Quick loan vs Express Loan: Key Differences

Quick Loan and Express Loan sound the same, right? Many people even use them interchangeably when talking about fast money solutions.

But the only thing identical between the two is that they offer swift access to funds. In reality, they differ in how fast they work, the loan amount, and the overall process. We break down what each term really means.

So, hang tight as we go from quick loan definition to differences between quick loan and express loan to when to choose what.

What is Quick Loan?

A quick loan is a short-term personal loan built for urgent, modest needs. Lenders design these products for borrowers who need money fast but don’t have time for lengthy verification.

Typical quick loans require basic KYC and simple income checks and are disbursed within 24-48 hours after approval.

Loan amounts tend to be small to medium, and tenures are usually shorter. It may attract slightly higher interest rates to compensate for the speed and risk.

Also Read: How to Get a Quick Loan Online?

What is Express Loan?

An express loan is a faster, often instant loan product that relies heavily on automation and pre-approval. Lenders offer express loans to customers with good credit history or an existing relationship.

Because much of the underwriting is automated (credit bureau checks, e-KYC), eligible applicants can see approvals in minutes and receive funds almost immediately.

Express loans may allow higher amounts and competitive interest rates for those who qualify. Think of an express loan as the quickest route for proven borrowers needing fast funds for time-sensitive uses.

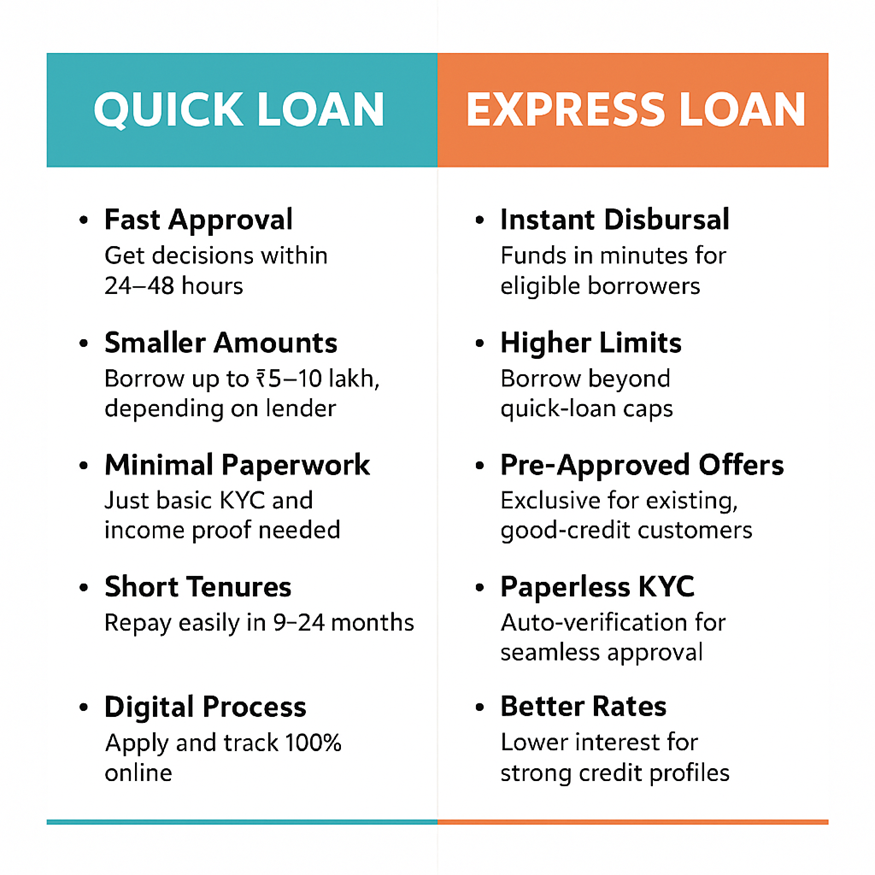

Key Difference Between Quick Loan and Express Loan

Quick loans are fast, but express loans are instantaneous. And the way they move money differs. Here’s a table highlighting the differences between quick loan vs express loan:

| Parameter | Quick Loan | Express Loan |

| Loan Amount | Generally smaller, often capped for short-term needs | Can be higher, especially for pre-approved borrowers |

| Approval Speed | Fast, usually within 24–48 hours | Instant or within minutes, depending on digital verification |

| Documentation Required | Minimal but may involve ID, income proof, and address verification | Fully digital and paperless, relying on KYC and credit score |

| Repayment Tenure | Short to medium-term (2 years) | Medium to long-term (5 years) |

| Interest Rates | Slightly higher due to flexible eligibility | Often lower for those with good credit scores |

| Use Case Examples | Emergency expenses, travel, or short-term financial gaps | Time-sensitive payments, bill settlements, or pre-approved top-ups |

How to Choose Between a Quick Loan and an Express Loan?

Choosing between the two depends on your situation -

● Choose a Quick Loan if you don’t have pre-approval, but need funds urgently for medical or personal reasons. It’s also suitable if you prefer some human guidance during the application.

● Choose an Express Loan if you’re tech-savvy, have a good credit score, and want instant money with minimal steps, such as for paying fees, bills, or consolidating debt.

Also read: Loan vs Bond: Know the Difference

Benefits of Choosing Hero FinCorp Loans

Choosing between a quick loan and express loan depends on your needs.

Hero FinCorp offers a transparent and trustworthy borrowing experience, whether you choose a quick loan or an express loan. Enjoy easy eligibility, flexible repayment plans, and digital processing, combining speed with comprehensive support.

Check your loan eligibility, calculate EMIs, or apply online for a Hero FinCorp personal loan in minutes.

Frequently Asked Questions

1. Can I convert a quick loan to an express loan later?

No, they’re distinct loan products. However, if you have a strong repayment history, you may become eligible for express loan offers later.

2. What are the typical interest rates for quick vs express loans?

Quick loans may have slightly higher rates due to flexibility. On the other hand, express loans generally offer lower rates for pre-approved borrowers.

3. Are there any hidden charges in quick or express loans?

No. Lenders like Hero FinCorp disclose all fees upfront. This includes charges like processing and prepayment fees.

4. What documentation is mandatory for both loans?

You’ll typically need ID proof, address proof, and income verification. Express loans may only require digital KYC.

5. Can self-employed individuals avail quick or express loans?

Yes, both are available. Quick loans may be more flexible for self-employed borrowers, while express loans depend on credit score and profile data.