What Is a CIN Number? Meaning and Importance Explained

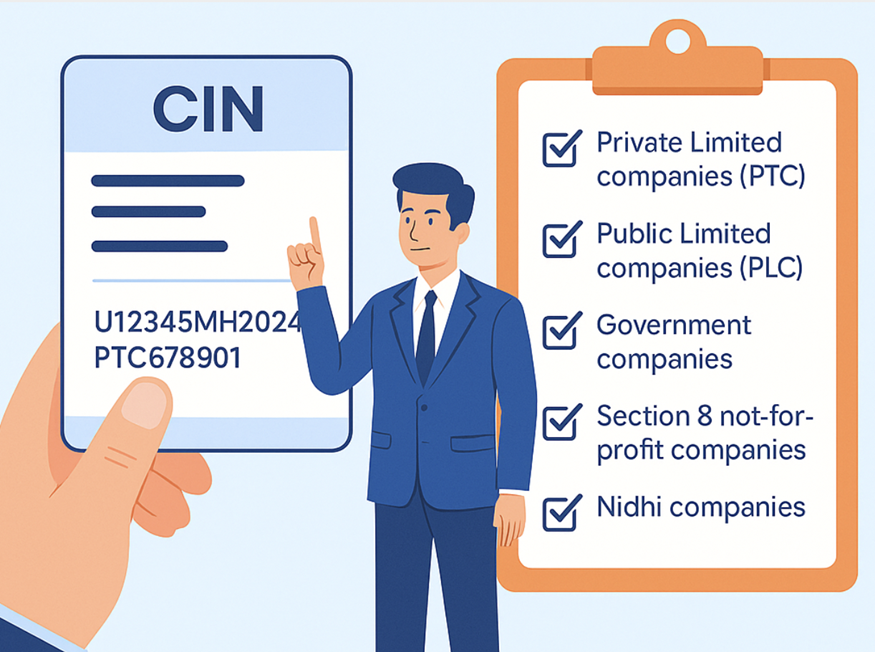

Every lawfully registered Indian company is given a unique Corporate Identification Number (CIN) by the governing body that oversees company establishment (the ROC), similar to how the Indian government issues Aadhaar cards for identification.

This alphanumeric code, consisting of 21 characters, is the exclusive identification of a company. It enables the government, investors, and owners to ensure compliance with Indian corporate law. Read on as we explore the CIN number, its formation, and its significance.

What Is a Company CIN Number?

The CIN number is a 21-digit alphanumeric code. All companies registered in India are allotted one CIN. The ROC issues it at the time of company registration and uses it to track company activities.

This number contains various company details, such as listing status, industry code, state of registration, year of incorporation, company type, and a unique registration number.

CIN is typically issued to:

● Private Limited companies (PTC)

● Public Limited companies (PLC)

● Government companies

● Section 8 not-for-profit companies

● Nidhi companies

Interestingly, LLPs do not get a CIN, but an LLPIN (Limited Liability Partnership Identification Number).

Structure of CIN Number: Breaking Down the 21 Digits

The CIN is a 21-digit alphanumeric number that contains key company details, explained as follows:

H3: Section 1: Listing Status (L/U)

This is the first letter in the CIN, and highlights whether a company is Listed (L) or Unlisted (U) on the stock exchange.

Section 2: Industry Code (5 digits)

A five-digit industry code represents the company's primary economic activity according to its official classification.

Section 3: State Code (2 letters)

State code is a set of two letters that represents the state where the company is registered (for instance, MH indicates Maharashtra).

Section 4: Year of Incorporation (4 digits)

The company’s incorporation year is represented by the four digits.

Section 5: Company type (3 letters)

The three letters you see in the CIN (such as PTC or PLC) represent what type of company it is.

Section 6: Registration Number (6 digits)

The last part of the CIN is a 6-digit registration number. It is a unique number assigned to the company by the Registrar of Companies (ROC).

Each part of the CIN can thus be used to glean various types of information about a company.

Uses of CIN Number

The CIN acts as the official identity for Indian companies, serving multiple practical uses across legal, taxation, and public aspects. It is used for:

● ROC filings and returns that are submitted to the Ministry of Corporate Affairs.

● Tax filings and compliance reporting for regulatory monitoring.

● Legal documents and contracts to establish the authenticity of companies.

● Formal communication and documents related to the business.

● Advertisements, notices, bills, and official letterheads.

● Company profiles and investor disclosures for transparency.

● You also need your CIN number to apply for a business loan.

The CIN facilitates the easy verification of companies and regulatory monitoring and strengthens legal compliance, thereby enhancing trust in conducting business with a company.

Wondering how to apply for a business loan? Install our instant loan app and get quick access to funds with just a few taps!

How to Find or Verify Your CIN Number

You can easily find and verify your company’s CIN number by visiting the Ministry of Corporate Affairs’ website and following the steps below:

● Choose "View Company/LLP Master Data" after selecting "MCA Services".

● In the search form, type your company's name, registration number, or CIN.

● Once the CAPTCHA verification process is finished, submit.

● The window will show the search results. You can then look up the information about your company, including the CIN.

Check your spelling and input other information, such as the state and year of incorporation, to ensure accuracy if you encounter numerous results. This procedure is totally free. The legal identification and compliance status of your business can be easily and affordably verified.

Penalties and Consequences of Non-Compliance

If your business does not yet comply with the CIN regulations, you may be subject to harsh fines and other legal issues:

● Officially, enterprises operating in India must place their CIN on all documents, and neglecting to do so will attract penalties.

● Legal consequences, including the prosecution of the responsible officers, may result from failing to present the CIN as required. The company's reputation and compliance status may suffer as a result.

● The corporation may face further ROC investigation if the infraction continues. Additionally, you might have to put up with additional implementation of the Companies Act of 2013.

Grow Your Newly-Registered Company with Business Loans

The CIN encapsulates key company information for businesses registered in India, facilitating business operations such as transactions, legal processes, and ethical, transparent business with others.

Just like your Aadhar is to you, a CIN is to your company. Make sure to check if you are following all the CIN mandates as prescribed by the GoI.

If you have a newly registered company and are looking for a business loan, Hero FinCorp can aid your growth journey with high-speed loans and quick approvals. We not only

So why wait? Download the Hero FinCorp loan app today and take the first step toward building a stronger, more successful business!

Frequently Asked Questions

1. What is the full form of CIN?

CIN expands to Corporate Identification Number. It is a 21-digit alphanumeric code.

2. Where can I find the CIN number of my company?

You can find your CIN on the Ministry of Corporate Affairs website.

3. Can the CIN number be changed or updated?

Generally, no. There is a change only when your company's incorporation details change.

4. Is CIN mandatory for all companies?

Indeed, in India, a CIN is required for all businesses that are not LLPs.

5. How is a CIN number different from a GSTIN?

CIN is a company registration number. A GSTIN is used for Goods and Services Tax registration.

6. In which papers is the CIN number required?

Your CIN should be included in all official correspondence, including contracts, invoices, letterheads, ROC filings, and tax records.