How to Improve Credit Score in 30 Days?

Many people only think about their credit score when a loan gets costlier than expected or an urgent approval suddenly slows down. It’s a stressful moment, because your score feels like a silent judge you never got a chance to prepare for.

But the truth is reassuring. Improving your CIBIL score doesn’t require drastic changes. Small, thoughtful corrections made consistently over the next 30 days can help lenders see you as a more reliable borrower.

In this guide, we break down simple, practical steps you can take this month to strengthen your score and build long-term financial confidence.

What Is a CIBIL Score and Why Does It Matter?

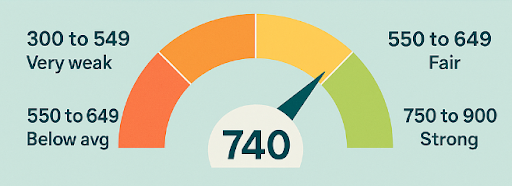

Your CIBIL score is a three-digit number between 300 and 900. It summarises how you handle loans and credit cards. Many users search for how to create a CIBIL score only after facing rejection.

Here is the usual range lenders see on reports.

- 300 to 549 - Very weak profile, high perceived risk

- 550 to 649 - Below average, approvals difficult, higher interest payable

- 650 to 749 - Fair profile, decent chance with some conditions

- 750 to 900 - Strong profile, smoother approvals, and better terms

A higher score can unlock faster approvals and more attractive rates. It also helps when you negotiate limits or tenures. Banks and NBFCs prefer people who show steady discipline.

Key factors affecting CIBIL score include -

- Payment history and whether EMIs are paid on time

- Credit utilisation across cards compared with total limits

- Mix of unsecured and secured products in your portfolio

- Length of your overall credit tenure and the oldest account

- Recent hard enquiries when you apply for fresh credit

Quick Ways to Improve Credit Score in 30 Days

A focused month can nudge your score upward. Use these steps as your simple plan when thinking about how to improve your credit score in 30 days.

Step 1: Pay Off High Credit Card Balances

Bring utilisation below 30% of your total limit. Lenders like measured use rather than maxed-out cards. Even one large part payment this month can improve your profile.

Step 2: Become an Authorised User on a Trusted Card

Join a disciplined family member’s long-standing card with low utilisation. Their strong history supports your report. This can help to improve the CIBIL score immediately, if managed carefully.

Step 3: Set Automatic Bill Payments

Switch EMIs and card bills to auto debit from your salary account. This prevents accidental delays. On-time payments across thirty days signal responsible behaviour to lenders.

Step 4: Use Cards for Small Purchases, Then Clear in Full

Make routine spending like groceries or fuel on your card. Pay the entire amount before the due date. This shows active yet controlled usage and can increase the CIBIL score quickly.

Step 5: Avoid Fresh Loans or New Credit Applications

Pause new cards, BNPL offers, or loan enquiries this month. Each hard enquiry slightly pulls down your score. Let your existing accounts tell a stable story for now.

Step 6: Dispute and Fix Errors on Your Credit Report

Download your latest CIBIL report and scan each entry. If you spot wrong limits, closed loans, or overdue tags, raise a dispute immediately. Correct data supports how to improve the CIBIL score quickly.

Step 7: Explore Available “Credit Boost” Services in India

Some platforms let you add regular payments like rent or utilities to reports. Use only trusted names linked with bureaus. Read the terms carefully before opting in for any credit boost tool.

During this period, track your progress through your lender’s Personal Loan App if they offer score views. Responsible actions today support better terms on your next quick loan application.

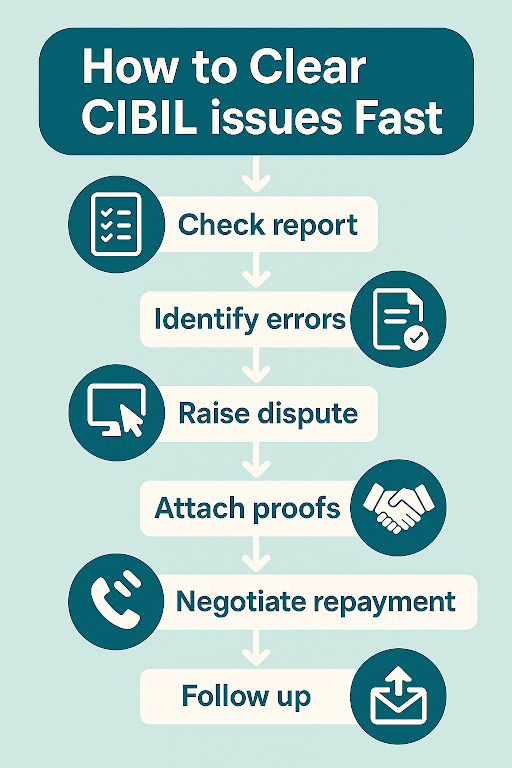

How to Clear CIBIL Issues and Negative Marks Fast?

Old defaults or disputed entries can slow your progress even with good current behaviour. Clearing these issues systematically supports recovery and future approvals.

Use this quick checklist when you want to know how to clear CIBIL issues efficiently and work on how to improve your credit score in 30 days at the same time:

Step 1: Download your full CIBIL report and highlight defaults or written-off accounts

Step 2: Match each negative entry with your own records and statements

Step 3: If the details look incorrect, raise an online dispute directly with CIBIL

Step 4: Attach bank proofs, closure letters, or payment screenshots wherever possible

Step 5: When the issue is genuinely overdue, contact the lender’s recovery or service team

Step 6: Negotiate a repayment plan or settlement based on your capacity

Step 7: After paying, collect a written confirmation of closure or settlement terms

Step 8: Follow up to ensure the lender updates CIBIL within the next reporting cycle

These actions support how to improve a credit score in 30 days, especially if large errors are corrected. Keep copies of every email and confirmation for future reference.

Tips to Increase CIBIL Score in One Day or Instantly — Myth vs Reality

Search results often promise how to increase the CIBIL score in one day. In reality, credit scores do not work like on or off switches. Bureaus update records in cycles after lenders share fresh data.

You can still take a few actions that support how to increase CIBIL score instantly in practical terms. Paying overdue EMIs, clearing card overlimit amounts, or fixing obvious errors today prepares your file for the next update.

Be careful of services that claim guaranteed overnight jumps for a fee. These offers can misuse your data or suggest risky behaviour. Focus on genuine steps you control rather than shortcuts that may harm your long-term profile.

Build a Stronger Credit Profile with Smart, Consistent Actions

Raising your score is not about tricks. It is about steady, responsible behaviour across all accounts. When you understand the bureau rules, you stop feeling anxious and start planning clearly.

If you plan a big purchase soon, start early. Use tools like Hero FinCorp’s personal loan eligibility calculator and credit education blogs to guide your decisions. Exploring the Personal Loan App or Instant Loan App can also help you track offers more comfortably.

Your improved score can open new doors. Explore Hero FinCorp’s personal loan offers and apply instantly for quick, transparent, and fully digital approvals.

Frequently Asked Questions

How often does CIBIL update scores?

Scores usually refresh whenever lenders send monthly data. Timing can vary slightly by institution and billing cycle.

Will closing a credit card improve my score?

Closing a healthy old card can reduce the total limit and history. This sometimes hurts utilisation and long-term depth.

Does loan prepayment increase score?

Prepaying can reduce future EMIs and total interest. The impact on the score depends on how other accounts and utilisations look.

How much can my score increase in 30 days?

Most users see modest improvement, not huge jumps. Cleaning errors and reducing utilisation can move the number in the right direction.

How to clear CIBIL issues fast?

Identify incorrect or overdue entries, then contact lenders and CIBIL together. Submit proofs, complete repayments, and track status until reports reflect changes.

Is becoming an authorised user safe?

Yes, if the primary holder pays on time and uses limits wisely. Avoid joining cards where spending is high or payments are irregular.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.