What is Repo Rate? Meaning & How it Works

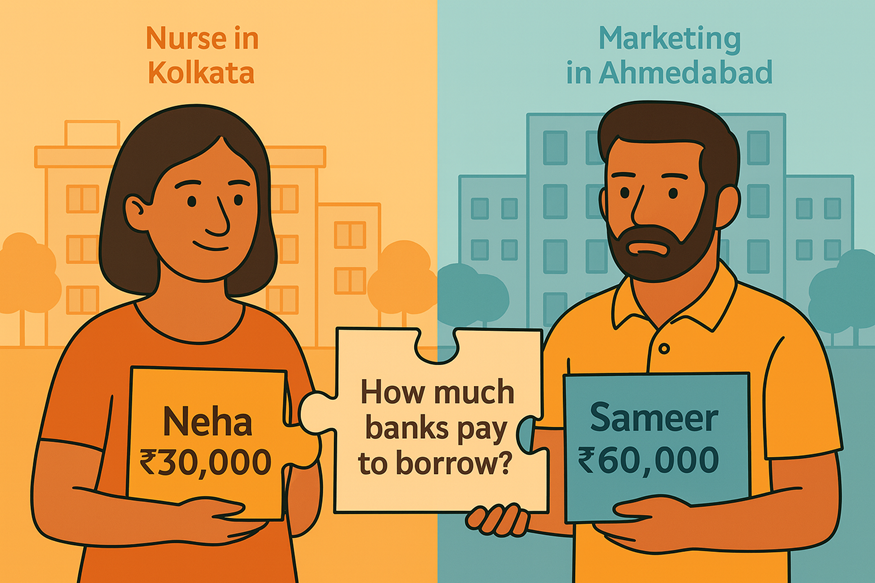

As Neha and Sameer explored home loan options, something stood out to them. Neha earns about ₹30,000 each month as a nurse in Kolkata, while Sameer earns ₹60,000 working in marketing in Ahmedabad.

Despite the gap in their salaries, both experienced shifts in their interest rates that had nothing to do with what they earn. It came down to how much banks themselves pay to borrow money.

That cost is guided by the repo rate. It has a direct effect on how costly or manageable loans feel. Once you know the basics of the repo rate, you can follow interest rate movements more easily and judge the best time to borrow.

What is Repo Rate?

The Repo Rate (Repurchase Rate) is the interest rate at which the Reserve Bank of India lends short-term money to commercial banks against government securities.

Banks sometimes need extra funds to manage their daily requirements. When that happens, they borrow from the RBI by offering government bonds as security.

The interest they pay is called the repo rate. A higher repo rate raises the cost for banks to borrow, which usually shows up as higher interest rates for borrowers. A lower rate reduces that cost so that loans can become more affordable.

To give a simple example, at a 6% repo rate, a bank taking ₹100 crore would repay the amount plus interest calculated at 6%.

How Does Repo Rate Work?

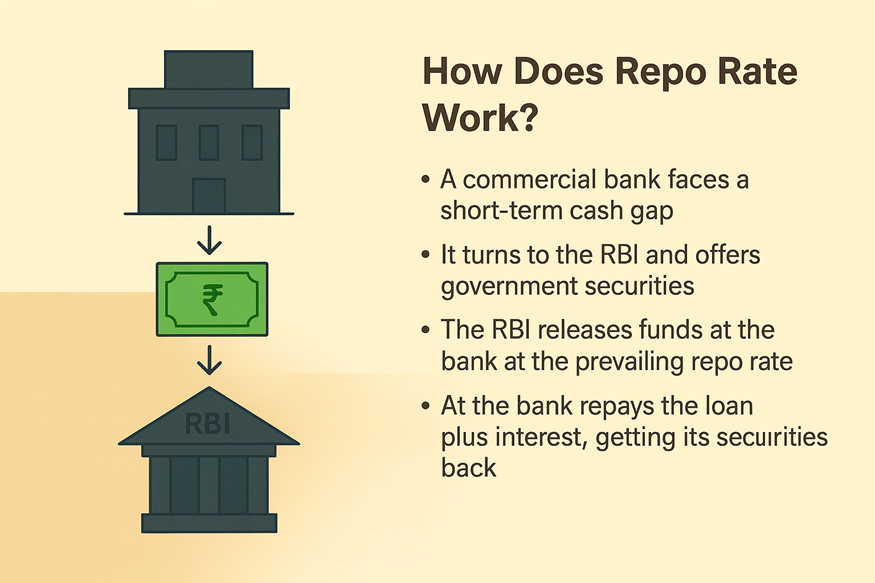

To understand how the repo rate works, it helps to follow what happens when a bank needs money.

1. A commercial bank may face a short-term cash gap.

2. To bridge this, it turns to the Reserve Bank of India and offers government securities as security.

3. The RBI releases funds to the bank at the prevailing repo rate.

4. At the end of the term, the bank clears the loan along with the interest, and its securities are released back to it.

5. A higher repo rate makes this entire process pricier, which can lead banks to hold back on new loans. A lower rate reduces that cost and encourages banks to lend more actively.

Impact of Repo Rate on Consumers and Businesses

Shifts in the repo rate affect both day-to-day borrowing and long-term money decisions. When the rate goes up, loans tend to get more expensive. When it comes down, borrowing generally becomes a little easier.

Consumer Impact

● Loan Interest: A higher repo rate pushes banks to increase lending rates on home loans, car loans, and personal loans. A lower rate usually brings some relief

● EMIs: When interest rates rise, monthly instalments go up. When interest rates drop, loan EMIs usually go down as well, which helps borrowers

● Savings and Deposits: Banks may increase fixed deposit or savings rates when the repo rate rises, which benefits savers. A lower rate tends to reduce these returns.

Business Impact

● Cost of Borrowing - Higher repo rates raise the expense of working capital and long-term loans for companies. Lower rates reduce the pressure on borrowing costs, allowing companies to access funds with a bit more ease.

● Investment Plans - Cheaper access to funds gives companies the confidence to expand, begin new initiatives, or upgrade their equipment. Higher borrowing costs may delay these decisions.

● Cash Flow for NBFCs - For NBFCs, a rate hike can tighten margins and slow loan demand. A rate cut often improves liquidity and supports stronger credit growth.

Repo Rate Effect on Personal Loan EMIs and Home Loans

Changes in the repo rate directly influence how much you pay each month on home loans and personal loans. When the rate goes up, borrowing becomes costlier, and EMIs usually rise. When the rate falls, banks can offer lower interest rates, which brings some relief to borrowers.

● Example 1 (Home Loan): On a ₹1 crore home loan for 20 years, a reduction in interest from 8.5% to 8% can bring the EMI down by roughly ₹6,000

● Example 2 (Personal Loan): If the repo rate increases, floating-rate personal loans often see a quick jump in EMI, while a cut can reduce the monthly outgo

What to look out for:

● If your loan has a floating or fixed rate

● How quickly your lender updates rates

● The impact of a change in EMI on your monthly budget

You can check potential EMI changes quickly using Hero FinCorp’s mobile app for Android and iOS.

Factors Influencing RBI’s Repo Rate Decisions

The RBI takes its time checking inflation, growth, and liquidity before making any move on the repo rate. After the RBI review is done, the Monetary Policy Committee gathers for its discussion and works out the most sensible move for the rate.

Key Influencing Factors

● Inflation: If inflation runs ahead of the RBI’s comfort level, increasing the repo rate can help bring demand back to a manageable level

● GDP Growth: Slow growth may prompt a cut to encourage borrowing and investment. Strong growth combined with high inflation can lead to a hike

● Money Supply and Liquidity: Excess liquidity can push up prices, while a shortage of funds may slow credit. Repo rate changes help balance this

● Global Factors: Movements in global interest rates, oil prices, or currency trends can affect inflation and capital flows

Understanding Repo Rate Helps You Borrow Smarter

Since banks follow the repo rate while setting their own rates, any shift in it usually shows up in the interest you pay and the EMI you end up with. Watching how it moves can help you make smarter choices and keep your monthly payments under control.

Hero FinCorp has loan options designed for varied financial needs. You can apply through a simple online form, see your eligibility quickly, and choose a repayment plan that fits your circumstances.

Explore your loan options with Hero Fincorp's personal loan eligibility calculator today.

Also Read: Reverse Repo Rate: Meaning and How It Works?

Frequently Asked Questions

1. What is the full form of repo rate?

Repo rate is short for Repurchase Rate. It is the interest the RBI applies when banks borrow money for a short period by pledging government securities.

2. How does repo rate impact home loan interest rates?

If the repo rate rises, banks face a higher cost of funds, and home loan rates normally move up with it, increasing EMIs. When the rate is reduced, interest rates tend to soften, and EMIs become lighter.

3. Why does RBI increase or decrease the repo rate?

The RBI changes the repo rate to keep inflation in check and ensure there is enough liquidity in the banking system.

4. How often does RBI change the repo rate?

At its meetings, the Monetary Policy Committee goes over the economy’s condition. If it sees a reason, it can move the repo rate up or down.

5. What is the difference between repo rate and bank rate?

The repo rate applies to short-term funds given against securities. The bank rate applies to long-term funds without collateral.

6. How does repo rate affect fixed deposit interest rates?

When the repo rate rises, banks may offer higher fixed deposit rates. When it falls, deposit rates often come down.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.