Home Loan vs Personal Loan: Key Differences Explained

Girish and Mahesh are both moving to a new house this year. Girish wants to renovate his existing property to accommodate his entire family. Mahesh, on the other hand, is purchasing a new apartment next to his existing flat to make a bigger house. Now the question is, “Who should take a home loan and who should take a personal loan?”

It is a fair question. These two products have very different purposes and follow different rules. Mixing up loan types can cost you more or limit your borrowing capacity.

So, let’s dive deeper into the home loan vs personal loan breakdown so that you know which one truly fits your goals.

Home Loan vs Personal Loan: Detailed Comparison

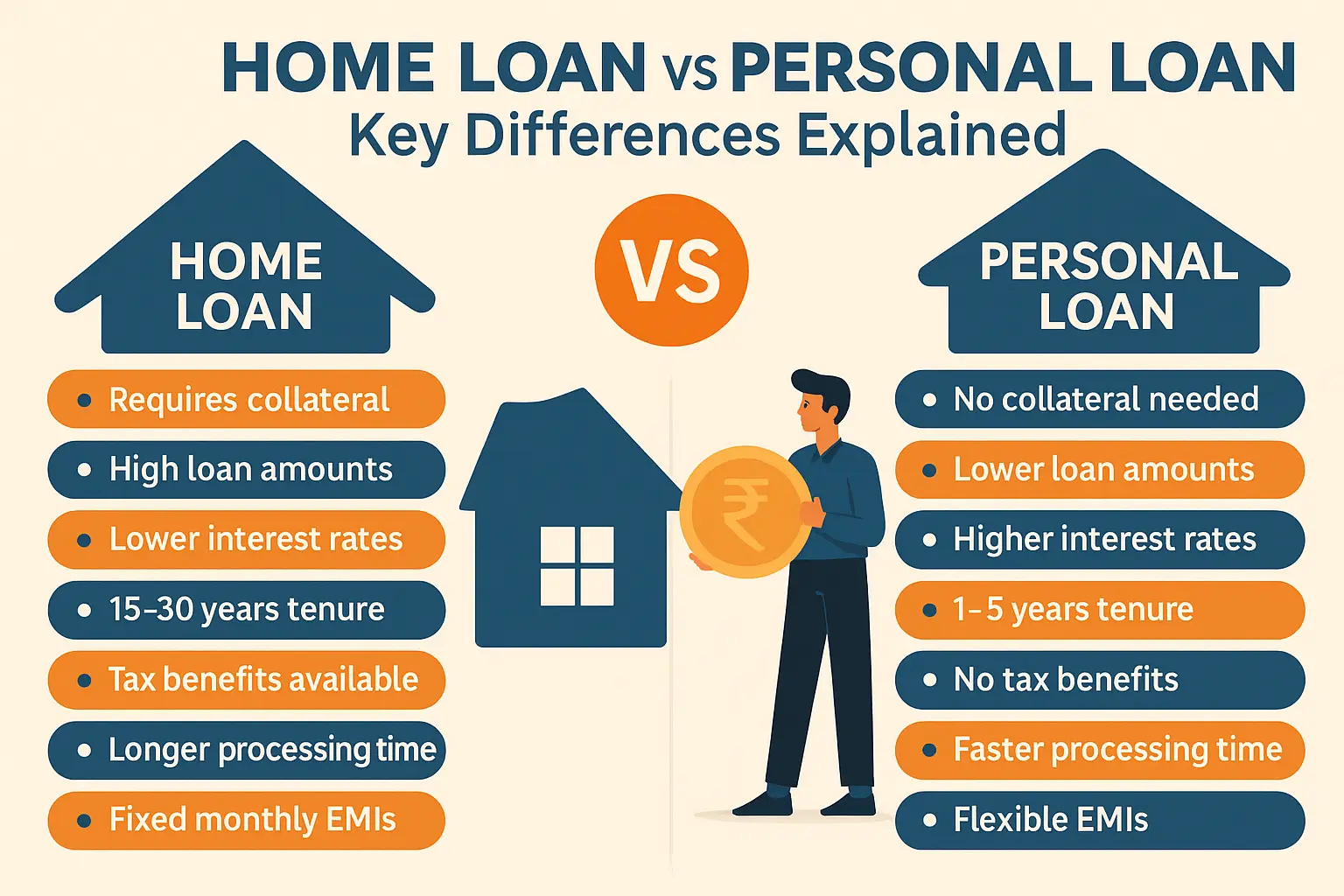

Here’s a quick cheat sheet to decide between a home loan and a personal loan based on your requirements -

| Parameter | Home Loan | Personal Loan |

|---|---|---|

| Collateral Required | Yes. The home you are purchasing is mortgaged. | No collateral needed |

| Loan Amount | Usually higher; can go into large sums up to ₹5 cr | Lower amounts, typically up to ₹50,000-₹5 lakh |

| Interest Rate | Lower, because it’s secured with your assets | Higher, since risk is higher |

| Repayment Tenure | Longer, often 10-30 years | Shorter. usually 1-5 years |

| Tax Benefits | Yes (Sections 24(b), 80C) | No tax benefits |

| EMI Size | Smaller due to long tenure | Higher due to shorter tenure |

| Processing Time | Longer (property checks, documents) | Quick approvals, often digital |

| Usage Flexibility | Only housing-related | Any purpose |

So, when it comes to home loans vs personal loans, both options have their benefits. But for Girish, who is renovating his house, a personal loan makes sense. Meanwhile, since Mahesh is purchasing a new flat, a home loan is the best option for him.

Home Improvement Loan vs Personal Loan: Which One Should You Choose?

While thedifference between a home loan and a personal loan is clear, what about home improvement loans? It is technically part of the home loan family, but it behaves a little differently.

If you’re planning a renovation, like giving your kitchen a proper upgrade or redoing your flooring, a home improvement loan can be a sensible pick. The rates are lower than those for personal loans, and the tenure gives you breathing space. But the catch? You’ll still deal with property checks, quotations, and more paperwork.

A personal loan, on the other hand, is almost frictionless. You decide, apply, upload a few documents, and you’re through. No one asks you for blueprints or renovation estimates. You could redo a bedroom or fix a sudden plumbing disaster; it's up to you.

So when it comes to a home improvement loan vs a personal loan, it is all about how quickly you need the funds and the intended use. If you are redoing your entire flat, a home improvement loan is usually the better option. But if you need to do urgent repairs in your bathroom or kitchen, you’ll thank yourself for going with a personal loan.

Also Read -Can I Get a Personal Loan for a House Deposit?

How to Choose Between a Home Loan and a Personal Loan?

The right choice between a home loan and a personal loan requires analysing your needs against the product features. Here is a checklist you can use for your loan decision tips in India -

- Loan Purpose and Amount -If it’s property-related, like buying, building, or major renovation, the home-loan family usually fits better.If it’s anything else (weddings, medical, travel, just life), go for a personal loan.

- Assess Repayment Ability and Tenure -If you need more than 20 years to repay the loan, only a Home Loan is viable. If you can comfortably repay within 5 years, a Personal Loan is faster.

- Consider Urgency and Ease of Paperwork -In the event of any emergency, if you need cash within 48 hours, a Personal Loan is advisable. If one has enough time for property valuation and legal checks, then a Home Loan is a better financial product.

- Analyse Credit Score and Eligibility - Lenders tend to be flexible in approving personal loans for individuals with good income stability, credit scores above 750, etc.

- Factor in Tax Benefits and Interest Rates - The tax benefits on a home loan save you more and thereby turn out financially superior despite the higher paperwork.

Apply for Home Loans or Personal Loans with Hero FinCorp

Choosing the right, trustworthy, and technologically advanced partner simplifies your borrowing journey. When you apply for a personal loan in India or opt for home financing with Hero FinCorp, you benefit from -

- Fast and frictionless digital application - The whole process, from application to approval, is completely digital and thus rapid.

- Competitive Interest Rates -We offer very competitive interest rates for all our loan products, geared towards your credit profile.

- Minimal Documentation and Fast Approvals -We are committed to rapid processing, especially for personal loans, so that you can get funds to meet your immediate needs.

- Dedicated Customer Service -If you have any questions or grievances with loan management and its repayments, our financial experts are always here to help you out.

Apply now for a personal loanand experience easy, transparent financing for your home renovations or any other requirement.

Frequently Asked Questions

Is it easier to get approval for a personal loan compared to a home loan?

Yes. Since a personal loan doesn’t require collateral, it is quicker to obtain than a home loan. It doesn’t involve the detailed due diligence and property valuation required for a home loan.

What are the prepayment options available for home loans and personal loans?

Both types of loans usually allow prepayment but also have a lock-in period. Personal loans often have a lock-in period, such as 6 months, and may charge a penalty on prepayment, while many home loans today do not have any penalty for floating rate customers.

Are there hidden charges in home and personal loans?

Yes. Look out for processing fees, late payment charges, and documentation fees so that you aren’t caught off guard. Trusted lenders disclose everything up front.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.