Buy an Air Conditioner on EMI Without a Credit Card

- Why Buy an AC on EMI?

- Ways to Buy an AC on EMI Without a Credit Card

- Things to Know Before Buying an AC

- Capacity (Tonnage)

- Cost

- Maintenance Cost

- Life Expectancy

- Inverter vs Non-Inverter AC

- Factors to Consider Before Opting for EMI

- Pros and Cons of Buying an AC on EMI without a Credit Card

- Common Myths About EMI Purchases

- How Personal Loan Can Help You Buy an AC on EMI Without a Credit Card?

- Conclusion

- Frequently Asked Questions

Indian summers can be very harsh. When we hear the word summer, especially in northern India, we associate it with hot weather and dryness. Not just cold water but cool air is also needed in the summer season. And that's where air conditioning (AC) has become a part of life. It is like a necessity for us when we want to feel cold and comfortable. But buying an AC involves a huge cost while still demanding some level of planning and thoughtfulness regarding money.

Generally, the cost of a good quality air conditioner is around Rs 40,000–50,000. The best part is that you can now purchase an AC on EMI without having to pay the full price upfront. Most individuals use their credit cards to purchase expensive products such as an AC. If you don't have a credit card; you can still purchase an air conditioner in instalments. Let's learn more.

Why Buy an AC on EMI?

There are many reasons to buy an AC on EMI. The most important factor is that it makes purchase affordable. The rate of interest is competitive and the purchase requires no down payment. The interest rate is based on your income and repayment ability, allowing you to budget and plan better. What’s more, the EMI plans are flexible, which you can choose as per your monthly budget.

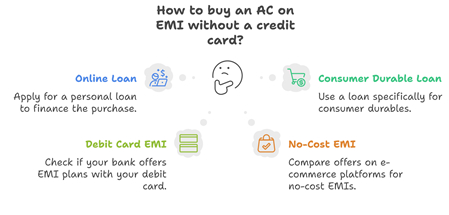

Ways to Buy an AC on EMI Without a Credit Card

When you want to buy AC in EMIs without a credit card, you can opt for any of the following financing methods. Choose one that best suits your requirements and purpose:

Option 1: Online Loan or Personal Loan Providers

When planning to buy an AC on EMI, you may apply for a Personal Loan and finance the purchase. You may use these unsecured loans for various big-ticket expenses, including buying an air conditioner.

Option 2: Loans for Consumer Durables

Many lending institutions offer loans for consumer durables to purchase expensive items on EMIs. Use the loan amount to buy an AC on EMI and distribute its cost into easy instalments.

Option 3: EMI via Debit Card

Contact your bank and check if they have an EMI plan with your debit card. With this facility, you can purchase the AC using your debit card and pay its price in instalments.

Option 4: No-Cost EMI Offers via E-commerce Platforms

Some e-commerce platforms offer no-cost EMIs on online purchases. Compare these offers on various online shopping sites and make your purchase via the most appropriate option.

Option 5: Financing at the Store

Offline stores have partnerships with certain finance providers. When purchasing an AC on EMI, enquire about these deals and opt for a suitable one.

Things to Know Before Buying an AC

Buying an air conditioner is a big investment. So, it should be done wisely. Let us look at the key factors before making the purchase.

Type: Window vs Split AC

- Window AC: Suitable for small rooms. It has all the elements in one device. It requires simpler installation.

- Split AC: It is more effective for large areas. It functions silently and has a designer look. It requires professional installation.

Capacity (Tonnage)

You should choose the AC capacity based on your room size:

- Up to 120 sq. ft. → 1 ton

- 121–180 sq. ft. → 1.5 ton

- Above 180 sq. ft. → 2 ton

Choosing proper tonnage ensures efficient cooling and power savings.

Cost

- Window ACs: Rs 25,000 – 50,000 (approx.)

- Split ACs: Rs 30,000 – 60,000 (approx.)

Note: Prices may vary based on brand, features and energy rating.

Maintenance Cost

Regular servicing is essential for performance.

- Window AC: Lower maintenance cost

- Split AC: Higher servicing and gas refilling costs

Annual Maintenance Contracts (AMCs) can help manage expenses.

Life Expectancy

- Average AC lifespan: 8–10 years with regular maintenance

- Inverter ACs generally last longer due to efficient operation

Inverter vs Non-Inverter AC

- Inverter AC: Varies compressor speed according to room temperature; conserves energy and offers uniform cooling.

- Non-Inverter AC: Fixed-speed compressor; cheaper but consumes more power and wears out faster.

Also Read: How to Choose Best Air Conditioner for Home

Factors to Consider Before Opting for EMI

Before opting for EMI, consider your interest rates, financial capacity, processing charges, overall purchase cost, the potential impact on your credit score, etc. Here's a detailed breakdown:

- Financial Capacity: Assess your income and ensure you can afford the EMI conveniently.

- Interest Rate: Shop around for the lowest interest rates from various loan and finance companies.

- Processing Charges: Check the company's processing fees for financing your loan.

- Overall Purchase Cost: Calculate the total purchase cost and ensure it aligns with your financial capacity.

- Impact on Your Credit Score: Pay EMIs on time and maintain a low credit utilisation ratio to minimise the loan’s impact on your credit score.

Pros and Cons of Buying an AC on EMI without a Credit Card

Let’s look at the pros and cons of AC EMI without a credit card:

| Pros | Cons |

| Keep savings intact | Additional interest charges |

| Distribute the AC’s cost into instalments | Missed EMIs negatively impact your credit score |

| No need to make an upfront payment | Need to remember the EMIs on time |

| No down payment required | Increase your debt-to-income ratio |

| Attractive interest rates | |

| Flexible repayment options | |

| Opportunity to improve your credit score |

Also Read: List of Best Portable Air Conditioners to Buy on EMI

Common Myths About EMI Purchases

Many refrain from buying an AC on EMI due to some common myths revolving around the system. Here’s an overview of myth vs reality:

- EMI facilities are accessible to the high-income group only: At Hero FinCorp, you can borrow a loan with a minimum monthly income requirement of Rs 15,000.

- Loans attract high interest rates: The interest rates are highly competitive.

- You need a minimum credit score to obtain approval: Hero FinCorp does not require a minimum credit score for Personal Loan approvals.

- Long repayment terms make loans affordable: Opt for a short repayment tenure to minimise the total loan cost.

- Getting a loan is a long and tedious process: New-age NBFCs have 100% digital and paperless loan procedures.

How Personal Loan Can Help You Buy an AC on EMI Without a Credit Card?

Instead of using a credit card, you can use a Personal Loan to buy an AC on EMI. Unlike credit cards, Personal Loans come at attractive interest rates. At Hero FinCorp, you can easily get a Personal Loan from 50,000 to 5 Lakh online at interest rates starting from 1.58%* per month and flexible repayment tenures of 12 to 36 months.

Conclusion

No matter which AC model you choose, you can distribute its cost into EMIs with easy repayment options. Finance the equipment’s cost with a Personal Loan and repay the loan in easy EMIs. You can borrow according to your requirements and repayment capacity.

Frequently Asked Questions

1. What are the different ways to buy an AC on EMI without a credit card?

You can buy air conditioners on EMI using various methods, including Personal Loans, consumer durable loans, EMI via debit card, no-cost EMI offers via e-commerce platforms, and financing at the store.

2. What are the eligibility criteria for buying an AC on EMI without a credit card?

If you wish to buy an AC on EMI with a Personal Loan, you must be 21 to 58 years of age, have sufficient work experience, and earn a minimum of Rs 15,000 per month.

3. Can I avail of no-cost EMI for purchasing an AC?

Many finance providers provide no-cost EMI options for purchasing an AC.

4. How do online loan platforms offer EMI options for buying an AC?

Online loan platforms like Hero FinCorp provide Personal Loans to distribute the AC’s cost into EMIs.

5. Can I repay my EMI early without any penalty?

Check the lender’s prepayment options to know the applicable charges.

6. How do I calculate my EMI for purchasing an AC without a credit card?

Use an online EMI calculator to calculate your AC EMI without a credit card.