What is a Tradeline in a Credit Report?

Trying to understand your credit report? Start with this question - What is a credit tradeline? Each loan or credit application creates a tradeline on your credit report, which ultimately affects your loan eligibility and creditworthiness.

If you are wondering what factors build and improve your credit score, this is where you start your journey.

In this blog, you will learn about tradelines, how they impact your credit score, what they include, and how you can check and monitor your tradelines.

What is a Tradeline?

Think of your credit report as a ledger that records all your loans (home, personal, car, etc.). In this report, a tradeline represents each active loan or credit account that you have. Each tradeline provides details of that specific loan/credit (referred to as "account"), like total amount, interest, etc.

Credit bureaus such as CIBIL, Experian, and Equifax in India compile your tradelines to assess your financial reliability. It helps them understand your creditworthiness, as they impact your overall credit profile and future borrowing ability.

What Does a Tradeline Include?

A tradeline on your credit report includes the following information about your loan/credit and your payment patterns -

- Lender's name and account type (credit card, loan, mortgage, etc.)

- Payment history (payment schedule, defaults, and delinquencies)

- Credit limit on the account

- Current balance

- Account status – open, closed, or transferred

- Opening and closing date

Consistent, on-time payments create positive tradeline entries that help your credit evaluation. Negative entries (like defaults) are risk signals that may reduce your credit score.

Types of Tradelines Explained

There are two major types of tradelines you should know about -

- Revolving Tradelines - These refer to accounts, such as credit cards, that have a credit limit but whose balances fluctuate with your spending. The key term here is Credit Utilisation (the amount you owe vs. your credit limit) - CU under 30% boosts your score.

- Instalment Tradelines - These include all your loans. They have a fixed amount that you repay in EMIs over a few months or years, until the remaining balance is zero. Managing these repayments well boosts your score.

- Other Tradelines - Utility bill payments and rental histories are sometimes considered tradelines (though less common).

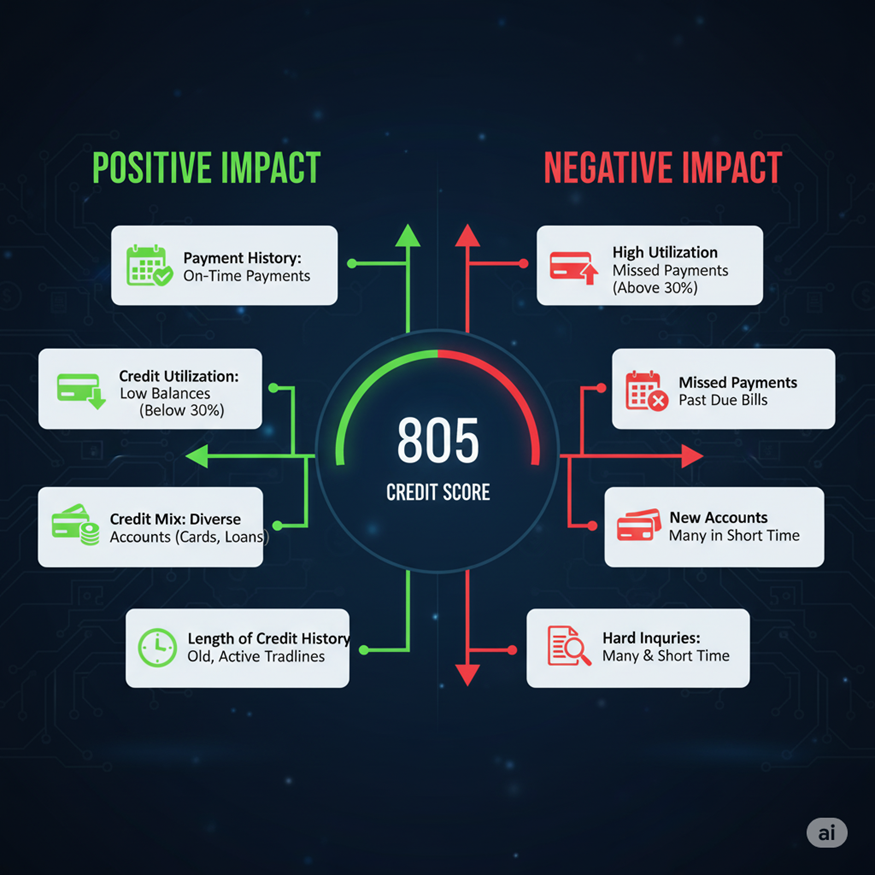

The Tradeline Credit Score Impact

Your credit score is determined by credit bureaus after they assess and analyse your tradeline details. The key factors they consider are -

- Payment history

- Account age

- Type mix

- Utilization

Timely repayments, low utilisation, and a healthy account mix create positive tradelines that improve your credit score. Your loan approvals are quicker, and you get better interest rates. Poor tradeline management (defaults, late payments, and maxed-out accounts) lowers your score, leading to costlier loans.

How to Check and Monitor Tradelines on Your Credit Report

The CIBIL, Experian, or Equifax offer free reports that you can easily access and download for free or pay for a more detailed version. All you need to do is locate the "Account Information" section to view all your tradelines.

You can inspect the tradelines for accuracy, spot any anomalous tradelines, and monitor them regularly for changes. It is important to address any errors to protect your creditworthiness promptly.

How Long Do Tradelines Stay on Your Credit Report?

Your tradelines remain active for as long as your account is open. Closed accounts (whether positive or negative) stay for about 7 to 10 years on your report as per the retention policies of Indian credit bureaus. If you maintain good credit habits, the negative impact of bad tradelines will slowly diminish, gradually improving your score.

Handy Tips to Manage Tradelines Responsibly

Tradelines have a significant impact on your credit score. To improve your creditworthiness, here are a few tips to follow -

- Make sure to pay all bills and EMIs on time.

- Keep the credit card utilisation rates low.

- Maintain a good mix of credit types.

- Regularly check your credit report for anomalies or mistakes.

- Dispute incorrect tradelines immediately for correction.

- Don't suddenly open or close multiple credit accounts.

Improve Your Credit with Hero FinCorp

Understanding tradelines is the first step to managing your credit health and borrowing opportunities better. It allows you to make smart financial choices and strengthen future loan approvals.

All leading lenders like Hero FinCorp value responsible credit behaviour for quick approvals and near-instant disbursement. Hero Fincorp's offerings include instant personal loans, business loan apps, and more. Visit Hero Fincorp to get your credit score checked today.

Frequently Asked Questions

1. What is the difference between a tradeline and a credit report?

A tradeline is one account entry in your credit report, whereas a credit report comprises of many tradeline entries.

2. How do authorised user tradelines affect credit?

Authorised user tradelines add the primary account holder's financial behaviour (good or bad) to the authorised user's credit report, thus impacting the credit score.

3. Can I add tradelines to improve my credit score legally?

Yes, you can legally improve your credit score with new credit accounts and timely payments.

4. What should I do if I find an unknown tradeline on my report?

You should report it to the bureau as soon as you discover it and monitor the tradeline for suspicious changes.

5. Is it safe to remove negative tradelines from my report?

Yes, if the negative tradeline is erroneous. If not, then focus on good financial habits to improve your score.

6. Does applying for a new credit create a tradeline immediately?

Yes, once your application is approved, your new account will display as a tradeline on your credit report.