What is Personal Loan Prepayment & How is it Calculated?

A personal loan is a versatile form of credit. Whether you need to fund your child’s education or pay your parents’ hospital bills, it can help in every situation. No wonder over 67% of Indians rely on it for financial emergencies.

But here’s the catch. Such short-term loans often carry high interest rates, sometimes shooting up to 24% p.a. So, many borrowers prepay their personal loans to save on interest.

But is personal loan prepayment a smart financial move? Read this blog as we discuss this and let you in on some expert personal loan prepayment advice.

What is Personal Loan Prepayment?

Personal loan prepayment refers to paying off a personal loan before its tenure expires.

So, let’s say you took a personal loan of ₹5 lakhs for your brother’s wedding. Your agreed rate of interest and loan tenure were 18% p.a. and 36 months, respectively. But after paying a few EMIs (say, 12), you decide to repay the outstanding loan amount in a lump sum before the tenure ends. This is called personal loan prepayment.

There are two types of prepayment options.

- Partial loan prepayment - When you repay a significant chunk of the outstanding personal loan amount, it’s called partial loan prepayment. It either shortens your loan tenure or reduces your monthly EMIs.

- Full loan prepayment - When you repay the entire outstanding personal loan amount in one go, it’s called full loan prepayment or loan foreclosure. It permanently closes your loan account.

Get quick funds without any hassle. Check out our Instant Loan App today!

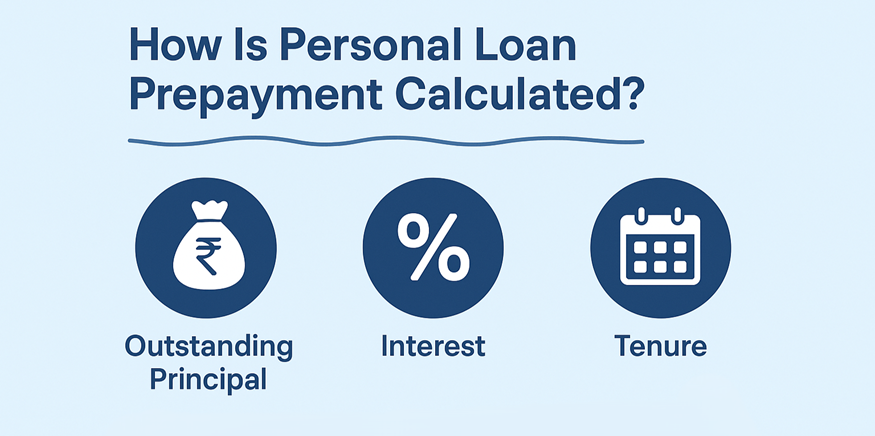

How Is Personal Loan Prepayment Calculated?

For personal loan prepayment calculation, lenders consider three key components:

- Outstanding Principal - The portion of your loan you haven’t repaid yet

- Interest - The amount you would have paid if you kept the loan for the original term

- Tenure - The number of months remaining until the loan is fully repaid

Formula Breakdown and Example

For Partial Prepayment

Partial Prepayment Amount = Chosen Principal Portion + Prepayment Charges on that Portion

For Full Prepayment (Foreclosure)

Prepayment amount = Outstanding Principal + Prepayment Charges

Let’s continue with our previous example

- Loan amount - ₹5 lakhs

- Interest rate - 18% p.a

- Loan tenure - 36 months

- EMIs paid - 12

- Outstanding loan principal - ₹3,40,000 (approx, calculated using the reducing balance method). You can find yours here.

To calculate the prepayment amount -

Step 1 - Ascertain Prepayment Charges

Suppose your lender charges 3% of the outstanding principal as a prepayment fee. Therefore,

3,40,000 x 3% = ₹10,200

Step 2 - Add Prepayment Charges to Principal Outsourcing

Adding the prepayment fee to the remaining principal gives:

3,40,000 + 10,200 = ₹3,50,200

So, if you pay ₹3,50,200, you'll close the loan and avoid paying all the extra interest for the next 24 months.

Note: Prepayment charges and exact interest saved may vary depending on your lender and EMI structure.

Tools for Personal Loan Prepayment Calculation

Various online tools can help you calculate personal loan prepayment amount and charges. Two of the best ones you can use for free are:

● Hero FinCorp Personal Loan Part Payment Calculator (for partial personal loan payment calculation)

● Hero FinCorp Personal Loan Foreclosure Calculator (for full personal loan payment calculation)

Prepayment Clauses and Charges in Personal Loans

Every bank and NBFC has prepayment clauses that define the conditions under which you can prepay your personal loan. Some crucial ones are:

- Lock-in Period: Some lenders don’t let borrowers prepay a loan until a certain lock-in period is over, typically between 6 and 12 months.

- Prepayment Penalties: Some banks and NBFCs charge a penalty for loan prepayment. It is either a percentage of the total outstanding loan amount or a flat fee.

- Partial Pre-payment Restrictions: Sometimes, lenders don’t allow partial loan prepayments. If you want to prepay your loan, you have to do it in full.

Also Read: Closing Your Loan Account? Do These Things First

Personal Loan Prepayment Charges

Most lenders charge personal loan prepayment charges when you prepay a personal loan, either in part or in full. It varies from lender to lender, but typically, the range in India is between 2-6% of the principal outstanding.

At Hero FinCorp, we don’t charge any fee for personal loan prepayments of up to ₹20,000, whether partial or full. For amounts above this, the following prepayment charges apply.

| Loan Amount | Prepayment Charges |

|---|---|

| Up to ₹20,000 | Nil |

| ₹20,000 to ₹1,00,000 | 4% of the outstanding principal + 18% GST |

| ₹1,00,000 and above | 4% of the outstanding principal + 18% GST |

Disclaimer - Prepayment terms and conditions for personal loans vary by lender. Always check with your lender before making a prepayment.

Benefits of Prepaying Your Personal Loan Early

There are various benefits of personal loan prepayment. For instance:

- Interest Costs: The main reason why borrowers opt for personal loan prepayment is that it saves them interest costs.

- Lowers Debt Burden: If you repay your loan amount in full, it closes your loan account. This reduces financial strain and helps you pay off debt faster.

- Improves Credit Score: One of the key benefits of personal loan prepayment is that it improves your credit score. It shows you’re a responsible borrower.

Drawbacks and Considerations Before Opting for Prepayment

Just the benefits, there are also certain disadvantages of personal loan prepayment, such as:

- Prepayment Penalties and Fees: One of the biggest personal loan prepayment cons is that lenders often charge a penalty for it. This sometimes defeats the purpose of interest savings.

- Liquidity Issues: Prepaying a personal loan means exhausting your liquid assets. So, you must plan mindfully to avoid financial emergencies.

- Opportunity Costs: When you prepay a personal loan, the money you use to clear the outstanding principal is locked into the loan repayment. So you can’t invest that same amount elsewhere, where it could potentially earn higher returns.

To Prepay, or Not to Prepay - That is the Question

Beyond clearing debt early, deciding whether to prepay your personal loan is also about smart financial planning.

Personal loan prepayment can save you interest and improve your credit score. Weigh the fees, consider your cash flow, and explore other potential ways to use that money. If you take your time and work with a good lender, you can get the most out of prepayment and minimise any drawbacks.

Ready to take charge of your loan journey? Apply for a personal loan with Hero FinCorp today and choose a plan that works for you.

Frequently Asked Questions

1. What Is the Difference Between Prepayment and Loan Foreclosure?

Prepayment usually refers to paying a part of your remaining loan amount early. Foreclosure means paying the entire remaining loan amount before the original end date.

2. Is Prepayment Allowed for All Personal Loans in India?

No. Personal loan prepayment policies vary from lender to lender.

3. Are There Any Tax Benefits Lost After Prepayment?

Yes, you might lose some tax benefits, especially for home loans and education loans, where the interest you pay can be deducted from your taxes.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.