Days Past Due: Meaning & Calculation in CIBIL Report

- What is Days Past Due?

- Why is Days Past Due Important in Your CIBIL Report?

- How to Calculate Days Past Due?

- How to Calculate Days Past Due in Excel

- Understanding DPD Values and Their Interpretation in CIBIL

- How to Correct Errors in Your DPD Report?

- Keep Your DPD Clean and Borrow with Confidence

- Frequently Asked Questions

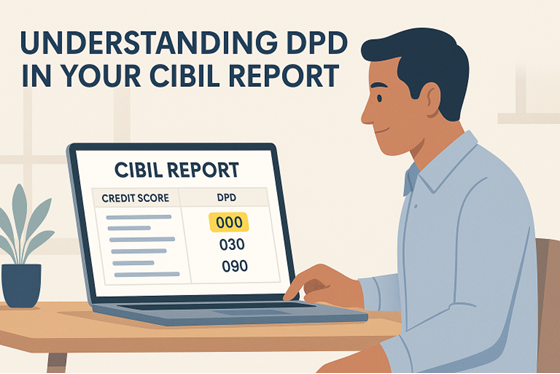

If you have ever opened your CIBIL report and wondered what those numbers like 000, 030, or 090 are trying to say, you are not alone. Most of us focus on the credit score and miss the one detail lenders quietly study first: Days Past Due.

Think of it as your EMI discipline scorecard. A small delay today can shape tomorrow’s loan decisions. So let’s decode it in the easiest, most practical way.

What is Days Past Due?

Days Past Due, or DPD, is simply the number of days you are late in paying a loan EMI or credit card bill. Even a one-day delay shows up here.

Lenders in India rely on this metric to gauge your repayment discipline and how responsibly you handle credit. A clean DPD shows stability. A delayed one signals risk. This small value often shapes how lenders judge your creditworthiness when you apply for a loan.

Why is Days Past Due Important in Your CIBIL Report?

Vivek has a CIBIL score of 720 and feels confident while applying for a personal loan. But the lender spots something he never noticed. His last month's DPD showed a ten-day delay.

For Vivek, it was a minor slip. For the lender, it was a warning sign. The result? The lender asked for more documents and offered a higher interest rate to stay cautious.

That's why it is crucial to understand the real impact of Days Past Due in a CIBIL report:

- Even a short DPD delay can slowly bring your credit score down.

- Frequent late payments can slow down or block approvals.

- A clean DPD record often unlocks better interest rates and smoother processing.

- Lenders study DPD trends to see if overdue payments are occasional or habitual.

- Higher DPD across loans signals financial stress and reduces lender confidence.

Dreaming of a clean DPD streak? Use an EMI calculator to choose an amount and loan terms your wallet can handle easily, so every payment stays on time.

How to Calculate Days Past Due?

Calculating DPD is easier than most people expect. It is simply the difference between your EMI due date and the actual date on which you make the payment.

Days Past Due formula:

DPD = Actual Payment Date minus Due Date

For example, if the due date of your loan was 5 June and you paid on 5 June, your DPD is 0. But, if the due date was 10 July and you paid on 20 July, your DPD is 10.

That's all lenders need to see whether a payment was on time, slightly late, or delayed enough to raise concern.

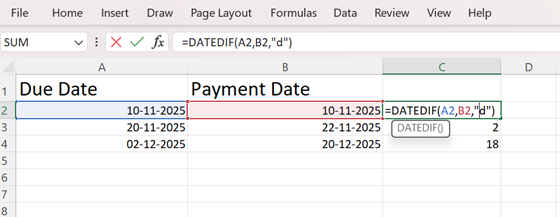

How to Calculate Days Past Due in Excel

Excel makes DPD calculations simple, especially if you manage multiple EMIs or maintain a loan tracking sheet. You do not have to count the days manually. Excel handles that.

Here are the two easiest ways to calculate Days Past Due in Excel.

Method 1: Basic Date Subtraction

Formula: =B2-A2

where,

A2 = Due date

B2 = Payment date

Excel returns the number of delayed days.

Method 2: Using DATEDIF

Formula: =DATEDIF(A2,B2, "d").

This gives you the delay in complete days. Once done, drag the formula across rows to automate DPD for multiple accounts.

Pro Tip: Use conditional formatting to highlight DPD entries above 30 days. It helps you spot risky delays without manually scanning every row.

Understanding DPD Values and Their Interpretation in CIBIL Reports

Want to read your CIBIL report the way lenders do? Here is a simple breakdown of the most common DPD values you will see in India and what they reveal about your repayment behavior.

DPD Value | Meaning |

000 | Paid on time. No delay. Strongest entry |

030 | Delayed by 30 days. Clear sign of late payment |

060 | Delayed by 60 days. Serious concern for lenders |

090 | Delayed by 90 days. Indicates high risk |