CIBIL Login & Registration Process for Individuals

What's the first thing that comes to your mind after hearing the word "credit report?" CIBIL score, right? Well, that's instinctive.

TransUnion CIBIL is arguably the most popular credit bureau in India. Over 100 million Indians use it to check their credit score.

However, if you're not a registered CIBIL member, you can't access more than one free credit report in a year. In short, you can't track your credit health without burning a hole in your pocket.

So in today's blog, let's learn how to create a CIBIL member login for individuals.

What is CIBIL Member Login?

A CIBIL Member Login is TransUnion CIBIL's online portal. It allows individuals to access and manage their credit information by entering their login credentials.

Once you register as a CIBIL login member, you can log in using your credentials to -

- Check your CIBIL score and credit report at any time.

- Monitor your credit health by tracking changes in your score or credit accounts.

- Spot and dispute errors if any incorrect information appears in your report.

- Get alerts or updates about your credit activity.

In short, the CIBIL Member Login gives you full control over your credit data, helping you stay informed, detect issues early, and maintain a strong credit profile.

Know your CIBIL score for free—calculate it here!

Step-by-Step CIBIL Registration Process for Individuals

The CIBIL login registration process for individuals is pretty straightforward. Here are the steps you need to follow -

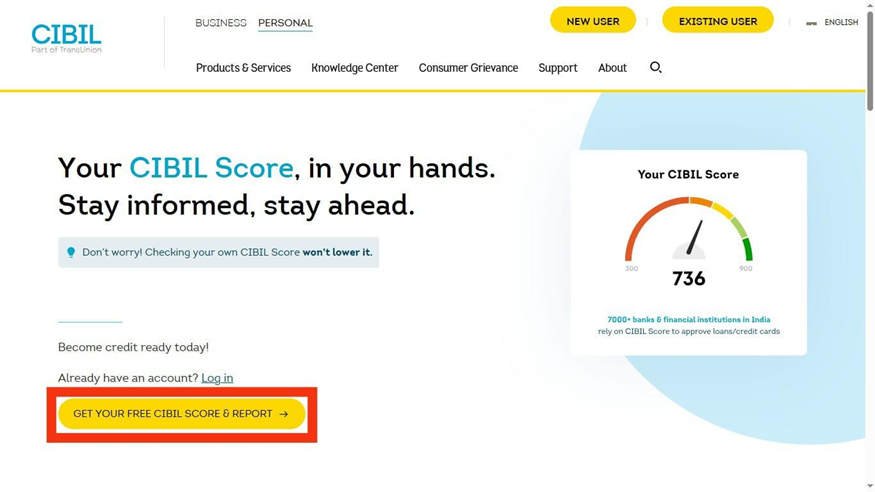

- Open the official website of CIBIL

- Navigate to the "Get Your Free CIBIL Score & Report" section and click on it

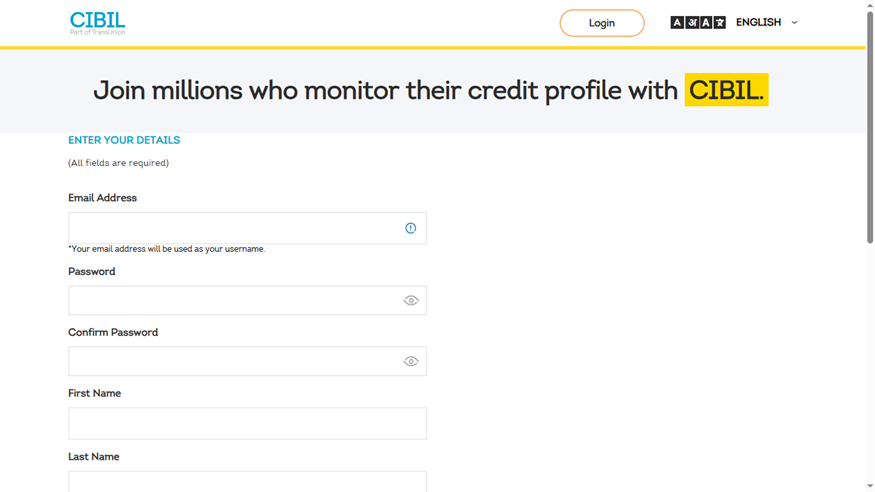

3. Once opened, enter your personal details such as your email ID, name, and date of birth, and tap on "Accept and Continue"

4. Once done, follow the next set of instructions to verify your identity

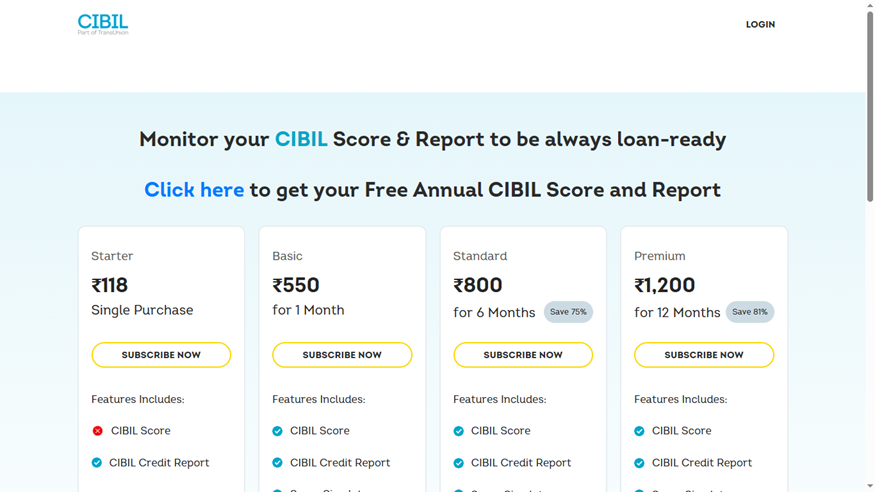

5. After this, you'll be asked to select a subscription plan

6. Once you choose your ideal plan, make the payment to successfully register with the site

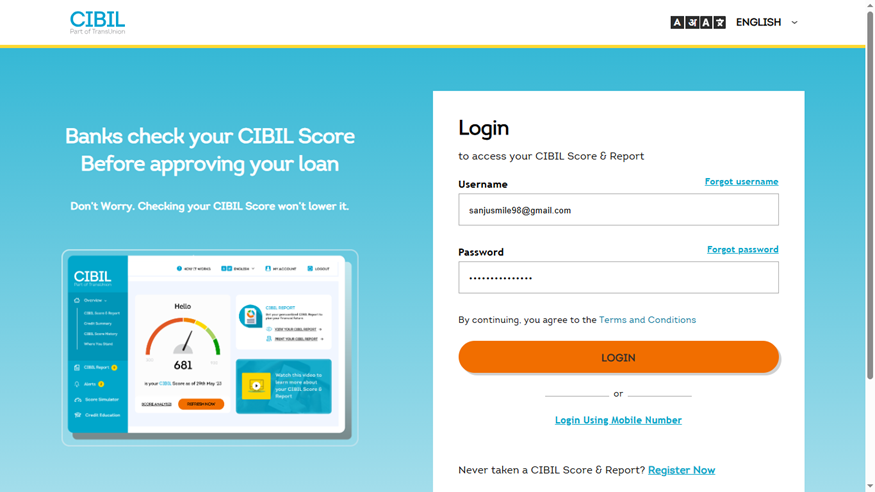

How to Perform a CIBIL Member Login?

Whether you're an existing CIBIL login member or have just registered, follow these steps to log in to your account -

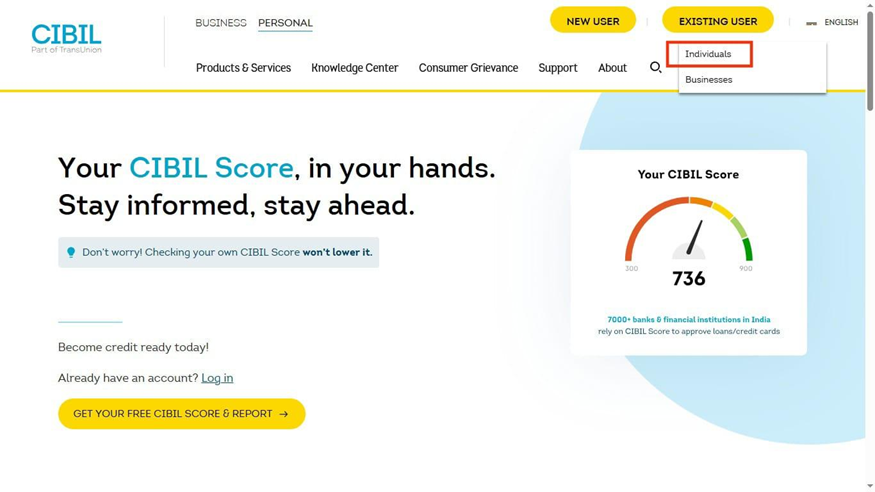

- Open the official website of CIBIL

- Navigate to the "Existing User" tab on the top right corner of the homepage and select the "Individuals" option. You'll be redirected to the login page

3. Once done, enter your username and password and click on "Login." Alternatively, you can also log in using your registered mobile number

KYC Documents Required for CIBIL Registration

When making a new CIBIL login registration, you'll be asked for a few documents for Know Your Customer (KYC) purposes.

Here's the list of the necessary CIBIL registration documents for individuals -

- Identity Proof: PAN card, Aadhaar card, voter ID card, passport, and driving license.

- Address Proof: Bank passbook, electricity bill, telephone bill, etc.

Also Read: How India's Credit Bureaus Are Adapting to AI & Real-Time Reporting

Benefits of Creating a CIBIL Account

Wondering if a CIBIL login registration is the best move? Here are some advantages you should consider -

- Instant Access to Credit Score: A CIBIL member login allows you to view your credit score and entire credit report anytime, anywhere. If you're not registered on the platform, you'll have to pay to access more than one credit report a year.

- Regular Credit Monitoring: With a CIBIL account, you can keep tabs on your credit health throughout the year. This has helped about 46% of people to improve their credit ranking.

- Early Error Detection: Thanks to a CIBIL account, you can always check and identify errors in your credit report. This helps raise a dispute and get the error fixed quickly.

- Timely Credit Alerts: CIBIL account holders receive alerts and notifications each time they near a due EMI. This helps avoid defaults and maintain a healthy credit score.

- Personalised Credit Insights: CIBIL sometimes gives insights or recommendations based on your credit data, helping you understand what impacts your score the most.

Get instant personal loans of up to ₹5 lakhs—try our Instant Loan App now!

How Hero FinCorp Supports Your Credit Journey

Your credit score plays a crucial role in shaping your financial future. Yet, many individuals struggle to maintain a healthy score due to limited awareness or financial setbacks. That's where Hero FinCorp steps in.

Hero FinCorp understands that every borrower's journey is different. Whether you're just starting to build your credit profile or working to improve your score, we make access to credit simpler and smarter. With over 11 million satisfied customers across India, Hero FinCorp has been helping people meet their financial goals through flexible, transparent, and quick loan solutions.

Remember, good credit isn't built overnight—it's built with consistent, responsible financial behaviour. Hero FinCorp makes that process easier, faster, and more accessible.

Take charge of your credit journey today! Apply for a personal loan with Hero FinCorp and start building a stronger financial future.

Frequently Asked Questions

1. Is CIBIL registration free for individuals?

Yes, CIBIL login registration is free for individuals. But you can only access one free credit report every year.

2. Can multiple users access the same CIBIL account?

No, multiple users can't access the same CIBIL member login.

3. What if I forget my CIBIL login username or password?

To recover your CIBIL login username or password, visit the official CIBIL website. For a forgotten password, tap on the "Forgot Password" link on the login page and follow the instructions to create a new one. For a forgotten username, tap on the "Forgot Username" link, enter your registered email ID and phone number to receive your username in the email.