Rejected Once? Here’s How I Got My Personal Loan Approved On The Second Try

Applying for a personal loan often seems simple. Borrowers research lenders, compare interest rates, complete the application, and wait for approval. Yet for many, the outcome is not what they expect. Instead of receiving funds, they face rejection.

The good news is that a rejection is not the end of the road. With the right approach, a personal loan can still be approved on the second attempt. Read on as we explore how it can be done.

Should You Reapply for a Personal Loan After Getting Rejected?

Absolutely yes!

A personal loan is a great financial tool that can help you finance everything, from a family vacation to a health emergency.

However, when reapplying for it, bear a few things in mind:

Address the Issue First

Before reapplying for a personal loan, seek a formal letter of rejection from your lender. It specifies the exact reason why your application got rejected in the first place. If you're still unsure, speak directly to your lender to understand where the fault lies. Take it into consideration, fill the gap, and then reapply for the loan. This will lower your chances of another rejection.

Don't Rush

Wait for at least 3-6 months before reapplying for a personal loan with the same vendor. If it's a different bank or NBFC, wait for at least 2 months after your first rejection. Reapplying too soon can make you look desperate, and that's a major red flag for lenders. It can also adversely affect your approval chances and interest rates.

Explore Other Lenders

If one lender has rejected your personal loan application, especially due to eligibility differences, try reaching out to a different institution the next time. But beware: don't apply to several institutions because each application triggers a hard inquiry.

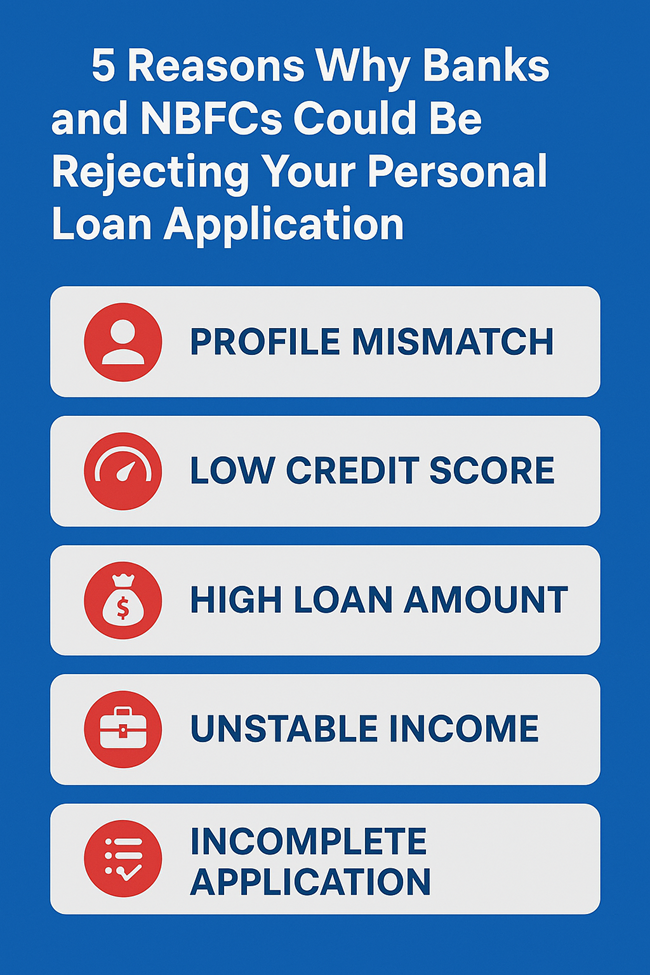

Top 5 Reasons Your Personal Loan Application May Be Rejected

Everyone's personal loan application gets rejected for a distinct reason.

But here are some of the most common ones:

1. Your Profile Doesn't Match Their Eligibility Criteria

Every lender has a unique set of loan eligibility criteria. As a borrower, you must meet each of them to qualify for the loan. If you fail to, your application will be rejected.

Want to check your personal loan eligibility? Hurry up and try our personal loan eligibility calculator now!

2. Your Credit Score Screams "Risky"

If your credit score is too low (below 680), lenders will avoid granting you a personal loan. That's because these loans are collateral-free. So, your credit score is the only indicator of your creditworthiness. And a poor score reflects negatively on it.

3. You Tried Borrowing Too Much

Lenders examine your income before granting a loan to determine whether you can afford to pay it back. Your application is likely to be denied if the loan amount you ask for is excessive, given your income.

4. Your Source of Income Is Unstable

Lenders don't just assess your monthly salary. They also evaluate whether your source of income is stable or not. If it doesn't seem promising, they will reject your application.

5. Your Application Was Incorrect/Incomplete

If you furnish incorrect or incomplete details on your personal loan application, it is deemed to be rejected. In fact, even a single typo can prevent you from getting a loan.

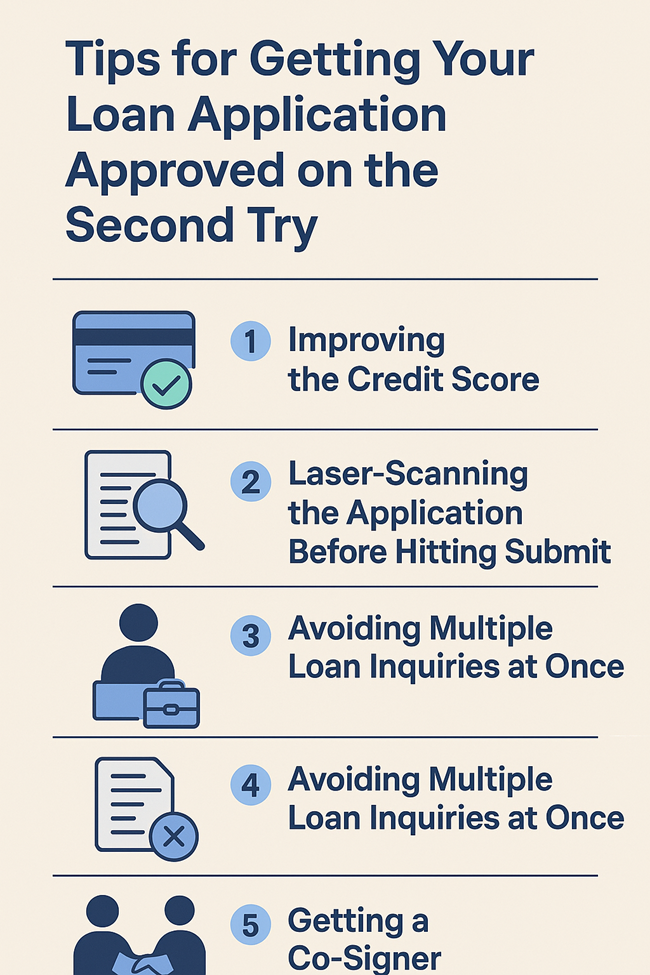

Here's What to Do Differently to Get Your Loan Application Approved on the Second Try

Now, let's get to the gist of the topic. Here are a few strategies you can follow to improve your chances of approval:

1. Improving the Credit Score

A good credit score is like a strong CV: it shows the other person that you're responsible and reliable. So, work on boosting your credit score; it should ideally be above 700. You achieve this by simply paying your EMIs, credit card bills, etc., on time. If possible, try to keep your credit utilisation under 30%. It also helps immensely.

2. Laser-Scanning the Application Before Hitting Submit

Simple form errors result in the rejection of many personal loan applications. Reviewing everything thoroughly before submitting will help prevent this. To guarantee correctness and clarity, every fact, figure, and spelling should be thoroughly examined.

3. Building a Stable Employment Record

Unstable employment history or a lack of work experience are frequent grounds for loan denial. Before requesting a larger loan amount, candidates should concentrate on establishing a stable work history to increase their chances of acceptance.

Since lenders frequently interpret frequent job changes as an indication of instability, avoiding them also helps.

4. Avoiding Multiple Loan Inquiries at Once

You may be inquiring about several different personal loans to find the best one. But it really just shows that you're credit hungry, borderline starving. That's not all: it also reduces your credit score. So, strictly avoid that.

5. Getting a Co-Signer

Adding a co-signer can greatly increase an applicant's chances of acceptance when their profile is weak.

Lenders are more confident when a co-signer has a high credit score, a clean credit history, and steady employment. The co-signer should ideally be a close family member, such as a spouse, parent, or brother.

Are you in urgent need of funds? Try our Instant loan app to get a personal loan of up to ₹5 lakhs instantly!

Wrapping Up

Rejections always hurt, whether it's your first love or your first personal loan application. While the former is out of our area of expertise, we can always help you with the latter.

In this blog, we discussed how you can reapply for a personal loan and get it approved. However, if you want to ditch the hassle and get quick funds of up to ₹5 lakhs in just 10 minutes, apply for a personal loan with Hero Fincorp.

Hurry up and connect with us today!

Frequently Asked Questions

1. What is the minimum salary required to apply for a personal loan?

Every bank/NBFC has a different income eligibility criterion for personal loans. At Hero Fincorp, you can apply for a personal loan if your monthly income is ₹15,000.

2. Can I apply for a personal loan if my credit score is low?

You can, indeed. Lenders can be hesitant to approve your loan, though. Paying off current debts, fixing mistakes on your credit record, or applying with a co-applicant who has a better credit profile can all increase your chances.

However, aim for a credit score of 700 or higher if you want better loan terms and quicker acceptance.

3. Can a CIBIL defaulter get a personal loan?

It is challenging but not entirely impossible. If you're a CIBIL defaulter, most banks will reject your application. However, some NBFCs or lenders may consider you if you have a co-applicant with a good credit score, offer collateral, or demonstrate a consistent repayment history after the default.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.