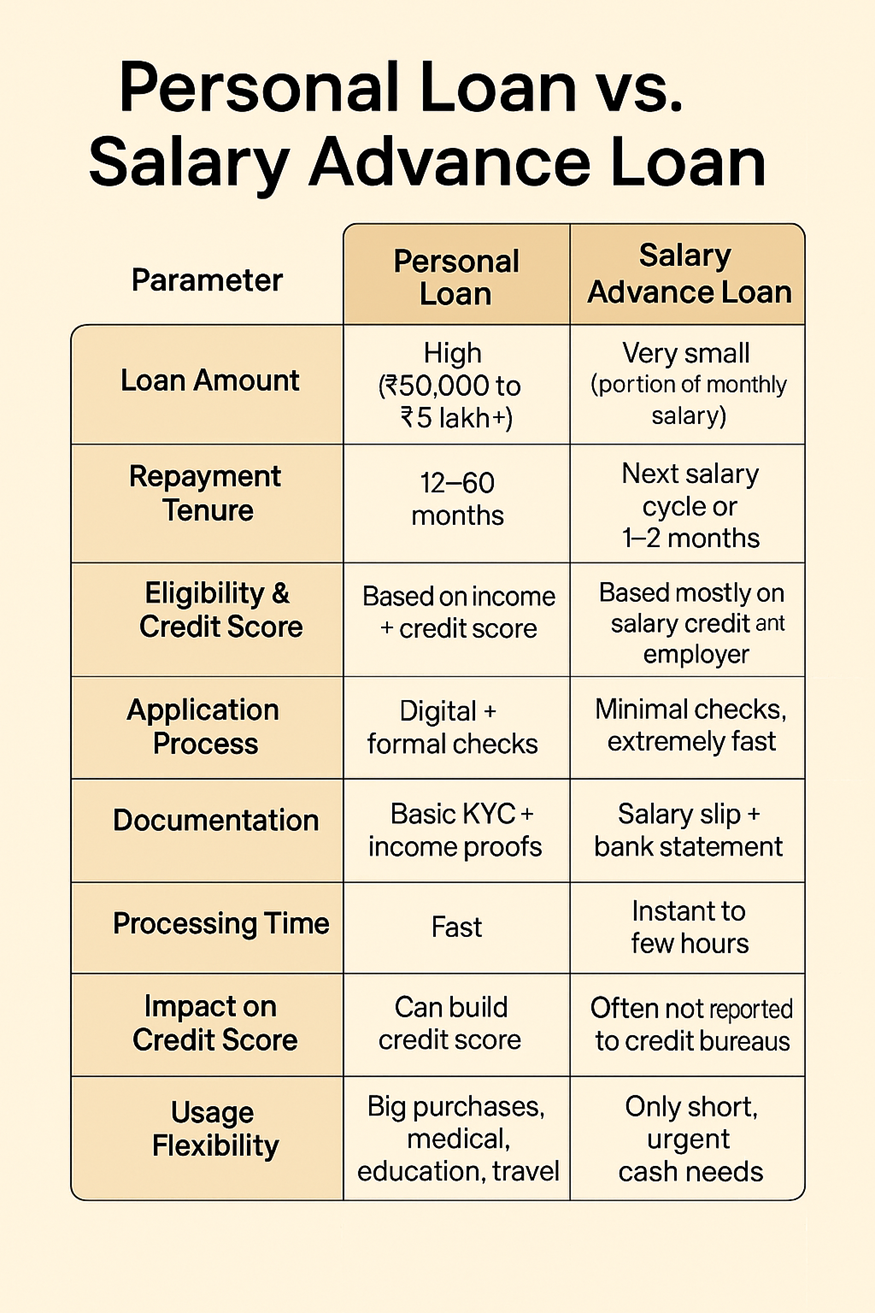

Side-by-Side Comparison: Personal Loan vs Salary Advance Loan

Both products offer cash access, but the difference between quick loan and express loan-style products like salary advances is massive. Here is a detailed personal loan vs salary advance loan comparison -

Also Read: know quick loan vs express loan

| Parameter | Personal Loan | Salary Advance Loan |

| Loan Amount | Higher ticket size. Can go from ₹50,000 up to ₹5 lakhs or even more, depending on eligibility. Suitable for planned and large expenses | Very small ticket. Usually equal to 25-50% of your monthly salary. Designed for tiny cash shortfalls, not actual “funding” needs |

| Repayment Tenure | Flexible repayment. Can be repaid in EMIs across 12 to 36 months. You get time to manage the repayment comfortably | Very short tenure. Usually cleared once the next salary hits or within 1-2 months. The repayment burden hits fast |

| Interest Rate & Fees | Structured interest. Annualised interest is lower when compared over the same time period. Transparent fee structure | Can appear low at first, but fees on a very short tenure end up being expensive if annualised. Some salary advances can be costlier than personal loans, comparatively |

| Eligibility & Credit Score Requirement | Lenders assess credit score, repayment history, income stability, and existing debt | Mostly based on confirmed monthly salary and employer details. Minimal reliance on credit score |

| Application Process | Fully digital with fast approval. Still more checks compared to salary advances because the loan amount is higher | Extremely fast process because loan amounts are small. Sometimes processed in minutes |

| Documentation | PAN, Aadhaar, bank statements, salary slips, etc. Basic but complete documentation is required | Usually, only a salary slip and a salary credit bank statement are enough |

| Processing Time | Fast with digital lenders like Hero FinCorp. Approvals and disbursal still follow the proper loan underwriting flow | Ultra-fast disbursal. Many salary advances are designed to reflect the same day |

| Impact on Credit Score | Repaying EMIs on time builds your credit score. This improves future borrowing power | Usually has no impact on credit score because many salary advance products are not reported to credit bureaus |

| Usage Flexibility | Can be used for anything: large expenses, planned spends, multi-category needs | Best only for immediate short-term emergencies before payday |

Borrow Smart, Not Just Fast

At the end of the day, Rohan could obtain either a personal loan or a salary advance loan to fix his car. But since a salary advance is like a small band-aid, he chose a personal loan.

A personal loan gives you structured funds, longer repayment tenures, and predictable EMIs without burning your next salary in one shot. So, if you want stability, transparency, and a loan that works for your real goals, apply for a Hero FinCorp Personal Loan online in minutes.

Frequently Asked Questions

1. Is a salary advance considered a loan or an advance?

Technically, a loan since you borrow it against your upcoming salary.

2. Does a salary advance impact my credit score?

Mostly no, because they are often not reported. Personal loans do.

3. Can I prepay my personal loan without penalty?

This depends on lender policy. Read terms before signing.

4. Which one is better for big-ticket costs?

Personal loan. Salary advance is only for short-term and small needs.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.