Borrowing for Gold & Silver Purchases—Smart Move in Festive Season?

The prices of gold and silver have been rising steadily and are touching new highs every few months. Despite this, with every festive season comes the urge to buy these precious metals either due to tradition, family commitments, or as an investment.

To add to this, there is also a flurry of discounts on offer. However, is borrowing to make these purchases a good move? Let's discuss a few factors to help you make this choice responsibly.

Should You Borrow for Gold and Silver Purchases?

In India, buying gold and silver, especially during festivals, is more than just a simple purchase. These metals are treated as investments and are given away as gifts to loved ones on special occasions.

Now, applying for an instant personal loan to get quick access to funds without having to dip into your savings does sound like a good idea. The real question is, "Should you do it?". Let's weigh the pros and cons first.

The Pros of Borrowing for These Purchases

Now, borrowing to buy gold and silver, especially during the festive season, has the following advantages, such as -

• You get the liquidity required to make the purchase without depending on your emergency fund, savings, or breaking any investments.

• Instead of shelling out one big amount in one go, you can repay the borrowed amount over a while via fixed and predictable EMIS.

• Instead of waiting for that festive bonus, borrowing can help you make the purchase before the festive hike kicks in.

The Cons to Keep in Mind

While the above benefits are clear, borrowing comes with its own trade-offs. Let’s look at the other side.

1. Contrary to popular belief, gold and silver in jewellery form are not investments and they do not generate income, unlike, say, a Fixed Deposit.

Personal loans, on average, are given out at interest rates starting from 19%. If this interest you pay on the loan exceeds the appreciation of the metal, the deal may not work in your favour.

2. Another risk of borrowing during this season is emotional overspending. If you overborrow, you may take on more debt than you can manage.

3. Finally, when you add this debt to your monthly expenses, it can reduce your flexibility for any future financial needs.

How to Decide If Borrowing is a Smart Move for You?

Now, the answer to the question of whether borrowing for such purchases is the right move comes down to your personal situation. Here are the main factors to consider.

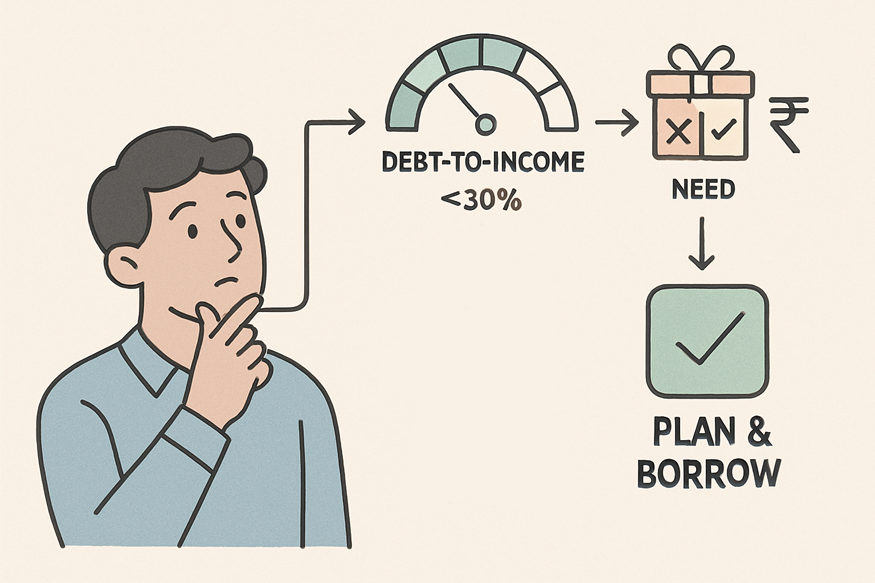

Your Debt-to-Income Ratio

You need to ask yourself -

• How much of your salary is already going toward EMIs?

• Can you take on additional EMIs without it impacting your monthly budget? (Use a personal loan EMI calculator to determine this)

• Will I have enough financial flexibility after taking on this loan?

The smart financial move is to keep your debt-to-income ratio below 30%. That way, in case you face a financial emergency in the future, you will still be in a position to borrow more funds comfortably.

The Purpose of the Purchase

Now, if you have the financial capacity to borrow for these purchases, the next question to ask yourself is, "Why am I making this purchase?". If this is an impulse buy, borrowing is not the smart move here. If you do have any family commitments coming up, you can give this a second thought.

Making the Right Calls on Loans

Borrowing to buy gold or silver purely as an investment is rarely the best financial move. The returns often don’t justify the interest you pay.

But, in the case of cultural needs or family commitments, a personal loan gives you the flexibility to meet the need without needing to touch your savings. The key is to plan and borrow responsibly.

If you are looking for an instant personal loan to help with your festive purchase, you can apply now for one via Hero Fincorp. The process is simple and paper-free.

Frequently Asked Questions

What are the documents required to obtain a personal loan?

You will need documents that can verify your income (salary slips and bank statements), along with the required identity and address proofs. With HeroFincorp, you can upload all of the above digitally.

Will buying gold on a loan affect my credit score?

No, buying gold via a loan will not impact your credit score. You will only see a negative impact on your credit score if you miss any EMI payments.

How fast can I get a personal loan approved during festivals?

With an instant loan app, you can get the loan approved and disbursed often within 24 hours. This, however, can vary based on your credit score, if all the documents are in order, and your previous repayment profile.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.