High Loan Amount

Get an instant one-lakh loan online for urgent needs or personal goals effortlessly.

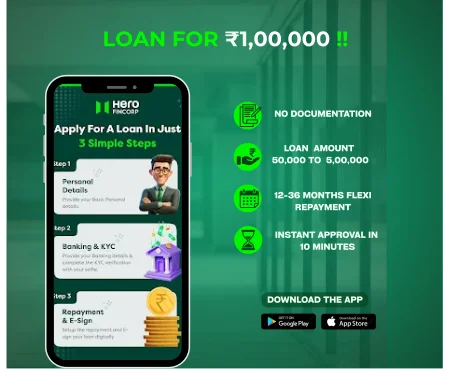

Need a quick fund of Rs 1 Lakh but not sure where to start? Apply for the Hero FinCorp Personal Loan of Rs 1 Lakh. Get fast approval without any collateral from the comfort of your home.

An instant Personal Loan of Rs 1 Lakh is a quick and easy option considered by both salaried and self-employed individuals for urgent cash needs. Be it a medical emergency, home renovation, higher education or last-minute wedding-related expense, you can get a Personal Loan of Rs 1 Lakh online from Hero FinCorp. Apply online with minimal documents and get approval within 10 minutes. It is a hassle-free way to get money at attractive interest rates (starting from 18% p.a.) and flexible repayment tenure of 12 to 36 months.

Applying for a one lakh personal loan with Hero FinCorp is an effortless and fast way to meet your financial needs. Here are some reasons to pick:

1. Instant Approval in 10 Minutes: Get quick approval and access to your money in just 10 minutes, so you don't have to wait long.

2. No Security or Collateral Needed: You can apply without having to put up any security or collateral, which makes the process easier.

3. 100% Digital Journey: The entire process, from application approval to submission, is online and paperless.

4. Flexible Tenure: Choose a repayment period that suits your budget and make it easy to repay with EMIs.

5. 24/7 Emergency Financial Support: Pay for medical bills, urgent travel, or other unexpected costs without touching your savings.

Here’s the calculation of a Rs 1 Lakh loan EMI at an interest rate of 18% per annum for different tenures.

| Loan Amount | Tenure (In Year) | Interest Rate (per annum) | Monthly EMI | Total Interest | Total Amount Payable |

|---|---|---|---|---|---|

| Rs 1,00,000 | 1 Year | 18% | 9,216 | 10,588 | 1,10,588 |

| Rs 1,00,000 | 1.5 Year | 18% | 6,428 | 15,170 | 1,15,710 |

| Rs 1,00,000 | 2 Year | 18% | 5,041 | 20,981 | 1,20,981 |

| Rs 1,00,000 | 2.5 Year | 18% | 4,213 | 26,398 | 1,26,398 |

| Rs 1,00,000 | 3 Year | 18% | 3,666 | 31,962 | 1,31,962 |

Disclaimer: EMI amounts shown are estimates; actual figures may vary based on lender terms.

Securing a Rs 1 Lakh loan opens doors to financial flexibility. Explore the features and benefits to understand how a Rs 1 Lakh loan can empower you financially.

Understanding the eligibility criteria is crucial for securing an instant loan of Rs 1 lakh. Typically, your credit score, monthly income, and employment stability are evaluated. You can use a personal loan eligibility calculator to check your eligibility instantly.

| Criteria | Requirement |

|---|---|

| Age | You must be between 21 to 58 years of age. |

| Citizenship | You must be an Indian citizen to apply for a Personal Loan at Hero FinCorp. |

| Work Experience | 1. Salaried Individuals: Minimum 6 months 2. Self-employed Individuals: Minimum 2 years of stable business operations |

| Monthly Income | The minimum income requirement is Rs 15,000 per month. |

| Credit Score | A score of 750+ is generally preferred for instant approval. |

Securing a loan of 1 lakh rupees is quick and easy, without any paperwork. Simply have the following documents handy for both salaried and self-employed individuals to instantly process your application.

You should be aware of the interest rates applicable on a one-lakh loan. These rates directly affect your total repayment. Lower personal loan interest rates make borrowing more affordable. It's important to find the best options available. For more accuracy, you can calculate your EMI and find the best available options.

| Charge Type | Details |

|---|---|

| Interest Rate | Starting from 19% p.a. |

| Loan Processing Charges | Starting from 2.5% + GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Loan app does not charge cancellation charges |

| 2. Interest paid is non-refundable | |

| 3. Processing charges are non-refundable |

Note: The above rates are effective from 27.10.2023.

Applying for a personal loan with low interest is very simple. Just follow the easy steps mentioned below, and you are good to go:

Visit the Hero FinCorp website or download the personal loan app.

Go to the instant personal loan section and click ‘apply now’.

Enter your mobile number. Register yourself by submitting the OTP received.

Select the desired loan amount.

Complete your KYC verification. Check the income eligibility.

Click ‘Submit’ to finish your application.

A personal loan of up to Rs 1 lakh can be used for various financial needs, including the following:

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.