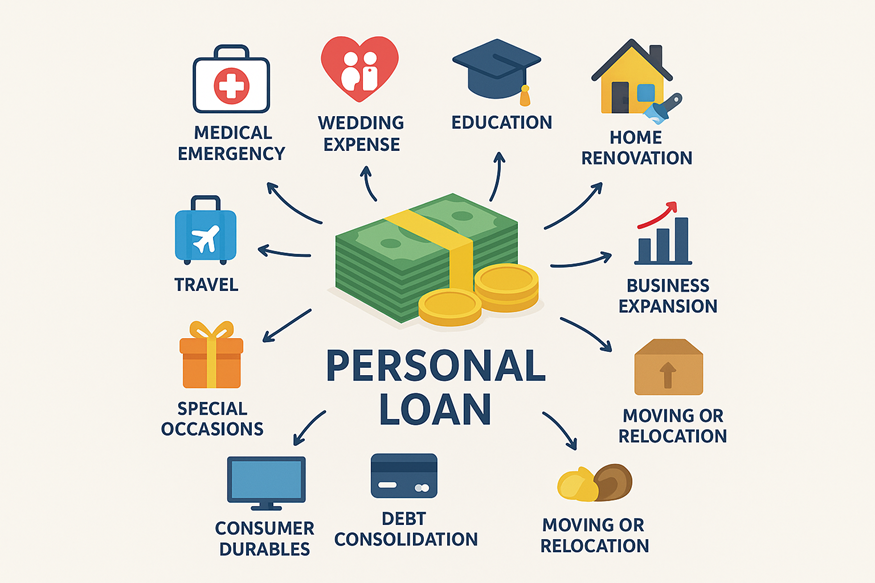

List of 10 Personal Loan Uses

A personal loan isn’t just quick cash; it’s financial breathing space. It is one of the most flexible forms of credit available today. It’s unsecured and easy to get. No collateral, no long queues. Plus, with the rise of digital platforms, applying for a personal loan in India is as easy as ABC!

Most importantly, it is truly multipurpose and versatile. You can use the funds for any of your needs. The personal loan uses vary depending on your needs, whether it’s a hospital bill, a dream wedding, or home repairs. Let’s revisit a few common ones.

Common Uses of Personal Loans in India

From emergencies to dreams, personal loans fit almost every need. Let’s look at some common personal loan uses in India.

Personal Loan for Medical Emergency

Health issues can crop up at any time. That’s when a personal loan swoops in to save the day. Sure, your insurance may cover basic costs. But when you’re looking at room upgrades, ambulance charges, or post-care expenses, a lot would come out of your pocket.

A personal loan for a medical emergency covers these expenses. With quick approvals and direct fund disbursements to your account, you receive immediate help when you need it most.

Personal Loan for Wedding Expenses

In India, weddings are a coming together of families. They’re a celebration of culture involving various rituals and ceremonies.

All of this can quickly turn expensive. Fortunately, a personal loan for a wedding takes the stress out of wedding planning (and financing). It lets you celebrate your special day the way you always imagined, without affecting your savings!

Personal Loan for Education

The cost of education has increased by 4.6 times between 2012 and 2024. This trend highlights the ramped-up costs.

Parents are finding it tougher to manage tuition fees, hostel expenses, exam prep classes, hobby classes, and other educational and extracurricular costs. But they don’t want to give up either. A personal loan for education supplements these expenses to secure your child’s future.

Also Read: How Can I Get Education Loan: A Complete Guide

Personal Loan for Home Renovation

Every home needs an occasional upgrade. It could be as fundamental as painting, plumbing, electrical, or furnishing. Or it could be a surface-level aesthetic makeover reflecting your Pinterest moodboard.

Either way, a personal loan for home renovation makes your dream home a reality. Many borrowers also use it to boost property value before resale.

Personal Loan for Consumer Durables

That new refrigerator, washing machine, or smart TV isn’t just a want; it’s often a need. But it’s not always possible to pay for everything up front. A personal loan for consumer durables lets you upgrade your home without waiting for Diwali discounts or year-end bonuses. You buy what you need now, and repay in easy, steady EMIs.

Wondering how to calculate your EMIs in advance? Use Hero FinCorp’s Personal Loan EMI Calculator to estimate your payments and make informed decisions with ease!

Personal Loan for Travel

We all love planning trips in our heads, but the crushing reality of finances holds one back. Well, you can use a personal loan for travel and finally kickstart your dream vacation.

Whether it’s a solo travel to a foreign destination or a family trip, a personal loan may cover everything. You can even spread repayments over comfortable EMIs, making travel memories stress-free.

Personal Loan for Special Occasions

Sure, every living moment is a celebration. But some deserve a little extra sparkle. We’re talking birthdays, anniversaries, or milestone celebrations. When these arrive, a personal loan for occasions allows you to celebrate without financial strain. Plan your event, set a budget, and repay gradually.

Personal Loan for Business Expansion

For small business owners, opportunity often comes without warning. Maybe a big order lands, or your café is suddenly packed every evening. A personal loan for business expansion helps you seize that moment. It’s quick, flexible, and more accessible than traditional business loans. In short, it helps dreams grow faster.

Personal Loan for Moving or Relocation

Relocating to a new city can be exciting, but it also drains your wallet faster than you expect. Movers, rent deposits, furniture, everything adds up. A personal loan for relocation cushions that transition. It helps you move comfortably, without feeling like every rupee needs to be stretched because a new beginning shouldn’t start with financial stress.

Download our Instant Loan App and apply for your loan today!

Borrow Smart, Build Strong Credit with Personal Loans

Don’t treat a personal loan as a last resort. From the personal loan uses above, it is clearly a practical choice for when life changes suddenly or when dreams simply can’t wait. What matters most is using it wisely and repaying on time.

With Hero FinCorp’s Instant Personal Loan App, the entire process from application to approval, disbursal, and repayment is effortless. Download now and take the next step toward your goals!

Also Read: Personal Loan Insurance: Everything You Should Know

Frequently Asked Questions

1. Can I use a personal loan for multiple purposes simultaneously?

Yes. Personal loans are multipurpose. Use them for any and all your needs.

2. How quickly can I get funds for a medical emergency?

With digital apps like Hero FinCorp, approval can happen within hours, and funds often reach you within 24-48 hours.

3. Are personal loans for weddings taxable?

No, since loans are liabilities and not income, they aren’t taxable.

4. Is a guarantor required for a personal loan in India?

No, since personal loans are unsecured, it does not require any guarantor or collateral.