Loan vs Bond: Know the Difference

Two people and a government are in need of money. Rohan wants ₹3 lakhs for their wedding. Mohit wants ₹50 crores to expand their business, and the government needs ₹10,000 crores for an infrastructure project.

Rohan's only option is to take a loan. Mohit can either take a loan or issue a bond. The government will definitely issue bonds to fund its project. But why can Rohan issue a bond, or the government simply take a loan?

The answer lies in the differences between these two financial instruments, and that is what this blog is all about. It will explain what these products are, and who can use them, along with the advantages and disadvantages of each.

Loan vs Bond - Key Differences Explained

Loans and bonds are both means of borrowing funds, in which one receives the funds they need now and repays them with interest over time. However, access to them and their structure varies drastically.

Loans can be obtained from either a bank or an NBFC. When someone applies for one, the institution verifies that they can repay it and approves the loan. They then repay the money as EMIs. There are no restrictions on how you can use the money in the case of personal loans.

Now, both Rohan and Mohit can apply for loans. However, no one bank or NBFC can handle the ask of the government's ₹10,000 crore. That's where bonds come in.

Bonds are instruments that a large corporation or a government can sell to raise money from the public (investors). Each bond an investor buys returns to them an interest payment (known as the coupon rate) for a fixed amount of time (when the bonds mature). Upon maturity, the issuer (the large corporation or the government) also repays the principal amount.

Here is how these two debt instruments compare:

Loan | Bond | |

Source of funds | Banks, NBFCs (like Hero FinCorp) | Public Investors |

Average Tenure | 6 months to 5 years | |

Interest | Can be fixed or variable | Fixed interest (coupon) rate till maturity. |

Repayment Structure | Monthly EMIs that account for the principal and interest. | Periodic interest payment. Lump sum paid back on maturity. |

Repayment Flexibility | Can be restructured or preclosed | Can be traded on stock exchanges |

Regulatory Purview | Reserve Bank of India | Securities and Exchange Board of India (SEBI) for corporate bonds and the RBI for government bonds. |

When to Choose a Loan and When to Choose a Bond?

Let's revisit our trio and add real-world calculations to it.

Rohan's (representing private individuals) only option is a loan, as bonds can only be issued by either a corporation eligible to do so based on conditions laid down by SEBI or by the government. He can download a personal loan app, complete the application process, and, if approved, receive the funds in a day or two.

The government has no choice but to issue bonds, as no one bank has ₹10,000 crore lying around.

It's Mohit who has the option to choose between a loan and a bond. Let's do the math.

Assume that Mohit's needs are ₹50 crore. His annual revenue: ₹200 crore, and their profits: ₹15 crore. Mohit can either:

Option 1: Take a bank loan where:

● Interest Rate is - 11% p.a. (typical for corporate loans)

● Tenure is - 7 years

● Total interest paid over 7 years (simple calculation) is - ₹50 crore × 11% × 7 = ₹38.5 crore

Option 2: Issue Corporate Bonds where:

● Interest Rate (Coupon) is - 9% p.a. (AAA-rated bond rate)

● Tenure is - 10 years

● Issuance costs are - ₹1.2 crore approx (merchant banking, legal fees, SEBI filings)

● Credit Rating Cost is - ₹8 lakh

● Total interest paid over 10 years - ₹50 crore × 9% × 10 = ₹45 crore

On the surface, it does seem like Mohit will have to pay less interest when he takes a loan. That said, there are a lot of factors due to which a bond works out to be a better deal, such as:

● Bonds don't require collateral, unlike loans.

● Bonds can be traded, giving some liquidity and exit options to investors.

● Finally, interest rates are fixed, unlike loans, which can sometimes come with variable interest rates.

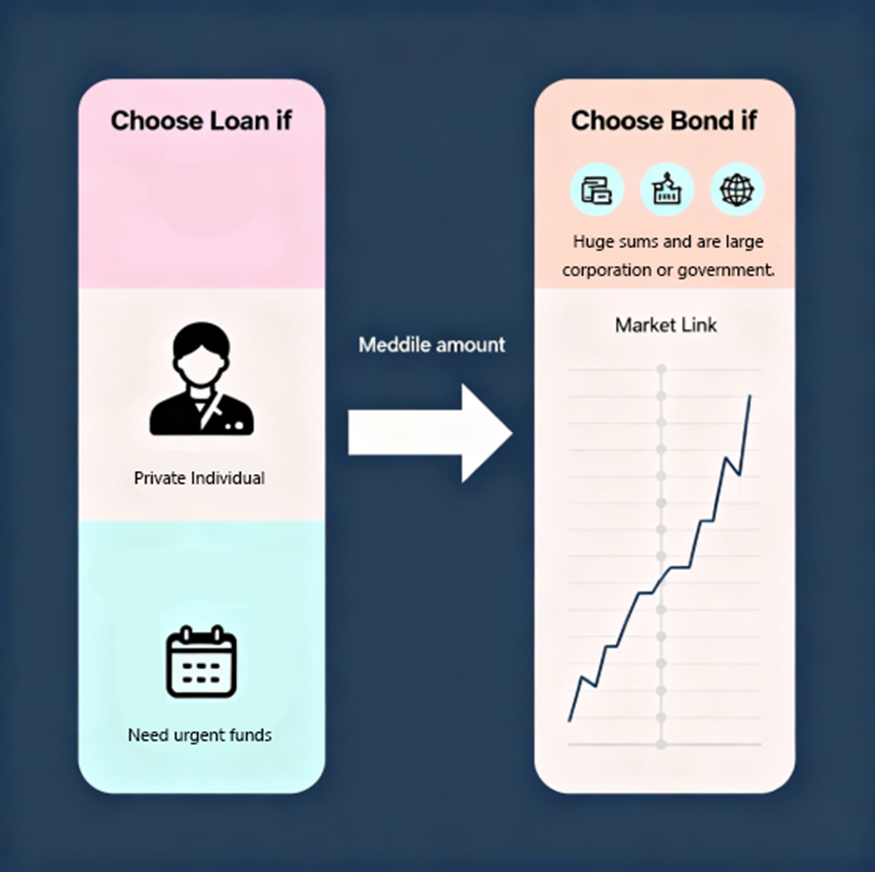

The ultimate decision criteria boils down to this:

● Eligibility - Private individuals can only take a loan. Eligible corporations and governments can issue bonds.

● The funds required - If the need is below ₹50 crores, a loan works best. Above ₹100 crores, bonds do. If between these two figures, evaluate based on your specific situation.

● Risk Tolerance - Loans offer fixed obligations with predictable costs. Bonds give access to market-linked returns with tradability.

● Urgency - Loans are usually issued in a matter of weeks; bonds can take months.

Interest Rate And Credit Rating Factors

How do loan interest rates differ from bond yields, and what role do credit ratings play in both?

Interest rates on loans depend on two major factors:

● The interest rate at which the RBI lends money to commercial banks, a.k.a the Repo rate.

● Your credit score

Bond interests (coupon rate), on the other hand, depend on a system or credit ratings – a system like just a credit score for individuals to rate the creditworthiness or risk of the bond issuer (a company or government). The scale goes from AAA, AA, A, BBB, BB, B, C, D (best to worst).

In both cases, higher credit ratings lower borrowing costs for both loans and bonds.

Advantages And Disadvantages Of Loans And Bonds

Loans and bonds have their pros and cons.

Loans - Why They Work

Personal loans can solve immediate money problems fast. Here's why they work for most people:

● Access to quick funds: Personal loans, at least with Hero Fincorp, get disbursed between 24 to 40 hours.

● The Math Stays Simple: EMIs are fixed, which makes budgeting easier. EMI calculators help you plan better before you take a loan.

● Access to anyone: Anyone with a stable income and a good credit score is eligible to take a personal loan.

The Not-So-Good Stuff

Nothing's perfect, and this applies to loans, too.

● Higher interest rates: For those who can choose between a loan and a bond, the interest rates on loans are much higher.

● Borrowing limits: How much you can borrow depends on your income.

Bonds - Why do they work?

For large entities and serious investors, bonds offer several unique benefits:

● Longer tenures: While loans max out around 5 years for most personal/business loans, bonds can have tenures for up to 30 years for corporate bonds and 40 years for government bonds.

● Costs Drop (At Scale): ₹500 crore at 9% saves ₹15 crore yearly versus a 12% bank loan. That's ₹150 crore saved over 10 years, which easily negates the upfront issuance cost.

The Not-So-Good Stuff

As is the case with loans, bonds too have their drawbacks.

● High Issuance Costs: Bonds have high issuance rates, which can exceed almost ₹1 crore (in the case of large corporations) before raising a single rupee.

● Time-Consuming Process: Bonds take between 8 and 12 weeks to be issued, unlike loans, which disburse in days.

● Set terms: Bonds have a set term, and you cannot prepay them like loans.

Go With Hero Fincorp For Quick Funds

For most people reading this blog, the answer to the question of a loan vs a bond is simple: you need a loan. A bond is best suited for large corporations and governments that have large capital to cover the issuance costs.

If you are looking for a loan, Hero Fincorp has your back. The entire process is digital, and you can get your loan approved in under 24 hours. You can apply anytime via our personal loan portal or download our app on Android or iOS.

Frequently Asked Questions

1. What is the main difference between a bond and a loan?

A loan is a one-on-one agreement between an individual and a lender. They give you money, and you repay through monthly EMIs. A bond, on the other hand, involves selling your debt to multiple investors who buy pieces of it, who in turn receive interest periodically and the principal at maturity.

2. Are bonds riskier than loans?

The answer is subjective. For borrowers, loans create fixed monthly obligations while bonds allow flexible lump-sum repayment. For lenders/investors, bonds carry market risk (prices change daily) while loans are fixed contracts.

3. Can individuals invest in bonds in India?

Yes, individuals can invest in a bond in India. They, however, cannot issue bonds to borrow funds.

4. How long does it take to get a loan compared to issuing bonds?

Loans in 2-24 hours from application (at least in the case of Hero Fincorp) to disbursement. Bond issuance takes anywhere between 8-12 weeks.

5. What are secured loans vs secured bonds?

Secured loans require collateral like property, a vehicle, or gold backing the debt. Secured bonds (debentures) are backed by company assets like machinery or land. In both cases, if you default, the lender seizes collateral.

6. How do tax benefits differ between loans and bonds in India?

Home loans get an interest deduction up to ₹3 lakh yearly under Section 24(b), plus a principal repayment deduction up to ₹1.5 lakh yearly under Section 80C. Bond interest (from regular corporate bonds) is fully taxable as income under your tax slab. However, certain government-backed tax-free bonds offer interest income that is exempt from tax under Section 10(15) of the Income Tax Act.