UPI ATM, UPI Lite & Tap-To-Pay: Using The Newest UPI Features Safely During Emergencies (Limits, Fees, Dispute Tips)

Have you ever stopped for lunch on the highway only to hear, “Sorry, no cards”? Carrying wads of cash isn’t safe, and ATMs aren’t always nearby.

While UPI apps can be a lifesaver, there are network issues and safety concerns. To access funds and make payments effectively, National Payments Corporation of India (NPCI) has released UPI ATM, UPI Lite, and Tap-to-Pay. UPI stands for Unified Payments Interface, a digital payments system supported by banks across India. Introducing UPI features like UPI ATM and Tap-to-Pay enhances digital payments, and these features are supported by major banks and robust financial infrastructure.

That said, you need to know what you’re doing. Here’s a breakdown on what these features are, their limits, and how to use them safely. These new features are part of ongoing efforts to support and expand digital payments in India.

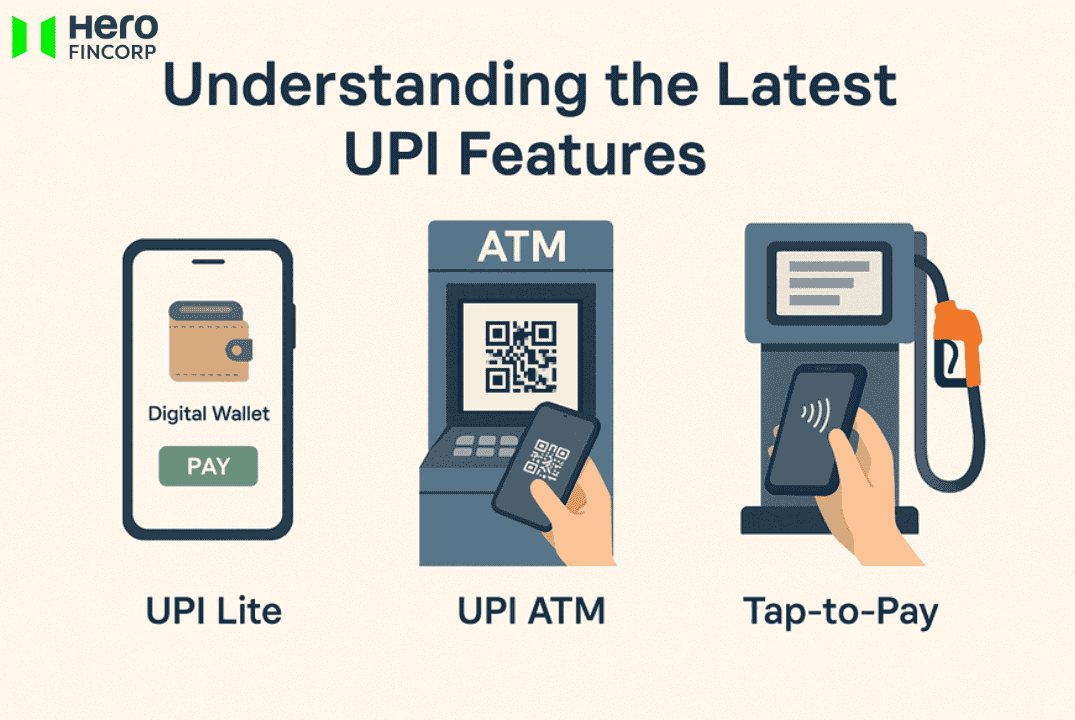

Understanding the Latest UPI Features

UPI apps have released three new features to help you through situations like no-network zones and card-free payment. UPI applications and UPI enabled apps allow users to perform financial transactions securely using their mobile phone.

Here’s all you need to know, right from features to processing fees.

UPI ATM: Cash Without a Card

UPI ATMs let you withdraw cash directly using your UPI app, no card needed. You simply scan a QR code displayed on the ATM screen and approve the transaction in your UPI app. UPI ATM transactions, also known as UPI cash withdrawal, allow users to withdraw cash without a card, and these transactions are supported by third party application providers and banks. Users can use their UPI ID and mobile number to authorize money transfer and cash withdrawal at ATMs. Users can also link multiple bank accounts to a single UPI application, making it easier to manage funds and perform transactions. Each user account is protected, and UPI transactions are processed in real time for added security. UPI enabled apps and third party application providers play a role in expanding access to UPI ATM transactions. Perfect for moments when your wallet isn’t handy.

Key features

• Withdraw cash using QR code scan

• Works with most UPI-enabled bank apps

• Instant debit from a linked bank account

Limit -Up to ₹10,000 per transaction

Charges & fees - Existing bank’s ATM withdrawal limits and fees will still apply.

Ideal for - Your debit card is missing, expired, or declined.

Read Also: A Simple Guide to Scanning and Paying with QR Codes via Mobile Banking

UPI Lite: Quick Small Payments Without PIN

Want to carry digital cash for everyday emergencies? UPI Lite is designed for that. It lets you store a small balance on your phone so you can make payments instantly, even offline, without entering your UPI PIN each time. UPI Lite uses an on device wallet, also known as a UPI Lite account, which allows users to make low value transactions even in offline mode. Super handy in urgent situations.

Key features

• Works for payments under ₹500

• Transactions don’t require UPI PIN

• Works offline once the wallet has a balance

• Users can load their UPI Lite account with a maximum amount up to the upper limit set by the system

Limit -Maximum ₹1,000 per transaction and a wallet balance of ₹5,000. The maximum amount per transaction and the upper limit for the wallet balance are designed to support frequent low value transactions.

Charges & fees - No transaction or processing fee

Ideal for - Paying for quick payments like for cab rides, grocery trips, or medicines in a hurry. UPI Lite is especially useful for low value transactions when network connectivity is unavailable.

Also Read -UPI Lite vs UPI: Full comparison for Indian Users

Tap-to-Pay with UPI: Just Tap, Pay & Go

If your phone supports NFC, you can use Tap-to-Pay at enabled machines. Just hold your phone close, approve, and done. Many Android devices and Google Pay support Tap-to-Pay with UPI, making it accessible to a wide range of users. Taking out the need for QR codes keeps things quick, perfect for petrol pumps or busy counters.

Key features

• Works on NFC-enabled phones and UPI apps

• No scanning required, faster than QR

• Secure with phone and UPI app lock

Limit - Up to ₹500 if through the LITE account, and the existing daily UPI transaction limit for standard bank accounts

Charges & fees - Free for bank transfers, chargeable for bill payments

Ideal for - You need speed at billing counters or transit.

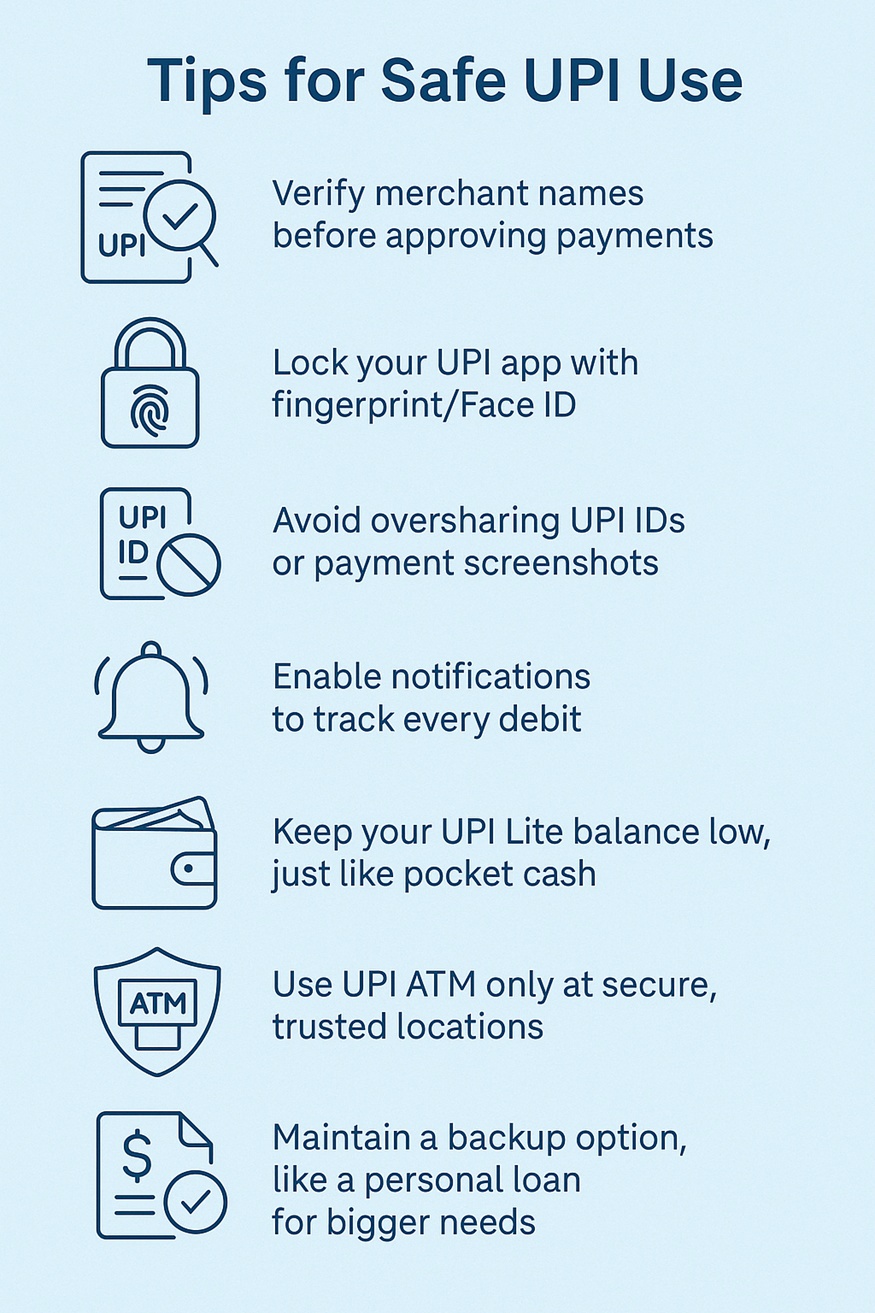

7 Key Tips to Make the Most of UPI Features Safely

Using UPI is convenient, and all these new features give you a lot of flexibility. But keeping it safe and secure is more than just minding the limits and fees. Customers should be aware of security features when they send money, request payments, transfer money, or handle refunds. Here’s how you can stay protected with UPI -

• Verify merchant names before approving payments.

• Lock your UPI app with fingerprint/Face ID to limit access to intruders.

• Avoid oversharing UPI IDs or payment screenshots.

• Enable notifications to track every debit and catch unauthorised transactions instantly

• Keep your UPI LITE balance low, just like pocket cash.

• Use UPI ATM only at secure, trusted locations.

• Maintain a backup option, like a personal loan for bigger needs.

• Use UPI Autopay and recurring payments safely, and regularly monitor all financial transactions for unauthorized activity.

• New customers should verify their identity and set up secure authentication before using UPI features.

Note - Your UPI spending creates a digital footprint. Lenders analyse this data to capture financial behavioural insights such as spending frequency, reliability, categories, recurring payments, transfer money activities, and other financial transactions. These patterns then feed into your credit profile, influencing how lenders assess your creditworthiness beyond traditional credit history.

So spend judiciously to maintain a healthy credit report. This will help you get faster loan approvals in situations when you need quick access to funds.

Also Read -UPI Spending Patterns & Your Credit Profile—A Hidden Link

Keep Every Transaction Secure and Successful

UPI’s new features make emergencies easier to handle. UPI ATM, UPI Lite, and Tap-to-Pay help overcome network issues and keep sensitive information private.

But when bigger expenses arise, you need more than just convenience. A personal loan is a viable credit option to meet financial emergencies. Plus, instant personal loans, quick approvals, and flexible repayment options help you prepare for the unexpected without having to wait long.

Want to stay ahead of life’s surprises? Use Hero FinCorp’s eligibility checker to see how much you qualify for and apply for your personal loan today!

Frequently Asked Questions

1. Is the UPI ATM available everywhere?

No. It’s still expanding. Check your bank app for enabled locations.

2. Can UPI Lite work without internet?

Yes. As long as you’ve preloaded the wallet, you can pay offline.

3. What if a Tap-to-Pay transaction fails?

You’ll get an auto-refund within five working days. Refunds for failed UPI transactions are processed automatically to your user account.

4. Are there hidden charges?

UPI features are free to use and come with daily limits. While there are no hidden charges, regular ATM withdrawal and processing fees apply.

5. Can I use the BHIM app or BHIM UPI for international payments?

Yes, the BHIM app supports international UPI transactions in select countries. Check the app for the latest list of supported countries and details.

6. How do I link multiple bank accounts to my user account and get a UPI ID?

In your UPI app, you can add multiple bank accounts to your user account by following the on-screen instructions. Once linked, you can generate a unique UPI ID (also called a Virtual Payment Address) for seamless payments and manage all your accounts securely within the app.

7. Where can I see my UPI transactions history?

You can view your UPI transactions history in the app by navigating to the 'Transaction History' or 'Passbook' section. This will show all your recent UPI transactions linked to your user account.