Why Regular EMI payments are essential for your financial health?

Loan EMIs have enabled everyone to afford the lifestyle they’ve always desired.

In India, people spend more than 33% of their income on paying EMIs. And why not? From buying a home appliance to purchasing a house, every financial goal looks achievable, thanks to this repayment method.

But beyond affordability, paying EMI on time brings several long-term financial benefits. Let’s explore them.

4 Benefits of Paying EMI Regularly

Whether you’ve taken a personal loan, a car loan, or a home loan, paying the EMI on time is not only important but also advisable. Here’s why:

W1. Improves Your Credit Score and Creditworthiness

In India, your loan approval largely depends on your credit score. If it’s below 650, your application can get rejected. So, it’s important to maintain a healthy score across all four credit bureaus.

Paying EMI regularly makes it easy. Timely repayments help build a positive credit history by 35%, indicating you’re a low-risk borrower. This makes future loan approvals easy and also enables you to get lower interest rates.

2. Helps You Avoid Late Fees and Penalties

The repercussions of late EMI payments in India are severe. Lenders charge upto 1%-2% of the EMI overdue amount as late fees. Moreover, if the default continues, they can also forfeit your loan product or collateral.

For example, if you took a car loan, they can take away the car to recover the amount. Luckily, one of the many benefits of paying EMI regularly is that you can prevent these.

3. Opens Doors to Additional Loans and Credit Benefits

Another key benefit of paying EMI regularly is that it helps you get future loans on EMI more swiftly than others.

The reason is straightforward. Regular payments show you can handle credit responsibly. This boosts the lender’s confidence in you. As a result, they become more likely to quickly approve your loan request, whether it’s for a top-up loan or a fresh loan. That’s not all—you can also get better loan terms.

Need funds without waiting in the queue? Try our Instant Loan App today!

4. Reduces Financial Stress and Improves Budget Management

Financial discipline is important for leading a stress-free life. Habits like budgeting and debt management give you a true picture of your finances so you can plan and achieve your goals on time.

Paying EMI regularly instils this discipline in you. It ensures you stick to your budget, pay dues on time, and manage debt smartly so your future is secured.

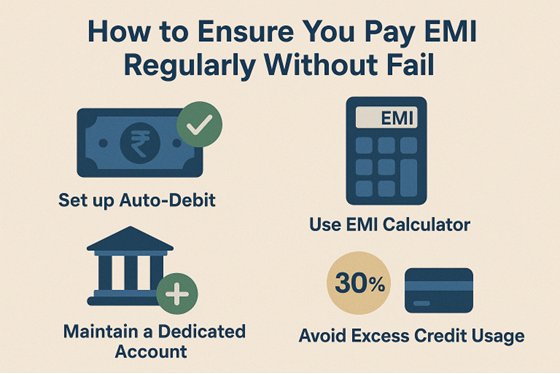

How to Ensure You Pay EMI Regularly Without Fail

If it’s your first loan or if you’re prone to defaults, it might feel impossible to pay EMIs on time consistently. But don’t worry—paying EMI regularly is easy. Here’s how you can do that:

Set up Auto-Debit: Lenders offer an auto-debit option for EMIs, which automatically deducts the amount from your bank account. You can enable it by setting up a mandate, such as NACH or ECS.

Use EMI Calculators: With an EMI calculator, you can derive the exact amount you’ll have to pay towards loan EMI each month. This will help you create a more realistic budget and skip EMI defaults.

Maintain a Dedicated Bank Account: A separate bank account makes sure your daily expenses don’t get mixed up with EMI payments. This makes it much easier to pay EMIs on time.

Avoid Excess Credit Usage: Avoiding excess credit usage keeps your debt manageable and ensures you always have enough cash to cover EMIs without delays. So, always limit it to 30%.

Create an Emergency Fund: Having an emergency fund ensures your EMIs are paid on time, especially during financial slumps. So, make sure you create one.

Monitor your loan EMIs in just a few clicks—download the Hero Digital Lending App now!

Real Customer Testimonials on EMI Payment Benefits with Hero FinCorp

The benefits of paying EMI regularly aren’t limited to your current loan. They also have a long-lasting, positive effect on your credit history, future loan applications, and financial well-being. However, you can only maximise these advantages if you’re associated with the right lender.

At Hero FinCorp, we offer flexible EMI plans so you can pick what suits your monthly budget and avoid missed payments. You can also track your EMIs anytime through our mobile app and stay on top of your payment schedule.

Take a look at what our clients have to say:

“I loved the flexible EMI option, which let me plan repayments comfortably. The entire journey felt professional and transparent. I got timely updates on every step through SMS and email. This kind of service is exactly what busy working professionals like me need. I’m a happy customer and will definitely use them again when needed.” — Ankita

“I borrowed 4 lakhs for home renovation and had a great experience. The approval was instant, and everything was done digitally. What impressed me most was the clarity—every charge, interest rate, and tenure option was shown upfront before I confirmed. No hidden surprises! I could pick an EMI plan that fits my cash flow, and repayment has been smooth.” — Vikas

“I had a wonderful experience at Hero FinCorp. I’m glad I made the decision to get a loan here. I don’t even have to go to the store to make payments. With repayment options, I do not have to worry about ever missing them.” — Shashi Prakash Bhakta

So, what are you waiting for? Enjoy convenient credit facilities - apply for a personal loan with Hero FinCorp today!

Frequently Asked Questions

1. What happens if I miss paying my EMI regularly?

If you don’t pay your EMIs regularly, your credit score will fall, and you’ll have to bear penalties like late fees and penal interest. The lender can also take legal action if the non-payment continues for a long time.

2. Can paying EMI regularly improve my loan eligibility in the future?

Yes, regular EMI payments enhance a borrower’s future loan eligibility.

3. How can I set reminders or automate EMI payments in India?

You can automate EMI payments by setting up auto-debit mandates, such as NACH (National Automated Clearing House) or ECS (Electronic Clearing Service), offered by lenders. For reminders, you can set alerts in your bank app, UPI app, or phone calendar to be notified before the due date.

4. Does paying EMI early offer extra benefits?

Yes, early EMI payments help reduce total interest, shorten the loan tenure, and improve the credit score.

5. How does timely EMI payment impact my credit score?

Timely EMI payments improve your credit score by boosting your creditworthiness.

6. Are there penalties if I occasionally pay EMI late?

Yes. Even if it’s just once in a while, late EMI payments can lead to penal interest, late fees, and a temporary dip in your credit score.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.