Instant Personal Loans for Side Hustlers—Boosting Income Streams Responsibly

Side hustlers may see orders flowing in for a week, while the next could bring them an emergency like a laptop repair, inventory maintenance, or late client payment. Some professionals may need startup finances to initiate a side hustle venture, too. Such incidents can require additional cash flow.

An instant personal loan isn't about borrowing more but about borrowing correctly. A small, short-term loan can help side-hustlers manage finances effectively.

Used judiciously with a clear intention, sensible EMI limit, and paperwork in place, an instant personal loan can fill gaps.

A personal loan allows side hustlers to begin a stress-free and well-informed journey. In this blog, we will see how!

Why Side Hustlers Choose an Instant Personal Loan

Handling a side hustle while keeping a full-time job means additional cash flow. A fast personal loan can cover gaps.

Here are some key reasons why side hustlers may need to apply for an instant loan:

- Purchase materials up front and pay back after the client clears the payment.

- Replace or repair a device like a laptop, on which their part-time income depends.

- Upskilling with clear ROI, for example, paying for short courses or certifications.

- Paying off multiple small dues with one structured EMI.

Advantages of Personal Loans for Side Hustlers

Applying for a personal loan online is a swift, transparent, and mobile-first process. Here are some reasons why side hustlers a personal loan to apply for funds:

- Eligibility & Web Application - Take the online personal loan path to check eligibility and understand documents before applying.

- Quick Disbursal - With a personal loan, side hustlers do not have to wait long before they get their loan, which can be beneficial in case of emergencies.

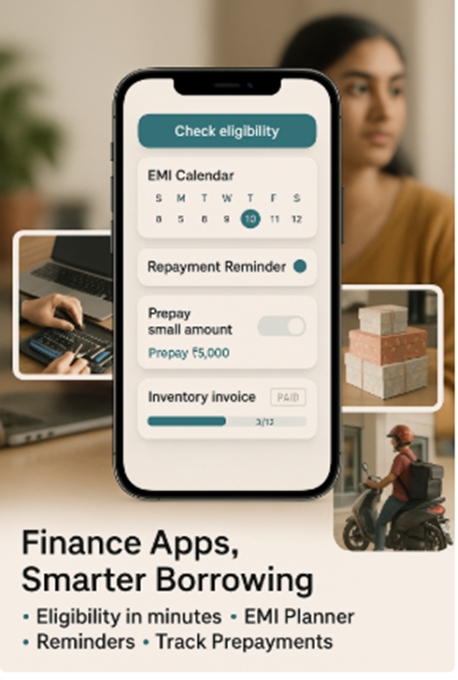

- On Android/iOS - Enjoy app-signup, install the android instant loan app to track steps, upload documents, and manage EMIs in your hands. Use the iOS loan app for the same experience on iPhone.

- Flexible Tenure - Unpredictable cash flow is easier to manage when repayment can be spread out, aligning with both your budget and long-term plans.

- Need Quicker Phone-Based Handling - Side hustlers tend to prefer a quick loan process so that they have it all, KYC to EMI planners, in one.

Also Read: can i get an instant loan online

The Borrowing Mantra for a Financial Multitasker

Here are some basic borrowing rules that every side hustler must obey:

Rule 1 - Pay First

Plan EMIs soon after salary credit to prevent month-end accumulations. To limit exposure, it is essential to have a clear EMI limit that suits their net salary, rather than relying on parallel loans.

Rule 2 - Proof Ready

Always have PAN, Aadhaar, bank statements, and salary slips or income proofs readily available.

Note: Hero FinCorp's personal loan is a fully digital, paperless process that requires no physical documentation

Rule 3 - Buffers Matter

Maintain a small buffer fund so a bad month doesn't put your EMI at risk. It is recommended to keep repayment or budget reminders on while turning off promotional nudges.

Rule 4 - Tenure with Intention

Choose a tenure that balances overall interest against hassle-free monthly expense.

Eligibility - What Helps a Side Hustler

- Sustained bank inflows – They should be able to demonstrate regular income, along with consistent side income evidence.

- Responsible credit behaviour – Credit history matters. Showcase on-time payments and stable credit utilisation.

- Debt-to-Income - Keep total EMIs within a tolerable percentage of the gross salary.

- Current employment & stability - Longer and stable tenures are viewed favourably.

- Serviceable location & primary KYC - Keep PAN, Aadhaar, address proof, bank statements, and salary slips handy. If your side income is not reflected in bank statements, start making payments online and label references clearly.

Plan the EMI Like a Pro

- Take what your next 6–12 months can comfortably pay.

- Plan EMI due dates a week or two after salary credit.

- Reduce misses and keep repayment reminders on.

- Recalculate if income boost and pay off low amounts early to save on total interest.

- Track all dues in the app to avoid piling multiple short-term loans.

Ensuring Easy Cashflow for Side Hustlers

For side hustlers, getting emergency funds from instant loan apps has become a measured cash-flow tool where they can check loan eligibility in minutes, and see EMI–tenure trade-offs before applying. All they need is to upload documents securely, set autopay and repayment reminders, and track prepayments when a good month lands.

Check your eligibility and embark on your personal loan journey with Hero FinCorp. Many multitaskers use their app to keep EMIs, reminders, and documents in one place and on schedule.

Frequently Asked Questions

Can I apply for a loan if I have irregular side income?

Yes, you can apply for a loan if your overall cash inflows and job are consistent enough to support the EMI. Clear banking records and timely payments of bills are an added advantage.

What does a side hustler require to apply for a quick personal loan?

PAN, Aadhaar, address proof, bank statements, and recent salary slips/income proof speed up the process.

Should side hustlers take a longer or shorter loan tenure?

Short tenures lower overall interest but raise the EMI. If your cash availability each month is uncertain, a slightly longer tenure with some prepayments can strike a balance between comfort and cost.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.