Why Brand Trust Matters—Choosing Hero FinCorp as Your Trusted Lender

Suppose your car breaks down, and the repair bill is far more than you planned for. Or a fee reminder pops up, but payday is still two weeks away. In that moment, your mind races: "I need a ₹50,000 loan urgently, where do I turn?"

A quick search brings up dozens of "instant personal loan" ads. Tempting, sure. But you're not just after fast cash. You want clarity, safety, and a lender you can actually rely on.

Because when it comes to your hard-earned money, trust isn't optional. It's everything.

That's where Hero FinCorp comes in, making your loan journey safe, transparent, and worry-free.

Why Brand Trust Matters in Lending

Borrowing money isn't like buying clothes online. If a shirt size doesn't fit, you return it and move on.

But a loan stays with you for months, sometimes years. Which means if you choose the wrong lender, you're stuck with the fallout:

- Endless paperwork with no clarity on why it's needed

- Rigid EMIs that seem affordable until life throws a curveball

- Sudden rejections with zero guidance on what went wrong

- Unregulated apps with no RBI oversight or real accountability

- Hidden fees that appear only after the loan is approved

Frustrating, right? That's why trust isn't a box you tick at the end - it's your first safety net.

When you start your personal loan journey with Hero FinCorp, that foundation is built in, so every loan starts with peace of mind, not second-guessing.

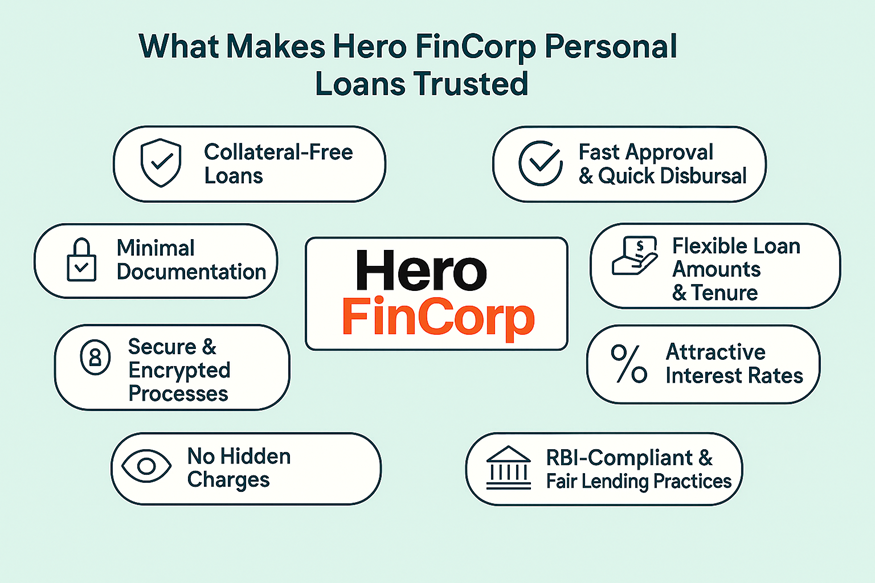

How Hero FinCorp Builds Trust Step by Step

When bills, fees, EMIs and savings all fight for space in your monthly budget, you can't afford to make impulsive decisions. The loan you pick should ease your load, not add to it.

That's where a lender needs to prove themselves, not with words, but with actions that build trust. Here's how Hero FinCorp does it:

1. Collateral-free Loans

The first question many borrowers ask is: "Do I need to pledge my valuable assets just to get a loan?" With Hero FinCorp, the answer is no.

Personal loans are unsecured, so you can access funds without putting what you already own at risk.

And once the money hits your account, you choose how to use it. Cover your kid's tuition, patch up the house, plan a trip, or clear lingering dues. It's your loan, your call.

2. Minimal Documentation

Paperwork is often the most stressful part when applying for a personal loan. Some lenders still ask for property deeds, guarantors, or years of financial records.

Hero FinCorp trims it down to the essentials. Along with your Aadhaar, PAN, recent bank statements, and other mandatory documents, here's what you need:

| Salaried |

|

|---|---|

| Self-employed |

|

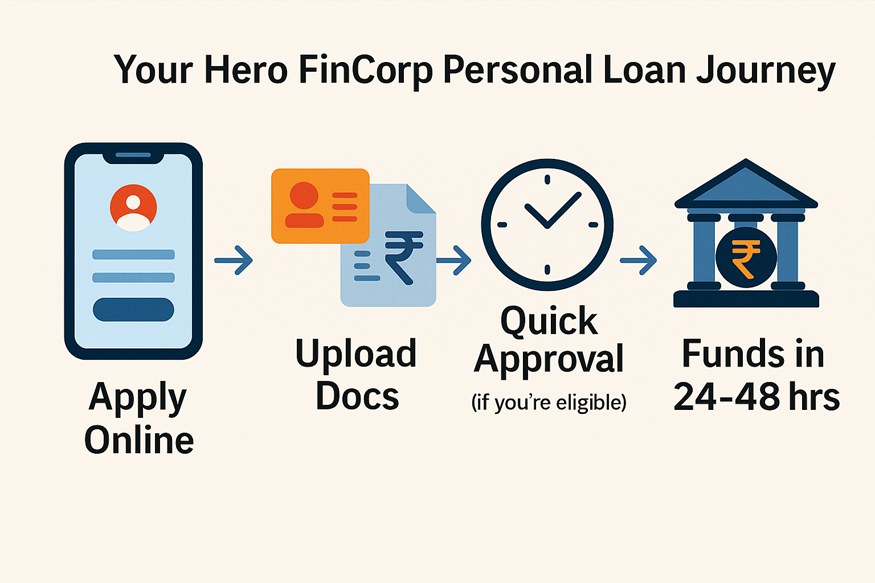

The best part? The process is fully digital—no stacks of photocopies or branch visits. Just upload the documents, complete the checks, and you're ready to move forward.

3. Fast Approval and Quick Disbursal

Urgent expenses don't wait, so your loan shouldn't get stuck in delays either.

With Hero FinCorp, things move faster. Tick all the eligibility boxes, and approval happens in minutes. Once that's done, the money usually lands in your account within 24–48 hours.

Here's what we check before saying yes:

| Age | Indian citizen, 21–58 years |

|---|---|

| Monthly Income | Minimum ₹15,000 per month |

| Work Experience | Salaried: 6+ months in the current job; Self-employed: 2+ years of business operations |

| Credit Score | 700+ for smoother approvals. Lower scores may still qualify if you have a steady income |

Do a quick eligibility check before applying to save time and get a clear picture of where you stand.

4. Flexible Loan Amounts and Tenure

Worried about being stuck with rigid loan terms? Maybe you only need a small buffer, but the lender pushes you to take more. Or the tenure feels too short, making EMIs heavier on your pocket.

With Hero FinCorp, you call the shots. Pick an amount that suits your need, anywhere from ₹50,000 to ₹5,00,000 and pay it back on your terms, whether in a year or three.

Not sure where your comfort zone lies? Test with our personal loan EMI calculator before applying.

5. Attractive Interest Rates

It's not the loan amount that usually stings; it's the rate behind your EMI. Even a tiny hike can eat into your budget month after month.

That's why we keep it simple: no fake promises, no "we'll tell you later." You see your rate upfront, before you commit.

Personal loan interest rates start at around 19% per year, and the rest depends on your income, credit score, and how you've handled past loans. The better your track record, the less weight your EMIs carry.

6. Fair lending practices

Interest rates are only one part of the story. The real test of a lender's trust lies in how transparent they are with the fine print.

With Hero FinCorp, what you see is what you get, fully in line with RBI's guidelines:

- Key Facts Statement (KFS): A snapshot of charges, terms, and Annual Percentage Rate (APR) before you sign

- No hidden costs: The amount you agree on day one is exactly what you repay

- Fair penalties: Miss an EMI? Only a flat fee, never compounding "penal interest"

Make Every Loan a Confident Choice with Hero FinCorp

A trusted lender offers more than money. It gives you peace of mind. With Hero FinCorp, you get digital ease and transparent terms that keep borrowing simple, secure, and stress-free.

So, why wait? Start today with quick, flexible personal loans you can trust to fit your life.

Partner with Hero FinCorp to kickstart your loan journey today!

Frequently Asked Questions

1. How can I boost my credit score for a personal loan?

Pay EMIs on time, clear old dues, keep card usage under 30%, and avoid multiple loan applications.

2. How much personal loan can I get on a ₹20,000 salary?

It depends on your profile. With Hero FinCorp, you could get up to ₹5 lakh, based on your CIBIL score and existing EMIs.

3. Does Hero FinCorp offer personal loans in Tier 3 cities?

Yes. You can apply from anywhere in India. The process is 100% digital, no branch visits required.