Mobile Wallet vs UPI: Key Differences You Should Know

Not long ago, in India, cash payments were non-negotiable. Today, from kirana shops to big retail stores, cash isn’t even expected. Your smartphone acts as your wallet, and with one quick scan, your transaction is done.

Accounting for 99.8% of transaction volume and 97.7% of value in early 2025, the shift to digital payments in India has been nothing short of exponential.

Among the multitude of digital payment options, two choices emerge as the most commonly used: UPI and mobile wallets. They both get the job done, but are different. This is why many people get confused about which one they should use and when.

In this blog, we explain how mobile wallets and UPI work, the differences between UPI and mobile wallets, and help you decide which option fits your everyday payment needs best.

Understanding the Basics: Mobile Wallet vs UPI

Both are easy digital payment methods, but it’s important to know how they work and how they handle your money.

A mobile wallet is a virtual wallet that allows you to store your money online and make payments.

What are the Features of Mobile Wallets?

India's mobile wallet market is expected to grow from USD 19.19 billion in FY2025 to USD 51.75 billion in FY2033.

Mobile wallets:

- Let's you store money digitally on your phone

- Makes payments quick and hassle-free

- Offer cashback, discounts, and reward points

- Works smoothly with shops and online platforms

- Makes it easy to add money using a debit or credit card

On the other hand, Unified Payments Interface (UPI) enables real-time fund transfers between banks. It links your bank account to a payment app, through which you can send money using a UPI ID or a mobile number.

What Are the Features of UPI?

UPI is the backbone of India’s digital payment system, with over 685 banks supporting the payment option and ₹27,96,712.73 crore in transactions.

Here are the core UPI features.

- Real-time transfers between bank accounts

- Payments via UPI id, QR code, or mobile number

- Available always

- Secure authentication using UPI PIN

Also Read - Advantages of Using UPI for Everyday Transactions

UPI vs Mobile Wallet: Let's Compare

Mobile wallets and UPI are different: while one is built around prepaid balance, the other connects directly to bank accounts. This difference affects everything from transaction limits and security to how, where, and how often you pay.

| Feature | Mobile Wallet | UPI |

| Source of Funds | Funds are preloaded, and transactions are deducted from the wallet's balance. | UPI links the payer's bank account to the recipient's bank account, enabling seamless transfers. |

| Transaction Limits and Charges | Limits

Charges

| Limits

Charges

|

| Use | Can be used for small payments. | Is used for high-value, regular transactions |

| Security | The security of the mobile wallet is based on the application layer, such as PIN, Password, or device-based authentication. The risk is higher if the device is compromised, as the money is stored in the wallet. | UPI is regarded as the most secure digital payment system owing to bank-level encryption, two-factor authentication, and UPI PIN verification. |

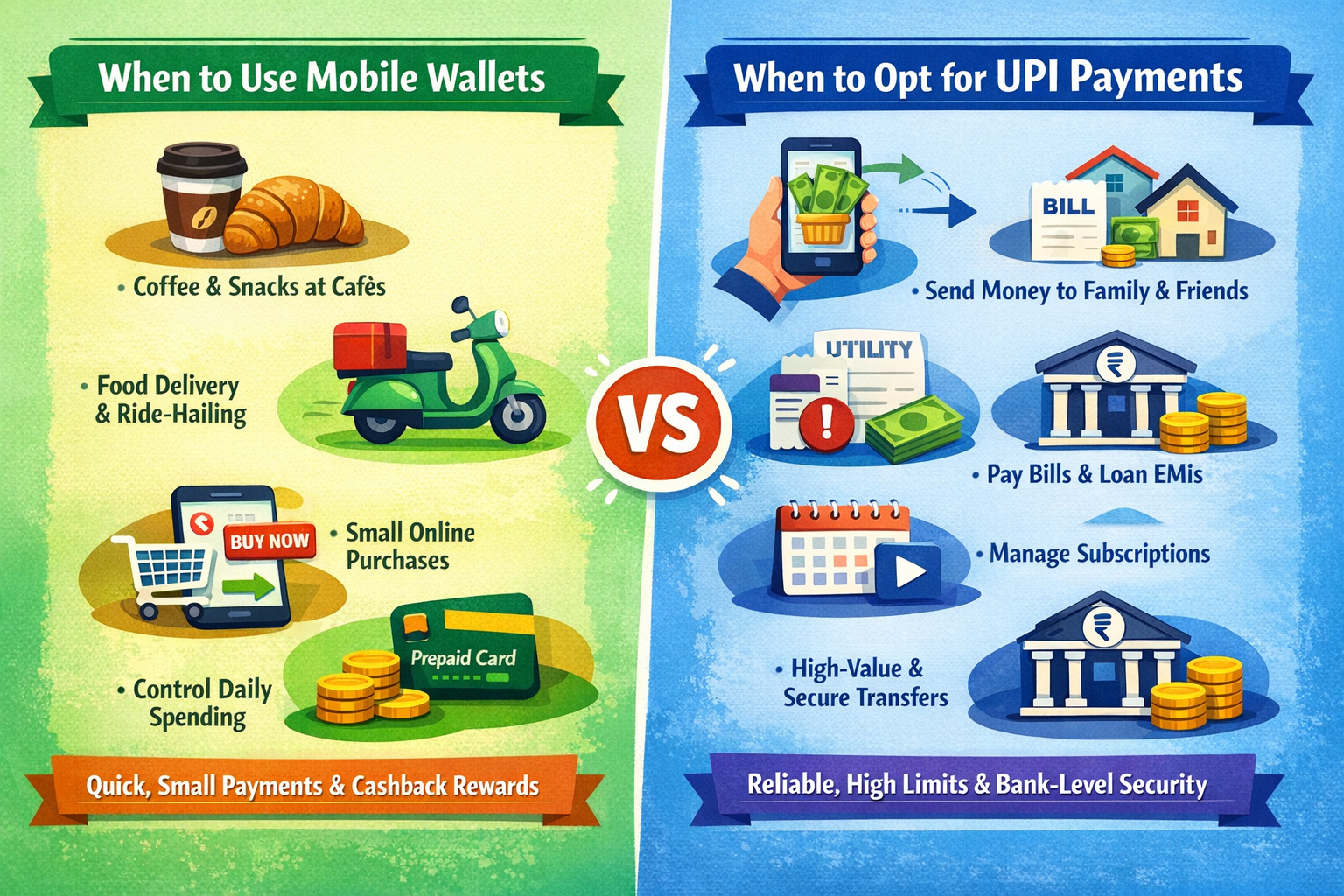

Mobile Wallet vs UPI: When to Use What?

Mobile wallets and UPI simplify digital payments, but their applicability varies. Using each in the right scenario can help you pay faster, smarter, and more conveniently.

When to Use Mobile Wallets?

Choose mobile wallets for -

- Daily transactions

- Cashback deals & promotional offers

- Merchants who accept wallet payments only

- Tracking expenses with a prepaid balance

- Avoiding banking authentication for small spends

When to Opt for UPI Payments?

Use UPI for -

- Sending money straight from one bank account to another

- Recurring payments such as EMIs, utility bills, etc.

- More secure payments

- Avoiding wallet top-up limitations

Also Read - How UPI Is Redefining Instant Loan Repayments in India

Digital Payments at Hero FinCorp

Many NBFCs now accept EMI payments through UPI, making repayments easier for borrowers. With facilities such as UPI AutoPay, EMIs are auto-debited on the due date, so you don't have to remember the due date, and there's no chance of default.

Meena, a 34-year-old IT professional and a busy mom of two toddlers, experienced this after taking a personal loan from Hero FinCorp. Using the Instant Loan App, she could check her EMI and loan details anytime.

Plus, by setting up UPI AutoPay she ensured her EMIs are never missed, even on her busiest days. This digital setup helped her stay financially disciplined and maintain a healthy credit score.

As digital payments evolve, the right financial partner becomes just as important as the right payment method. Hero FinCorp makes managing your money simpler with smart tools for digital transactions.

And when expenses get overwhelming, you can rely on their instant, hassle-free, paperless personal loans to cover your needs.

Frequently Asked Questions

Are all UPI apps also mobile wallets?

UPI apps support only bank-to-bank transfers, whereas mobile wallets are prepaid and may or may not offer UPI.

What is better for transactions involving large amounts, Mobile Wallet or UPI?

UPI is preferred for higher-value transactions, as it directly debits a bank account and offers higher transaction limits than mobile wallets.

Are there more rewards/cashback from a mobile wallet as compared to UPI?

Yes. You get more rewards from mobile wallets than from UPI, which is more about ease and direct transfers.

Are mobile wallets as secure as direct UPI payments?

UPI is more secure because it is encrypted at the bank level and requires two-factor authentication. Mobile wallet security depends on the app and device.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.