Why Rural Borrowers Are Driving Personal Loan Growth in 2025

Have you ever seen a personal loan ad on TV? Notice how they almost always feature urban citizens? Well, that's no coincidence.

Personal loans have traditionally been popular in cities, whether to clear an education loan or start a business. However, as of May 2025, research showed that a substantial 24% of FinTech borrowers came from rural areas, marking a big shift.

So, is this just a casual trend or the start of something bigger? Let's find out.

Reasons More Rural Borrowers Are Opting for Personal Loans in 2025

Instead of pledging jewellery or borrowing money from friends and family, rural Indian citizens are now turning to personal loans to fulfil their financial obligations. Here's why:

Increased FinTech Reach

Personal loans are unsecured, so lenders need proof of creditworthiness and stable income. While urban borrowers can easily provide payslips and credit scores, rural borrowers often can't.

FinTech changed this by introducing Aadhaar-based KYC and alternative credit scoring, making it easier to assess repayment ability and boosting personal loan adoption in rural areas.

Growth of Young Borrowers

According to statistics, 66% of the total sanctioned personal loan value in FY 24-25 went to borrowers below 35 years. This includes both urban and rural youngsters who take personal loans for financing every expense, from buying a smartphone to funding their side hustle.

Government Push

Government schemes are playing a big role in boosting credit availability in rural regions. For example, the Kisan Credit Card (KCC) limit was raised to ₹5 lakh, which made formal borrowing more accessible to farmers. Similarly, rural digitisation drives, Jan Dhan bank accounts, and Aadhaar integration are making it easier for lenders to target eligible rural borrowers.

Wondering how to check your personal loan eligibility? Try our free Personal Loan Eligibility Calculator now!

Rise in Small Ticket Demand

Rural borrowers don't always need lakhs at a time. What they need is ₹10k–₹50k personal loans for starting a new business without security. FinTechs cater perfectly to this by offering instant, collateral-free, short-term loans.

Other Key Factors Behind India's Massive Personal Loan Growth

Increased rural borrowing is just one aspect. Here are three other factors driving personal loan growth in India:

Easy Application Process

Gone are the days when applying for a personal loan was hectic and complicated. With simple online personal loan applications and an Aadhaar-based KYC, it has now become a painless process.

Get quick funds without any hassle. Check out our Instant Loan App today!

Flexible Tenure

Unlike before, lenders today offer a variety of personal loan tenures. You can choose to pay off the amount in a few months or stretch it to several years, as per your convenience. This has made it much more appealing.

Competitive Interest Rates

To gain more customers, banks and NBFCs are offering highly competitive rates of interest on personal loans. This makes them affordable for everyone.

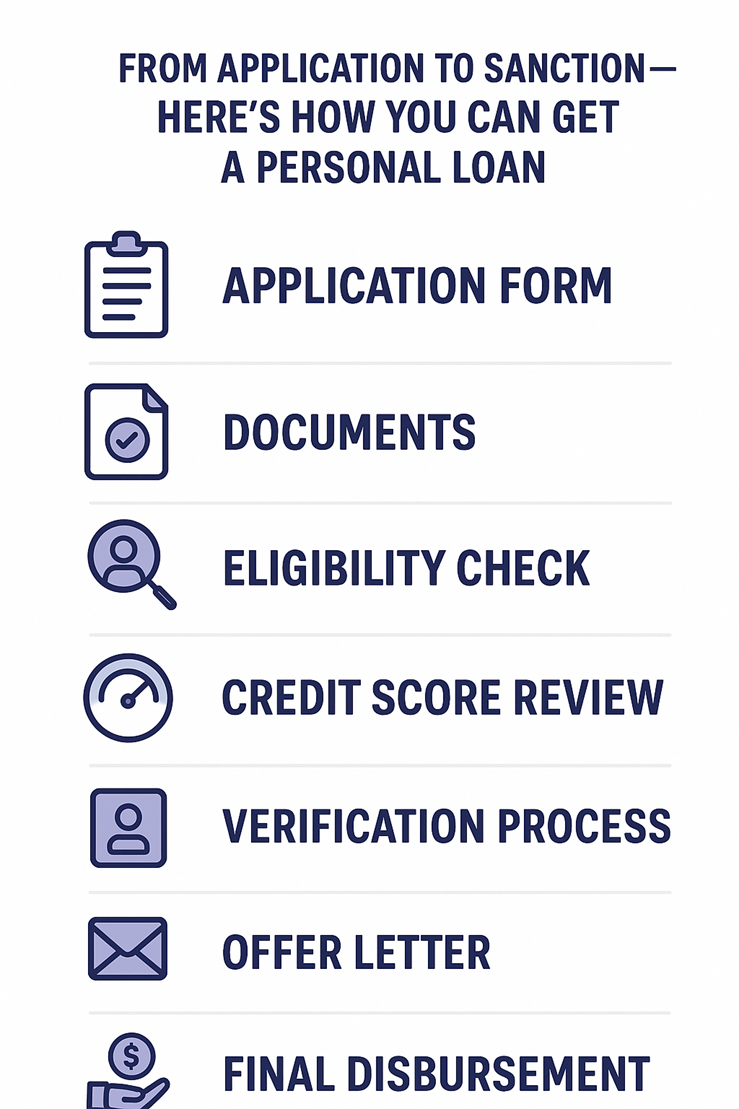

From Application to Sanction - Here's How You Can Get a Personal Loan

Wondering what a typical personal loan application and approval process looks like? Well, here are the steps:

- Application Form: The process starts when you fill out a personal loan application form by entering your personal, employment, income, and other details.

- Documents: Along with the application form, you will also need to submit a few documents. This essentially includes your KYC (PAN card, Aadhaar card, etc.), income statement, address proof, etc.

- Eligibility Check: Now, the lender will check your income, age, debt-to-income ratio, and other factors to ascertain if you qualify for the loan.

- Credit Score Review: Once done, they will pull out your credit score to check your creditworthiness.

- Verification Process: Some lenders also call your employer or visit your residence for a quick background verification.

- Offer Letter: If you pass the checks, you'll receive a sanction letter with the approved loan amount, tenure, EMI structure, interest rate, and fees.

- Final Disbursement: Once you agree to the terms and sign the agreement, the lender releases the funds, usually within 24–72 hours.

Secure Your Personal Loan Today with Hero Fincorp

A personal loan is more than just debt. It's like an instant emergency fund you didn't know you had. As more rural Indians embrace this form of credit, the borrowing landscape will continue to expand, making personal loans more accessible for everyone in the country.

In an effort to contribute to this revolution, Hero Fincorp offers quick, hassle-free personal loans of up to ₹5 lakhs with a CIBIL score of just 700.

So, why wait? Apply for a personal loan with Hero Fincorp today!

Frequently Asked Questions

1. How much personal loan can I get on a ₹30,000 salary?

Most Indian banks and NBFCs offer personal loans ranging from ₹3 lakh to ₹6 lakh to individuals with a monthly salary of ₹30,000. The exact amount you get depends on your credit score, existing debts, lender's policies, etc.

2. How to get a low-interest loan?

Your personal loan interest rate mainly depends on your creditworthiness. Focus on improving your credit score and providing a stable source of income. You can also negotiate with the lender or browse others offering lower interest rates.

3. How can I increase my credit score?

To increase your credit score, pay your EMIs on time, limit your credit utilisation to 30%, avoid applying for too many loans simultaneously, and maintain a healthy mix of credits.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.